Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

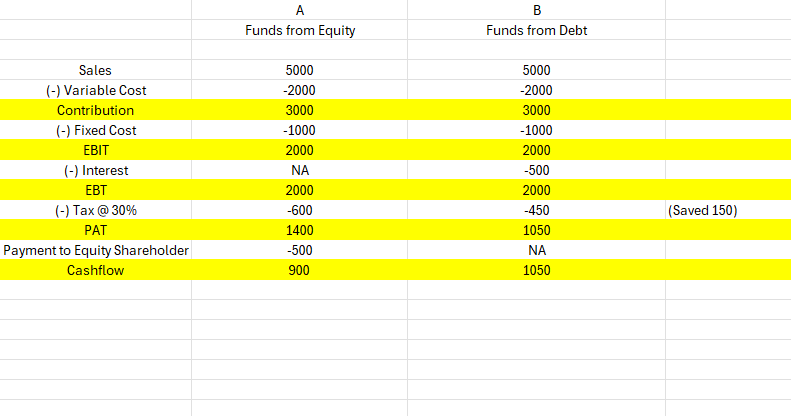

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher than interest rate/cost of debt.

Replies (11)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreRohan Saha

Founder - Burn Inves... • 8m

Tomorrow, the RBI's interest rate decision is scheduled. Some believe the rate could be cut to as low as 5.75%. But that's not the main issue right now the key question is what decision the RBI takes regarding liquidity. Today, the market is performi

See MoreHavish Gupta

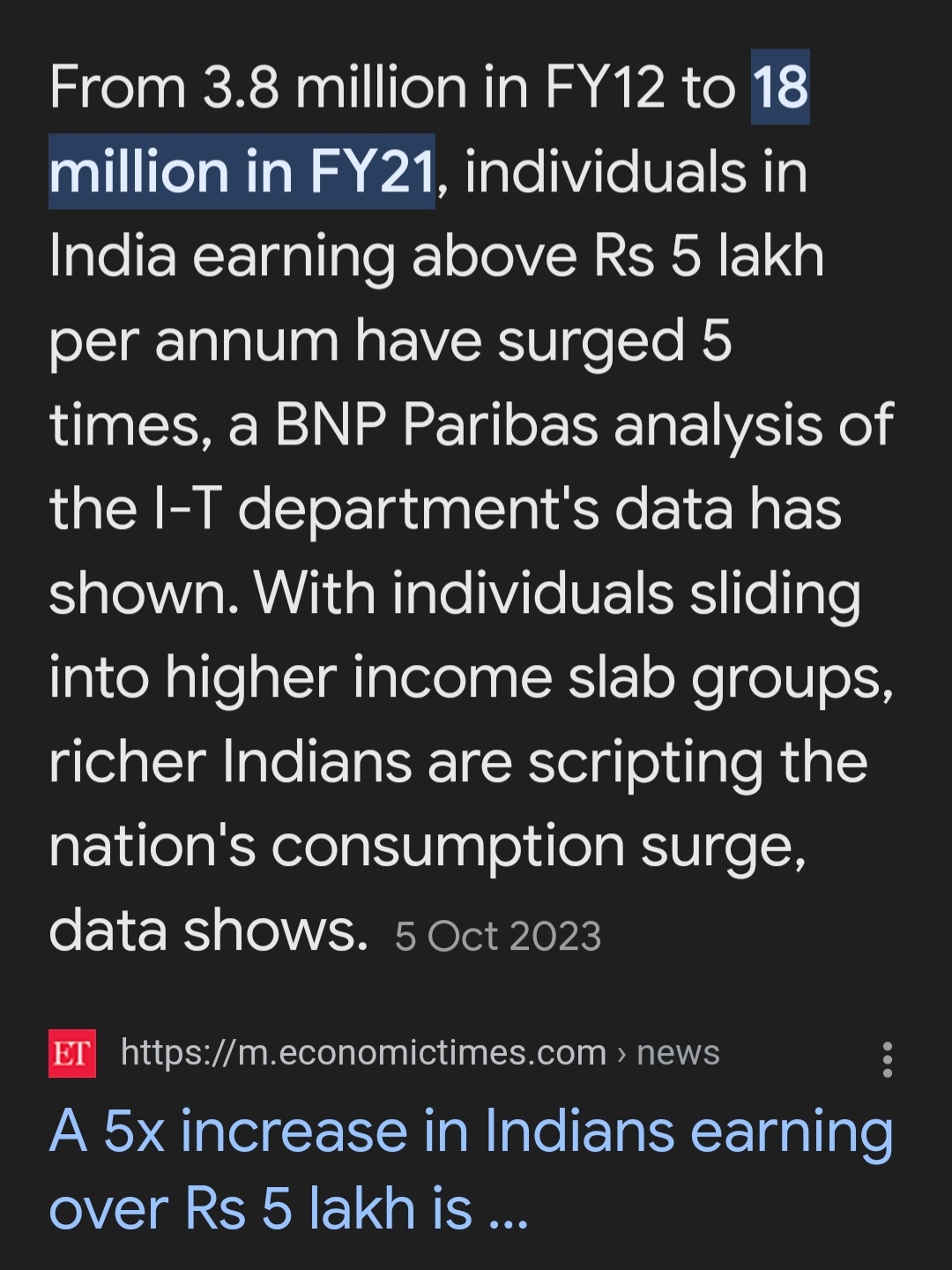

Figuring Out • 2y

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Anonymous

Hey I am on Medial • 1y

“I have been earning around 10 LPA (lakhs per annum), but a significant portion of my income is being deducted as taxes. I’m unsure about what steps to take. Could you please provide some tips on how I can minimize my tax liability and save more mone

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)