Back

VCGuy

Believe me, it’s not... • 10m

I came across an interesting PE business model by Cranemere Group. They operate similarly to a 'mini-Berkshire Hathaway'. Traditional Private Equity (PE) Model i). Closed-end funds with a fixed lifespan (~10 years) ii). Limited partners (LPs) have minimal involvement in operations iii). Exits/Payouts occur through trade sales, secondary buyouts, or IPOs Downsides of Traditional PE - Premature Exits : Firms may need to sell investments before realizing their full potential. - Limited Liquidity : Investors cannot access payouts unless a part or all of the business is sold. - Dependence on Market Conditions : Exits through sales, buyouts, or IPOs may not always be well-timed. Cranemere’s Alternative Model a). No LP/GP Structure → Investors receive shares in Cranemere (Hold Co.), which then invests in companies. (stock value is reassessed annually based on investment performance) b). Liquidity Managed at Cranemere Level → Investors can either stay invested or choose to take a payout. c). Active Shareholder Role → Investors receive board representation, and quarterly business meetings are held. If you build and own a great business, why sell it?

Replies (1)

More like this

Recommendations from Medial

Hrishikesh Thakkar

Confused between bei... • 1y

Exciting news for India’s startup ecosystem! For the first time, the central government is set to allocate a dedicated corpus to the Small Industries Development Bank of India (Sidbi) to oversee a fund of funds focused on secondary transactions. Wh

See MoreVamshi Yadav

•

SucSEED Ventures • 9m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-

See MoreShrikant Barve

Hey I am on Medial • 1y

A social business model I created offers free coaching to economically weak students. The model's initial funding will come from investors, and then it will continue through donations and CSR funding. I am curious about the potential of a social busi

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

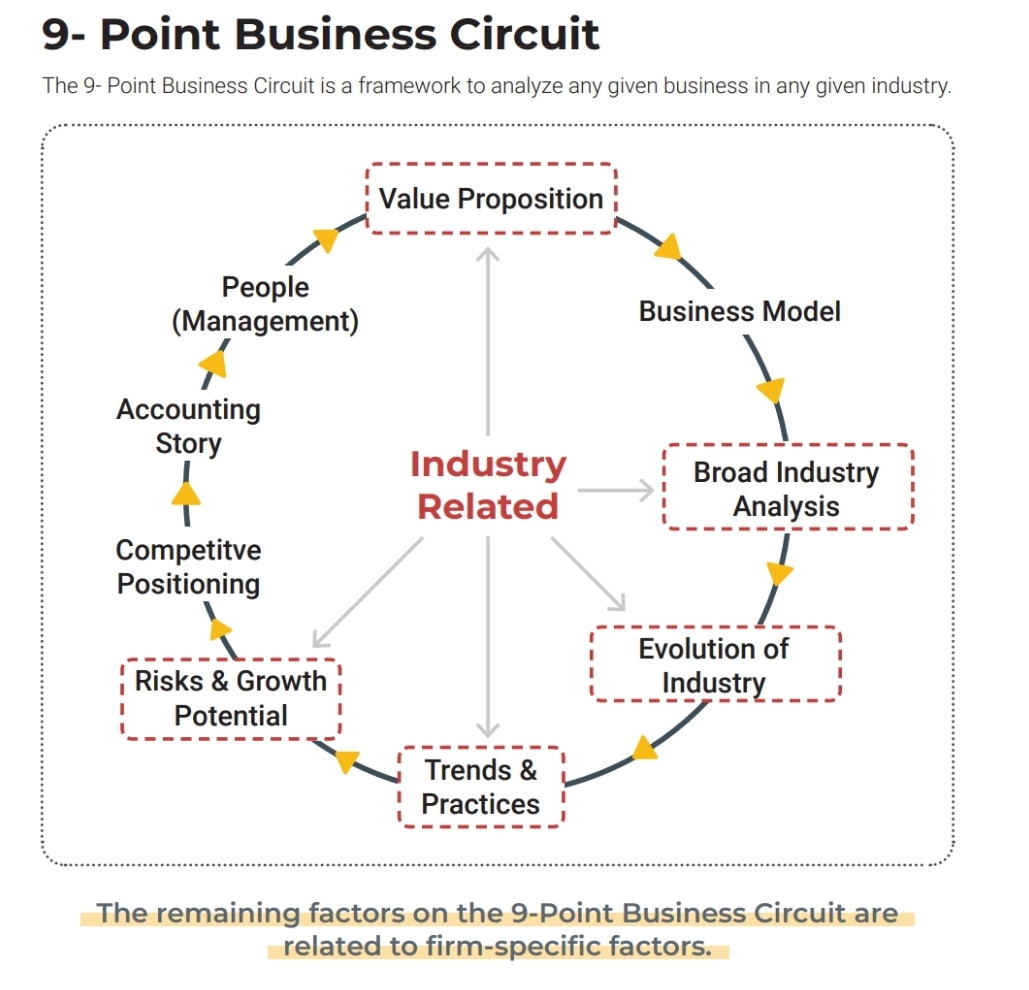

The 9 Point Business Circuit is a comprehensive framework for analyzing any business within its industry. It covers key aspects such as value proposition, business model, industry trends, competitive positioning and growth potential, helping entrepr

See More

Rohan Saha

Founder - Burn Inves... • 7m

Okay so WeWork and Studds IPOs have been approved. But honestly I am not feeling confident about WeWork’s India operations or its financials. Their US business was already a complete failure and now they are coming with this IPO as an OFS which simpl

See More

Ch sai teja

Founder of Safefeed ... • 11m

I have started a startup based on AI-health care....I have prepared a good pitch deck along with the market research, business model , plan and monetization etc ...and everything....Should I contact investors now or should I develop prototype first t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)