Back

Sairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll need to repay with interest. This can be a great option depending on your business model and growth stage. What is Debt Financing? Debt financing means taking out loans or lines of credit that need to be repaid over time. This includes: Bank Loans: Traditional loans from banks or credit unions, often requiring solid credit history and collateral. Lines of Credit: Flexible borrowing with interest paid only on the amount used. Convertible Notes: Short-term loans that can convert into equity, typically used in early-stage startups. Pros of Debt Financing: No Equity Loss: Maintain full ownership and control of your business. Predictable Payments: Fixed repayment schedules make it easier to plan your finances. Tax Benefits: Interest payments are often tax-deductible. Cons of Debt Financing: Repayment Obligations: Regular payments can strain cash flow, especially for early-stage startups. Interest Costs: Over time, the cost of interest can add up. Risk of Default: Failure to repay can harm your credit rating and potentially lead to business failure. When Does Debt Financing Work Best? Debt financing is particularly effective for businesses with predictable cash flow and clear revenue models. It’s ideal when you need funds for specific projects or working capital without diluting ownership. A Word of Caution: While debt financing is a common and effective way to invest money into your business, it’s not always the best choice for every startup. Personally, I find that it may not align with all business models, especially those in their early stages with uncertain cash flow. Assess whether the potential financial strain from repayment will be manageable for your business. Real-World Example: Consider Tesla in its early days. Tesla used debt financing to fund its operations and growth, allowing it to expand without giving up equity. The key was balancing debt levels with the company’s ability to generate consistent revenue. Take the time to evaluate if debt financing fits your business needs. Understanding the pros and cons will help you make informed decisions that align with your goals. For more insights into startup funding, stay tuned for our upcoming posts! See you next time, Kadam

Replies (3)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreSairaj Kadam

Student & Financial ... • 1y

I recently posted about debt financing and got some interesting responses. I want to dig a bit deeper into this topic. For those new to startups or even those with some experience, how do you feel about using debt financing? Robert Kiyosaki, from "R

See More

Vivek Joshi

Director & CEO @ Exc... • 2m

Funding Insight: Debt Done Right Many SME and project owners focus solely on the size of the loan. The truly powerful insight? Focus on the structure and source. * Structure: Is the repayment schedule aligned with your project's cash flow cycles, no

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

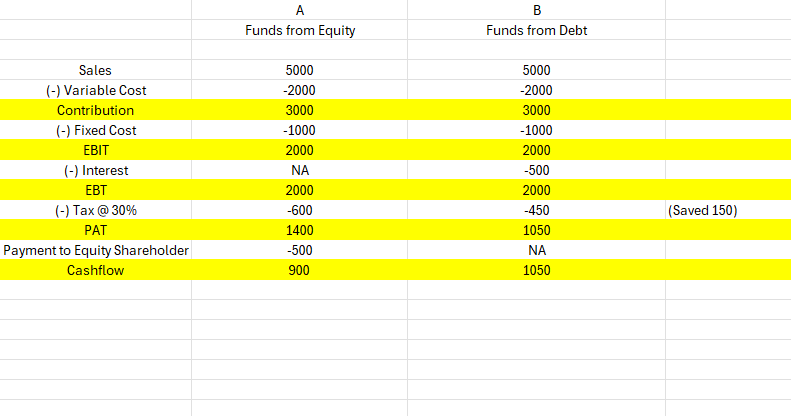

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)