Back

Sairaj Kadam

Student & Financial ... • 1y

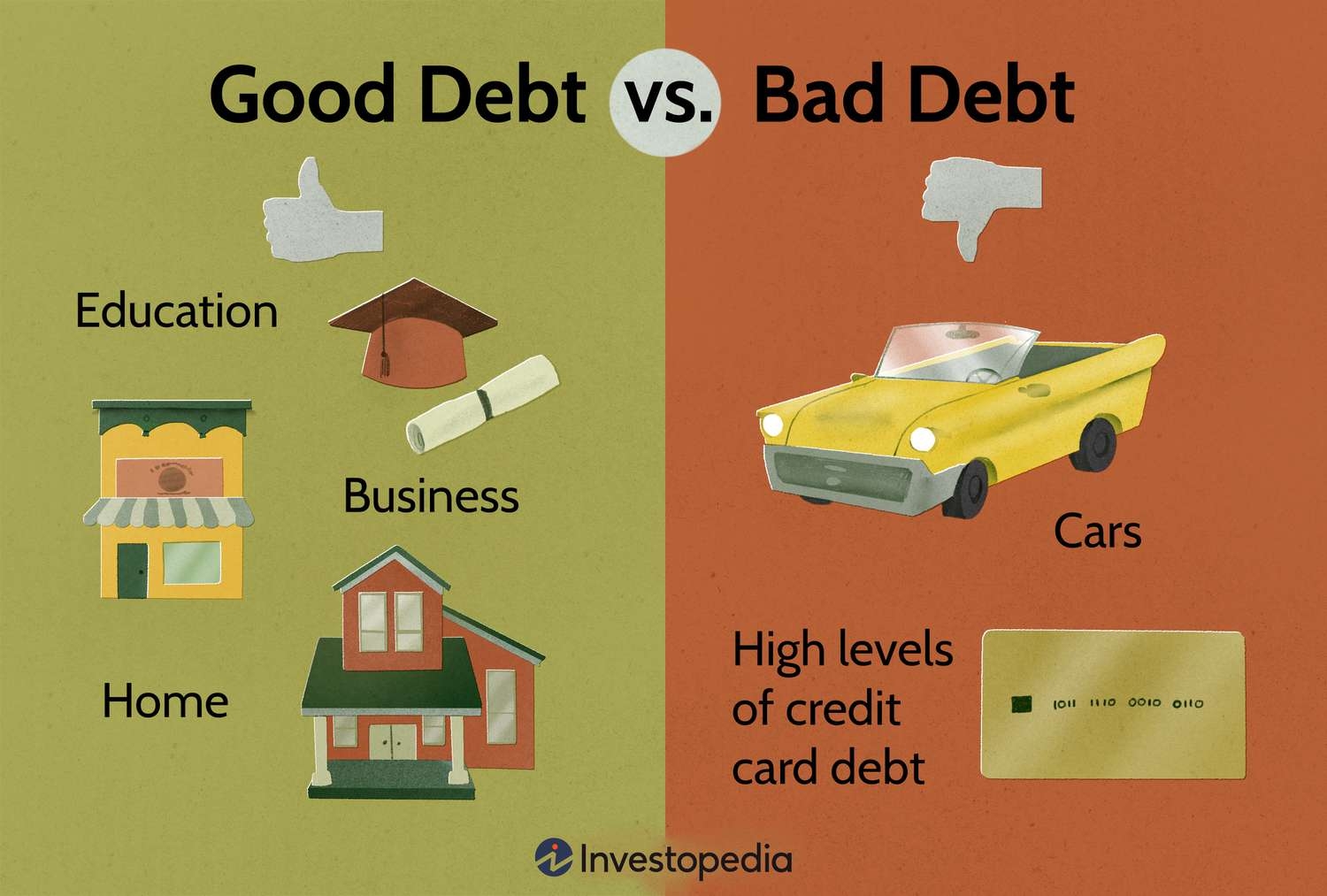

I recently posted about debt financing and got some interesting responses. I want to dig a bit deeper into this topic. For those new to startups or even those with some experience, how do you feel about using debt financing? Robert Kiyosaki, from "Rich Dad Poor Dad," is often cited in discussions about debt. There’s a claim that he once mentioned being $1.2 billion in debt, though it's important to verify such details. The question is, would you consider taking on significant debt to grow your business? Many would say such large loans are too risky. So, should we explore ways to manage these risks, or avoid high debt altogether? I’m curious to hear your thoughts on this!

Replies (3)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

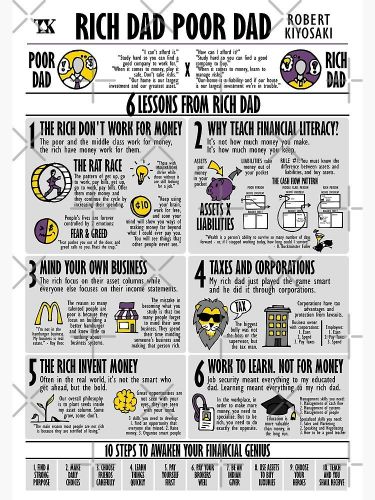

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

financialnews

Founder And CEO Of F... • 1y

"8 Powerful Assets to Help You Achieve Financial Freedom and Quit Your Job" Robert Kiyosaki's 8 Essential Assets to Achieve Financial Freedom Robert Kiyosaki, author of the bestselling book Rich Dad Poor Dad, is known for his unique approach to per

See MoreSairaj Kadam

Student & Financial ... • 1y

Kiyosaki’s Bold Bitcoin Predictions: Did They Hit the Mark? Robert Kiyosaki, author of Rich Dad Poor Dad and a well-known financial commentator, made waves with his ambitious Bitcoin predictions throughout 2024. While some of his forecasts remain un

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreInovbiz Studio

Inspire. Innovate. S... • 10m

Business Tips #12 Top 3 Books Every Business Owner Should Read 📚 Want to level up in business? Read these 3 game-changing books: 1️⃣ The Lean Startup – Eric Ries 📖 → Learn how to start small, test ideas, and grow fast. 2️⃣ Rich Dad Poor Dad – Rober

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreTuhin Subhra Biswas

Building in 🥷🏻• Pr... • 1y

1 Hour with Robert Kiyosaki (Rich Dad Poor Dad) on Billionaire Mindset & World War 3 Lessons which I've learnt from the podcast -if you want to get a desired position, start talking and take sessions with the person who already achieved that Positio

See MoreAccount Deleted

Hey I am on Medial • 1y

Let's decode one pattern : • Companies were backed by Softbank such as OYO, OLA Electric and FirstCry are continuously filing for IPO but some IPO's approved or some failed for IPO. • Startups backed by Softbank such as OLA Electric and OYO are ra

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)