Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

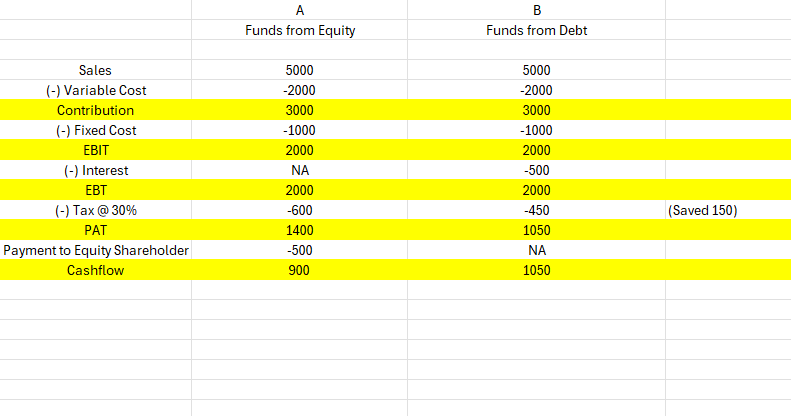

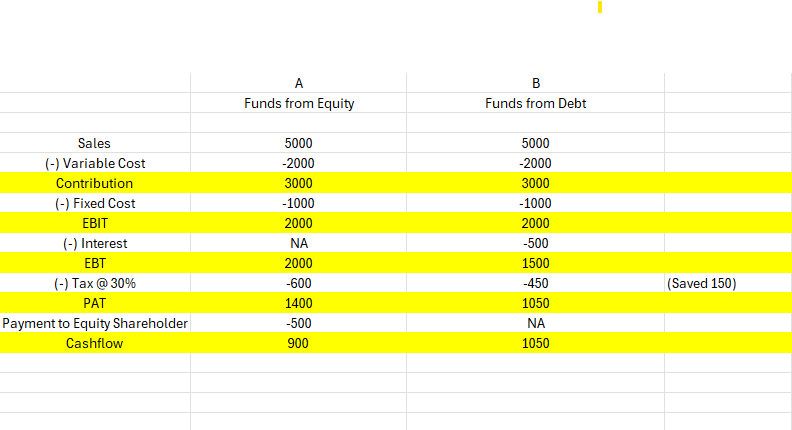

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded entirely through equity Scenario B: Funded with debt, incurring ₹500 interest Key Insight: Despite interest expense in B, the tax savings (₹150) make a significant impact. Result - Higher cashflow in Scenario B: ₹1050 vs. ₹900 in Scenario A. This is the power of the debt tax shield.🔥 However, while debt improves cashflow, it also increases financial risk. The optimal choice depends on your risk appetite and business stability. Moral: Leverage can work for you - if managed wisely. Note: Debt is better if ROI > Cost of Debt Would you go with equity or debt for your startup?

Replies (7)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

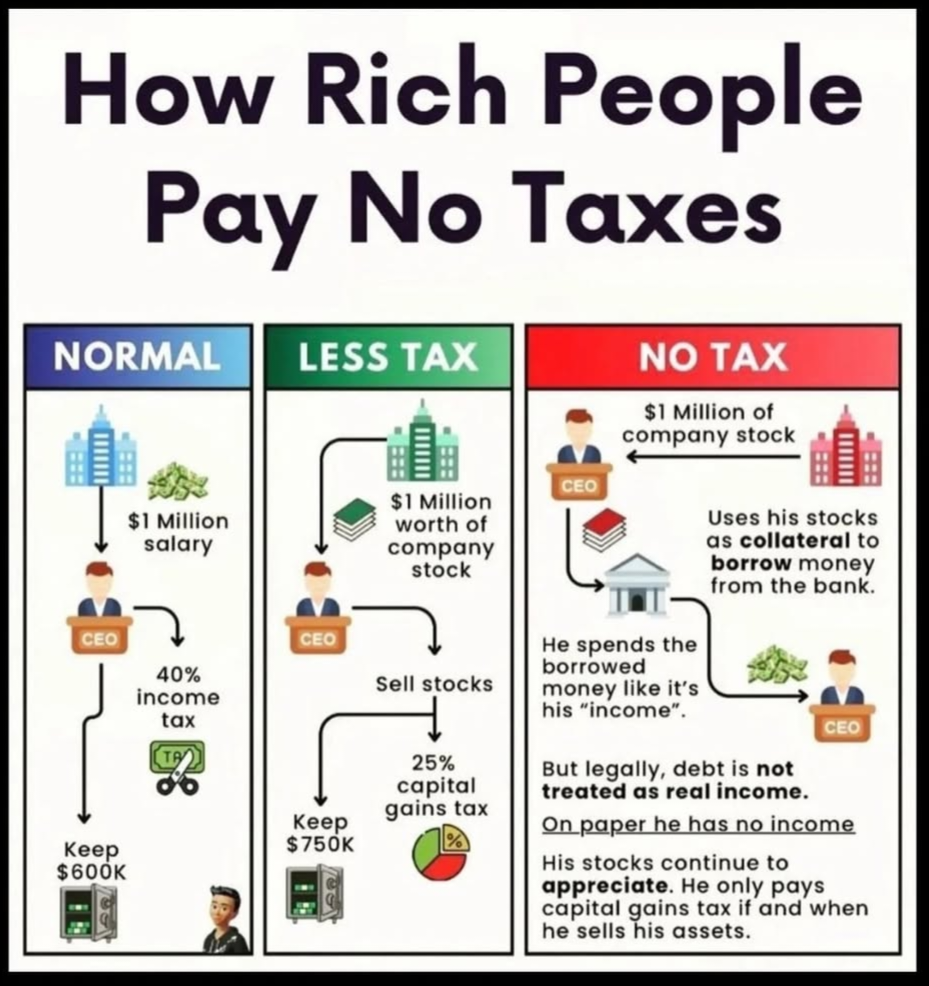

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreAccount Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Sairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreManik Gruver

