Back

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle loans 10% of the total debt, and consumption loans growing significantly, rising interest rates are adding to the financial strain. This will push the inflation rate more and surely RBI will have to increase the repo rate. Will we see a decline in consumer spending. Will it affect the new age Startups.

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAman Khan

Connecting Heart And... • 1y

AI spending in India is expected to increase to $5 billion with CAGR (compound annual growth rate) of 31.5 per cent between 2023 to 2027. By 2027 AI will be everywhere," Sharath Srinivasamurthy, Associate Vice President, IDC said. He said that in 202

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

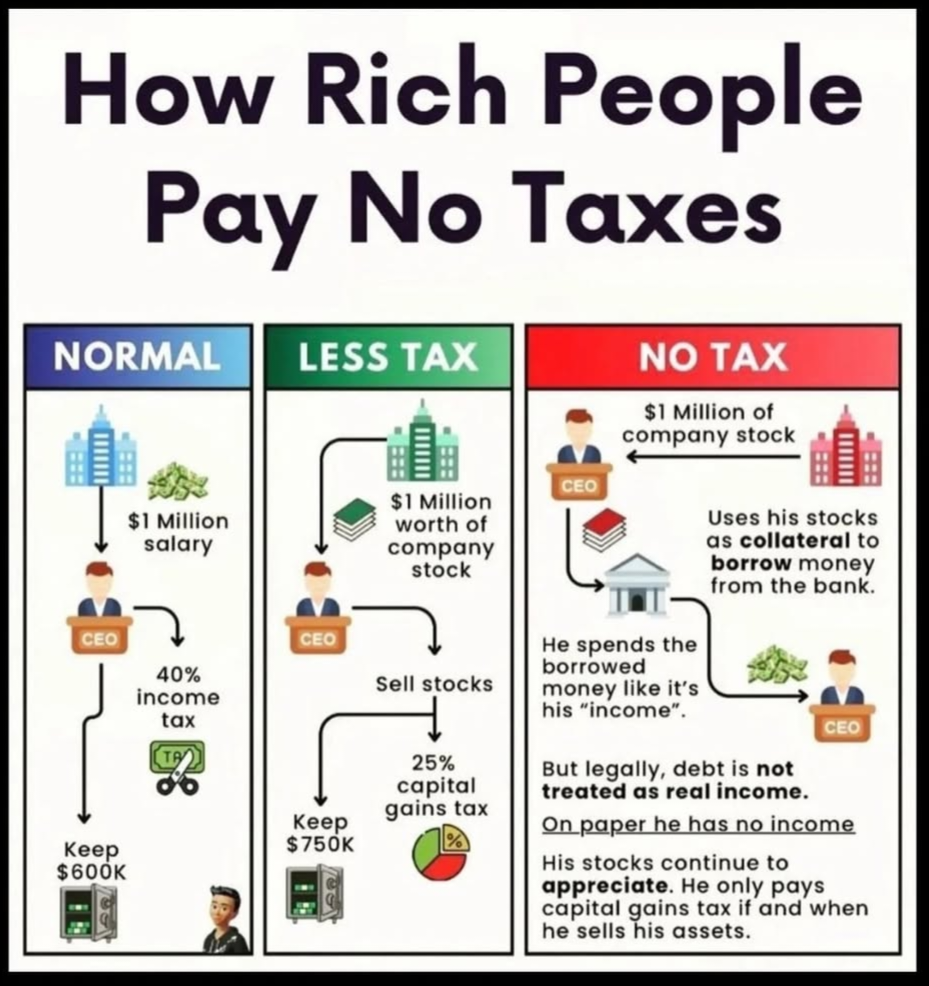

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Havish Gupta

Figuring Out • 1y

Why do you think that in the last 2 years, the Number of Instant Loan Startups have skyrocketed, and also almost every company have started to provide loans? Like what happened in this period that have helps these companies dicide whom to give loans

See MoreRajan Paswan

Building for idea gu... • 1y

Bad News: Rupee falls to record low 83.60/$ Here are negative impacts of falling Rupee: 1) Increased Costs for Imports: Many Indian businesses rely on imported goods and raw materials. A weaker rupee means they will have to pay more for these impor

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)