Back

Amanat Prakash

Building xces • 10m

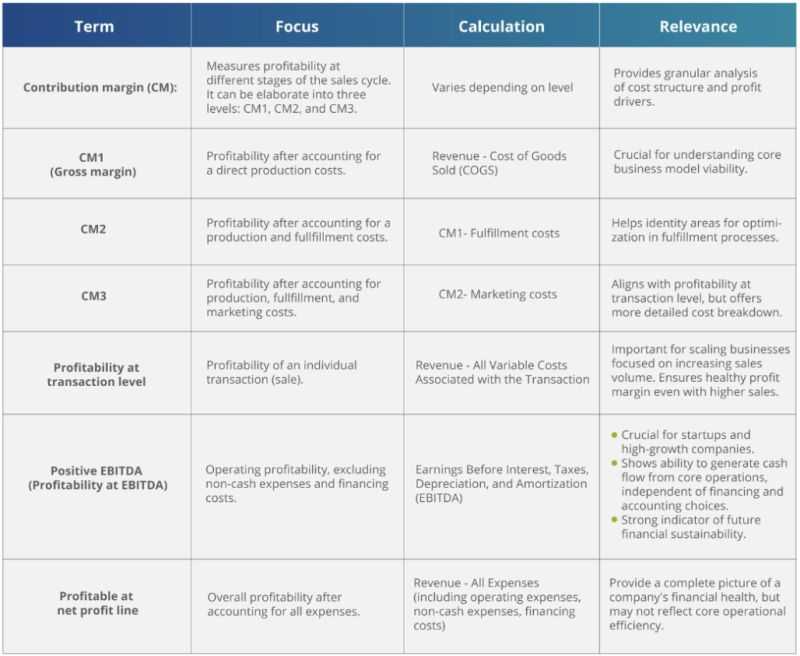

Day 1 Business Terms 1. Revenue vs. Profit – "Revenue is what you earn, profit is what you keep. A startup making ₹10L/month in revenue but spending ₹9.5L has only ₹50K profit. See the difference?" 2. Burn Rate – "How fast are you burning cash? If you spend ₹5L/month and have ₹50L in the bank, your burn rate is 10 months. Manage wisely!" 3. Equity vs. Debt Funding – "Should you raise money by selling shares (equity) or taking a loan (debt)? Equity = shared control; Debt = fixed repayment but no ownership loss." 4. MVP (Minimum Viable Product) – "Your startup idea doesn’t need to be perfect. Start with a basic version, test, and improve. Dropbox’s MVP was just a simple demo video!" 5. Fixed vs. Variable Costs – "Rent & salaries = Fixed. Marketing & raw materials = Variable. Know these to budget smarter."

Replies (1)

More like this

Recommendations from Medial

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

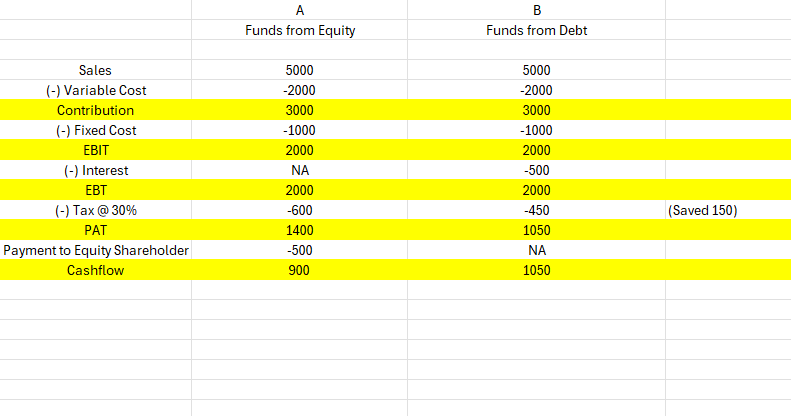

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Vedant Tiwari

Founder of VedspaceA... • 1y

Guysss... How to calculate the burn rate? like a initial startup... who's in initial stages... And a investor asking how much you need??? as our last post, a lot of you suggested some of the great ideas.... thanks for that... one of them was, burn

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)