Investment Lead at M... • 9m

Get Started - 11 Our Poll 7(medial.app/post/6845b975d8f52f7fe0a6717c) revealed that after "Juggling Cashflow" (which we've roasted enough), "Tax and Governance Tangle" is your second biggest headache! We’ve already unraveled the cashflow mess in ea

See MoreVIJAY PANJWANI

Learning is a key to... • 5m

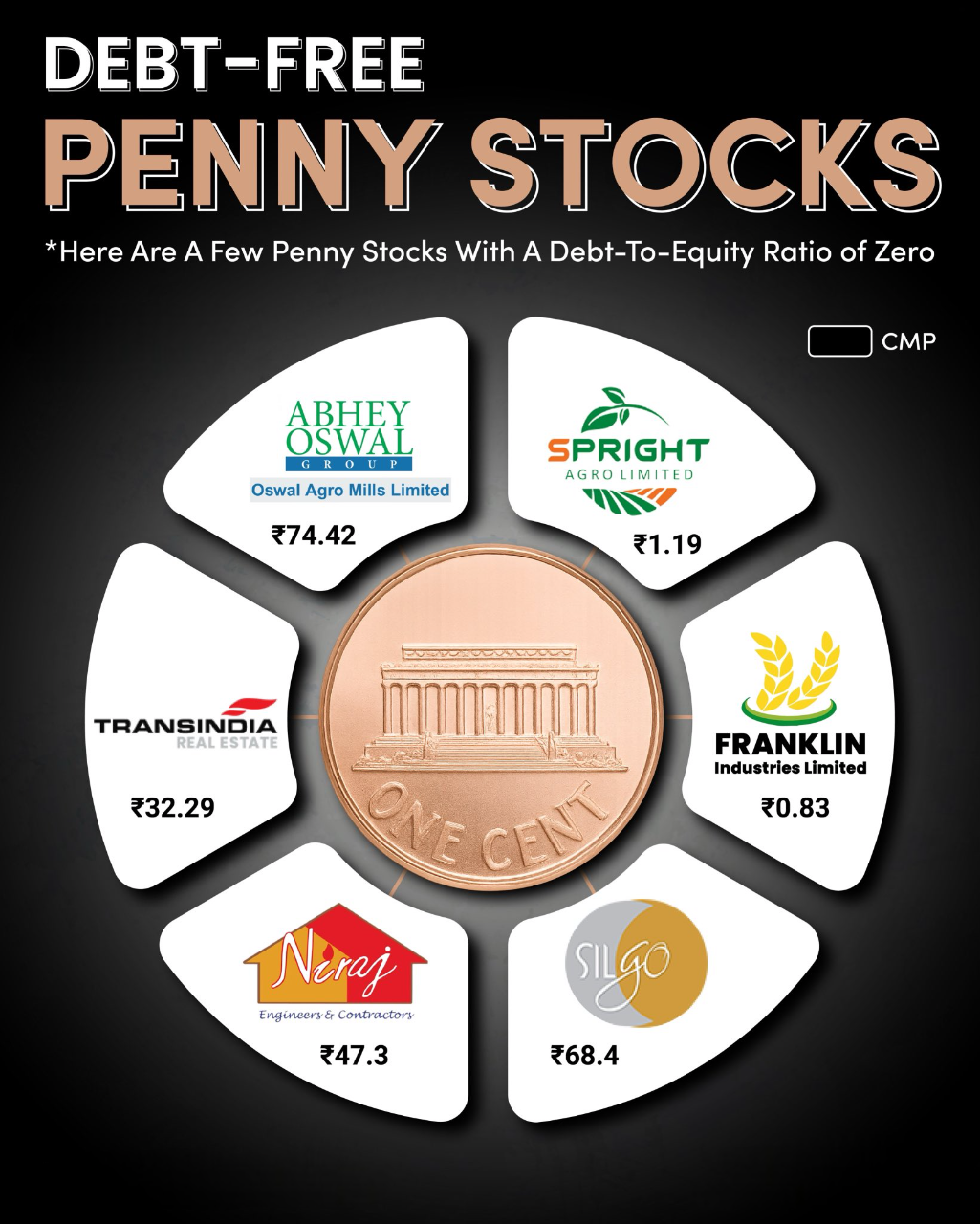

Debt-Free Penny Stocks to Watch in 2025 When it comes to penny stocks, financial health matters the most. One strong indicator is the Debt-to-Equity Ratio – and a zero debt ratio signals a company with no debt burden. Here are a few debt-free penn

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)