Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

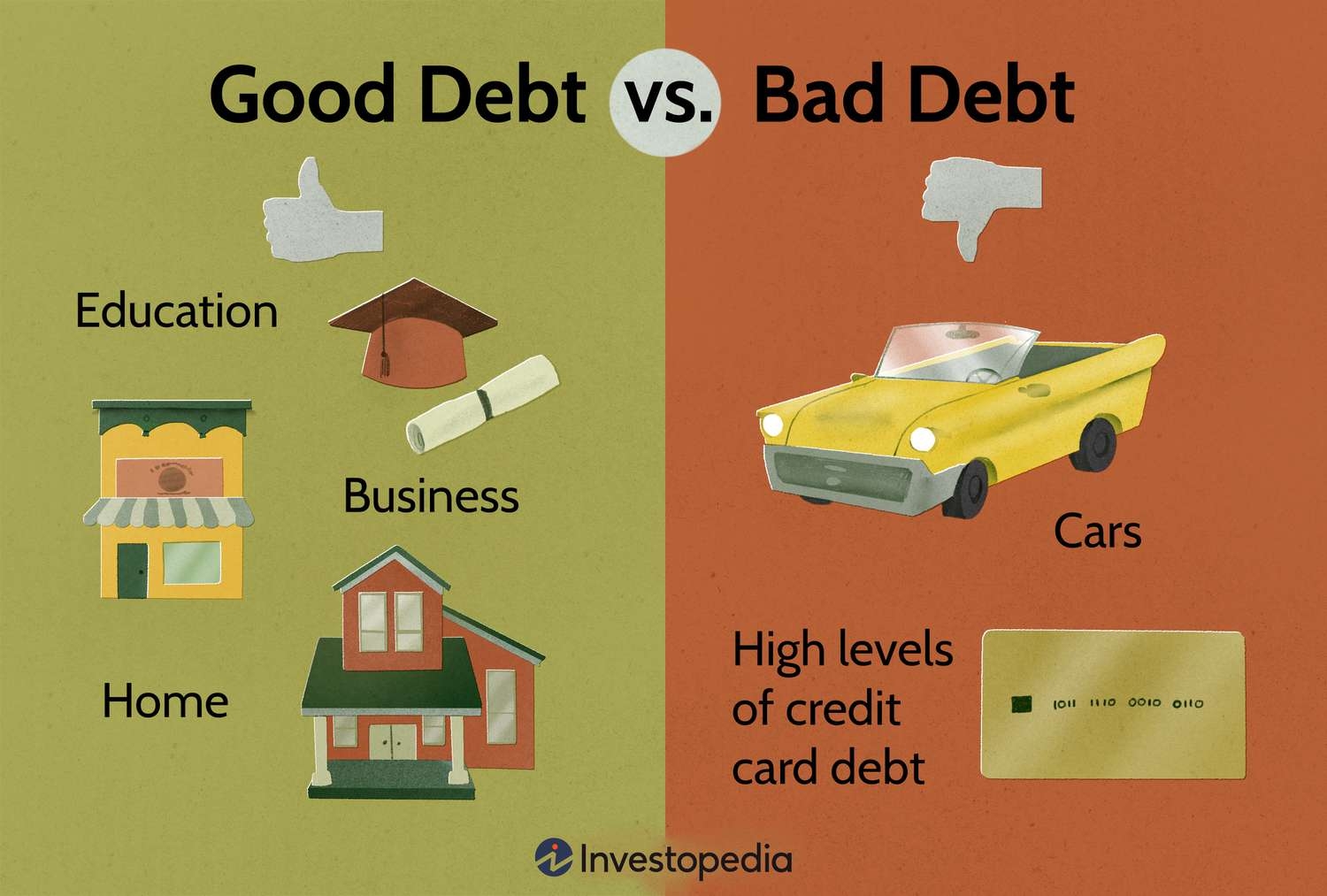

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a part of his financial philosophy, which differentiates between assets and liabilities. he uses debt to purchase assets rather than liabilities. Kiyosaki categorizes debt into good debt and bad debt, with good debt being that which helps build wealth, such as loans used for acquiring income-generating assets like real estate, businesses, or investments. Middle class man buys loan for the liabilities like purchasing a home or a car. but he takes loan to buy assets eg. a real estate and income from that is used to pay for the interest. Next post will be on how to take decision while buying an assets and some calculation. as a CA student its helps a lot.

Replies (8)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

I recently posted about debt financing and got some interesting responses. I want to dig a bit deeper into this topic. For those new to startups or even those with some experience, how do you feel about using debt financing? Robert Kiyosaki, from "R

See More

Sairaj Kadam

Student & Financial ... • 1y

Kiyosaki’s Bold Bitcoin Predictions: Did They Hit the Mark? Robert Kiyosaki, author of Rich Dad Poor Dad and a well-known financial commentator, made waves with his ambitious Bitcoin predictions throughout 2024. While some of his forecasts remain un

See More

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See Morefinancialnews

Founder And CEO Of F... • 1y

"8 Powerful Assets to Help You Achieve Financial Freedom and Quit Your Job" Robert Kiyosaki's 8 Essential Assets to Achieve Financial Freedom Robert Kiyosaki, author of the bestselling book Rich Dad Poor Dad, is known for his unique approach to per

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTuhin Subhra Biswas

Building in 🥷🏻• Pr... • 1y

1 Hour with Robert Kiyosaki (Rich Dad Poor Dad) on Billionaire Mindset & World War 3 Lessons which I've learnt from the podcast -if you want to get a desired position, start talking and take sessions with the person who already achieved that Positio

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)