Back

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 10m

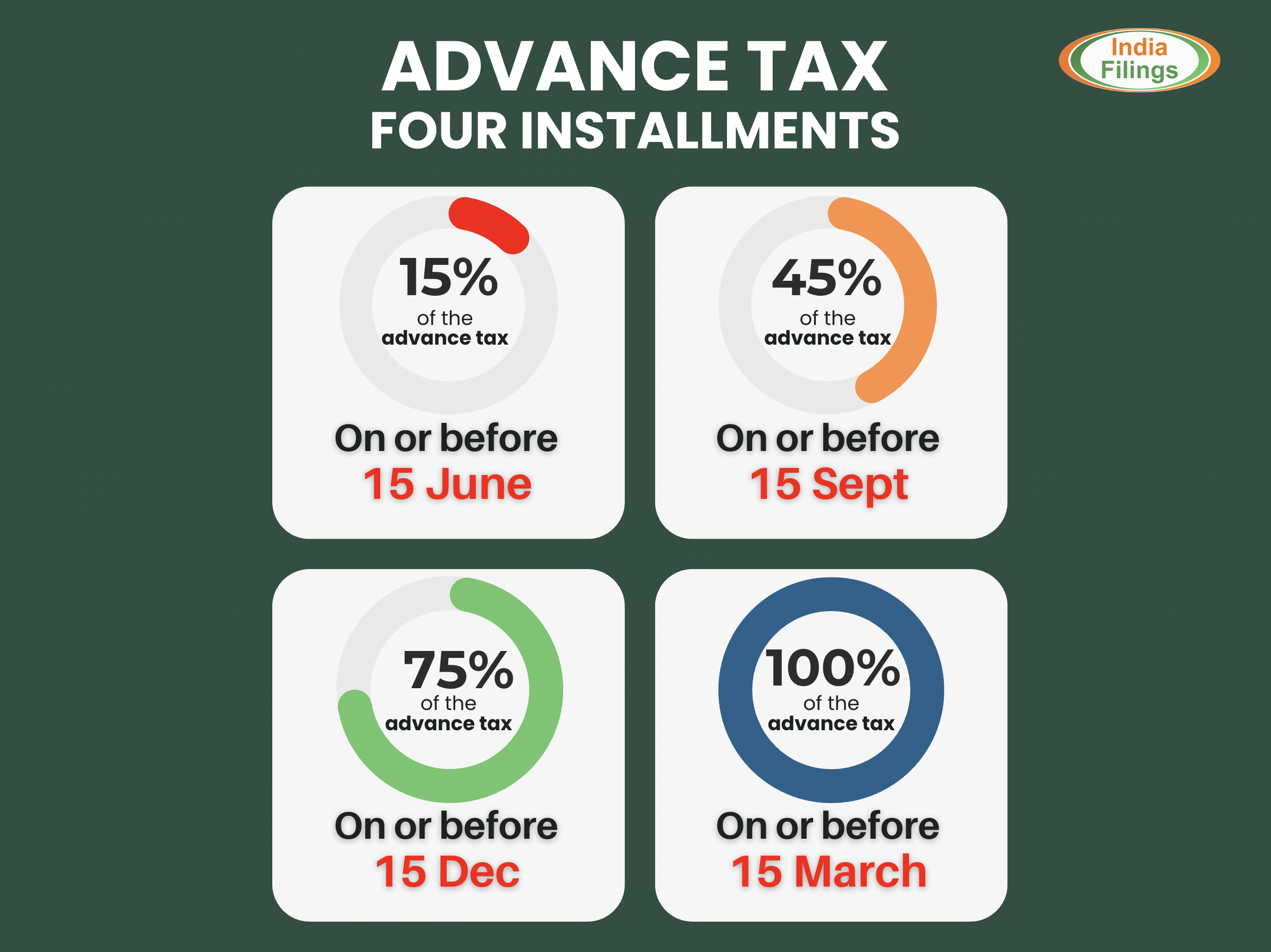

Tax season got you sweating? 😅 Here’s your survival kit: ✅ Organize receipts monthly (use apps like Expensify!). ✅ Track deductible expenses (yes, that home office counts!). ✅ Hire a CA who speaks ‘tax’ fluently—😎 DM me for a FREE tax checklist to

See More

Kiran aiwale

The business solutio... • 9m

Bajaj Allianz Life insurance Term insurance 1. *Affordable premiums*: Lower premiums compared to whole life insurance. 2. *High coverage*: Provides a high death benefit to ensure financial security for loved ones. 3. *Flexibility*: Choose term le

See MoreSandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)