Back

Amanat Prakash

Building xces • 10m

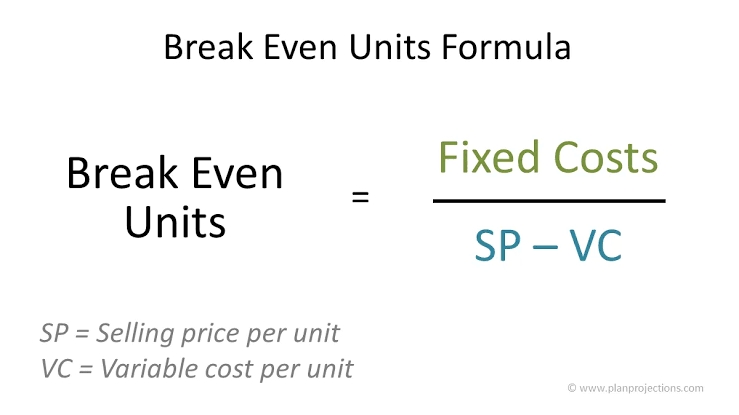

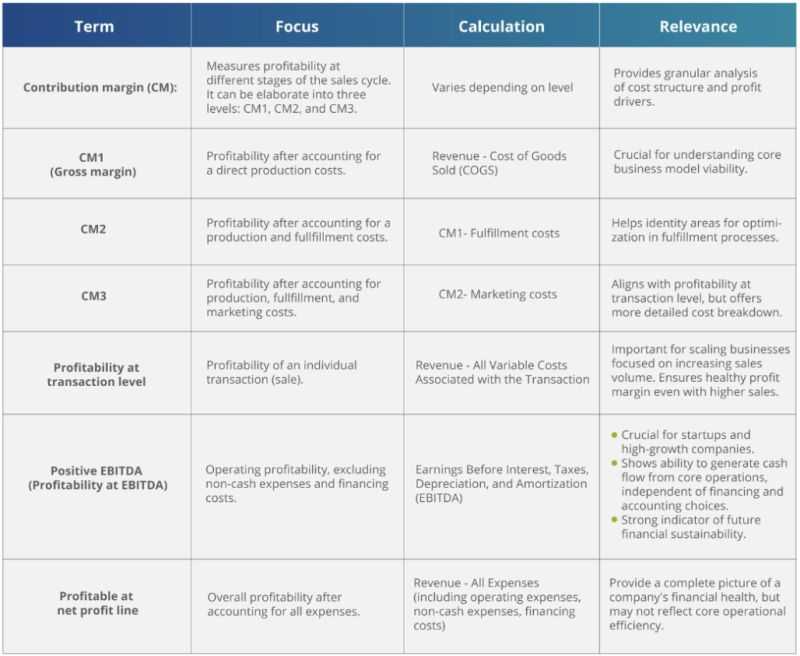

Day 4 Business Terms Contribution Margin – The Profit Clue Most Businesses Ignore Most founders talk about revenue and profit… but ignore what really drives profitability: Contribution Margin. What is it? Contribution Margin = Revenue – Variable Costs per unit It tells you how much money you make from each unit sold—after covering just the variable costs (like materials, delivery, packaging). Why it matters: Shows how much is left to cover fixed costs like salaries, rent, or marketing. High contribution margin = better control over scaling and pricing. Vital for pricing decisions, discounts, and growth planning. Example: You sell a product for ₹500. Variable cost = ₹300. Contribution Margin = ₹200 If your fixed costs are ₹2,00,000/month, you need to sell 1,000 units to break even. Pro Tip: Focus on improving your contribution margin before chasing growth—or you might scale losses instead of profits.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Dipesh Pimpale

Data Analytics | 𝐀�... • 1y

Imporant metric for Start-ups - Break Even Units Suppose we are a shoe brand and we want to calculate our units to be sold for break even (No profit No Loss) Fixed Cost - 4,00,000 Selling Price per Unit - 1200 Variable Cost per Unit - 800 Contributi

See More

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

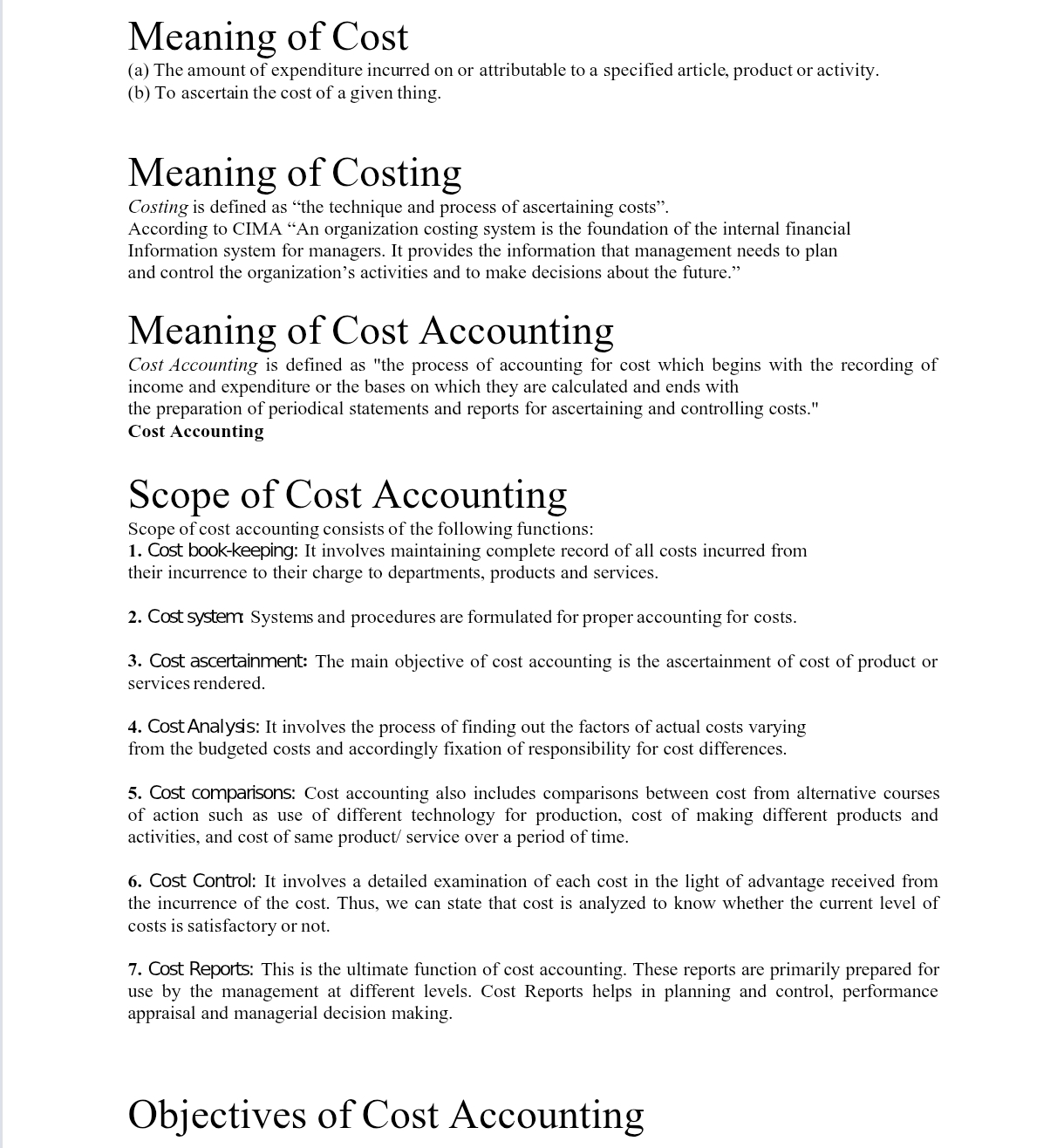

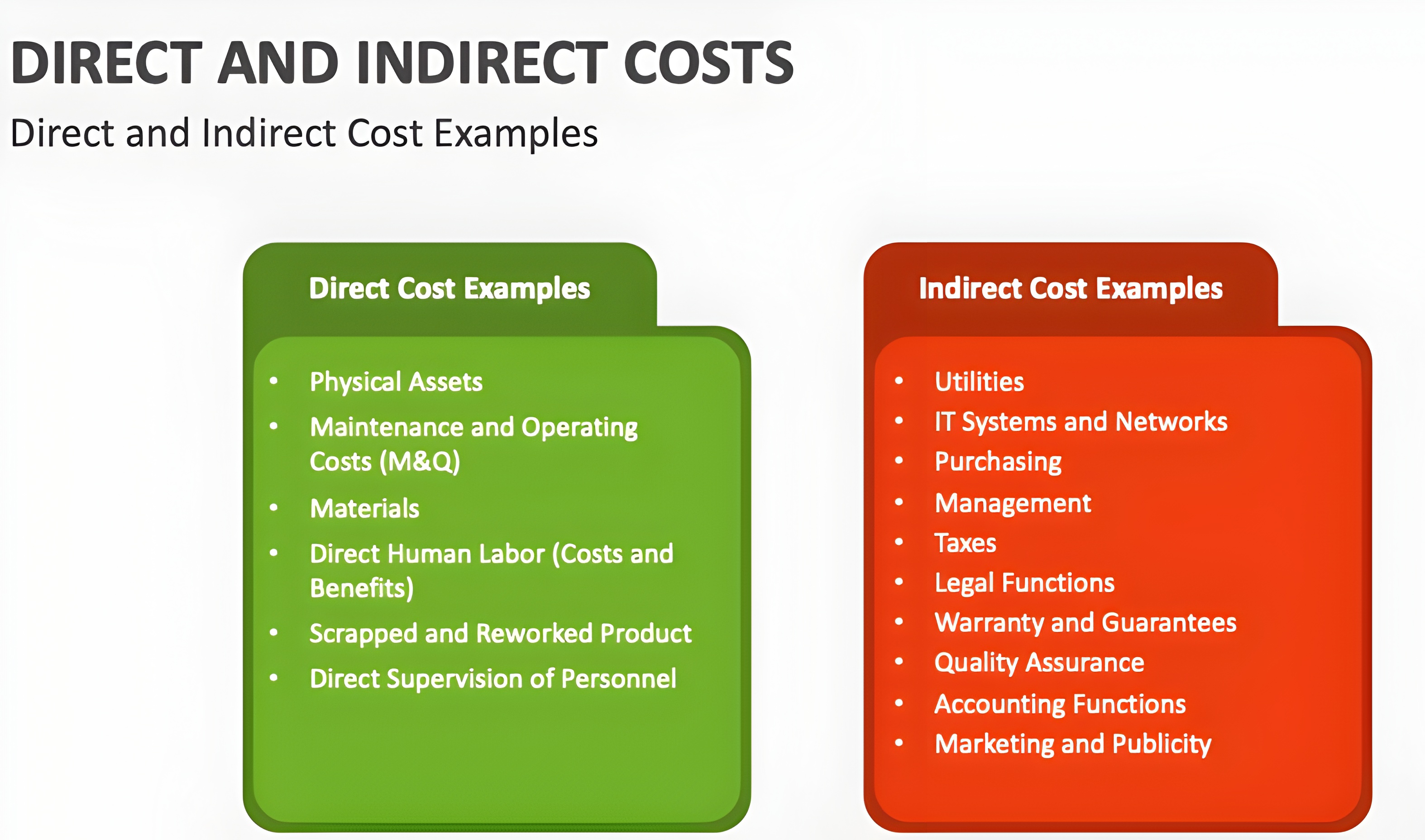

💰Learn Start-up Maths —( Concept - 2 )📊 💱 All details about “ COST ” Whenever someone asks you about the cost just tell him that “ Cost the amount of money that a business spends on the creation of something ” • There are many types of cost #

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)