Back

Sandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognized by the DPIIT, you can benefit from a 3-year tax holiday within your first 10 years. It’s a great way to reinvest profits into scaling your business. •GST Benefits: Understanding GST can help you manage cash flow better. Opt for the Composition Scheme if your turnover is under ₹1.5 crore—it simplifies filing and lowers tax rates. •R&D Deductions: Invest in innovation? You can claim up to 150% deduction on expenses related to in-house R&D. •Angel Tax Exemption: If your startup meets certain conditions, you can avoid the angel tax on investments, easing fundraising efforts. By leveraging these tax benefits, you can stretch every rupee and focus on what matters—growing your startup! Keep these tips in mind to navigate the tax maze like a pro.

Replies (7)

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 5m

🏠 GST & Real Estate Update Realtors are waiting for govt clarity on how GST input tax credit benefits should be passed on to homebuyers. This decision will directly impact whether home prices go up or come down under the new GST regime. What do you

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

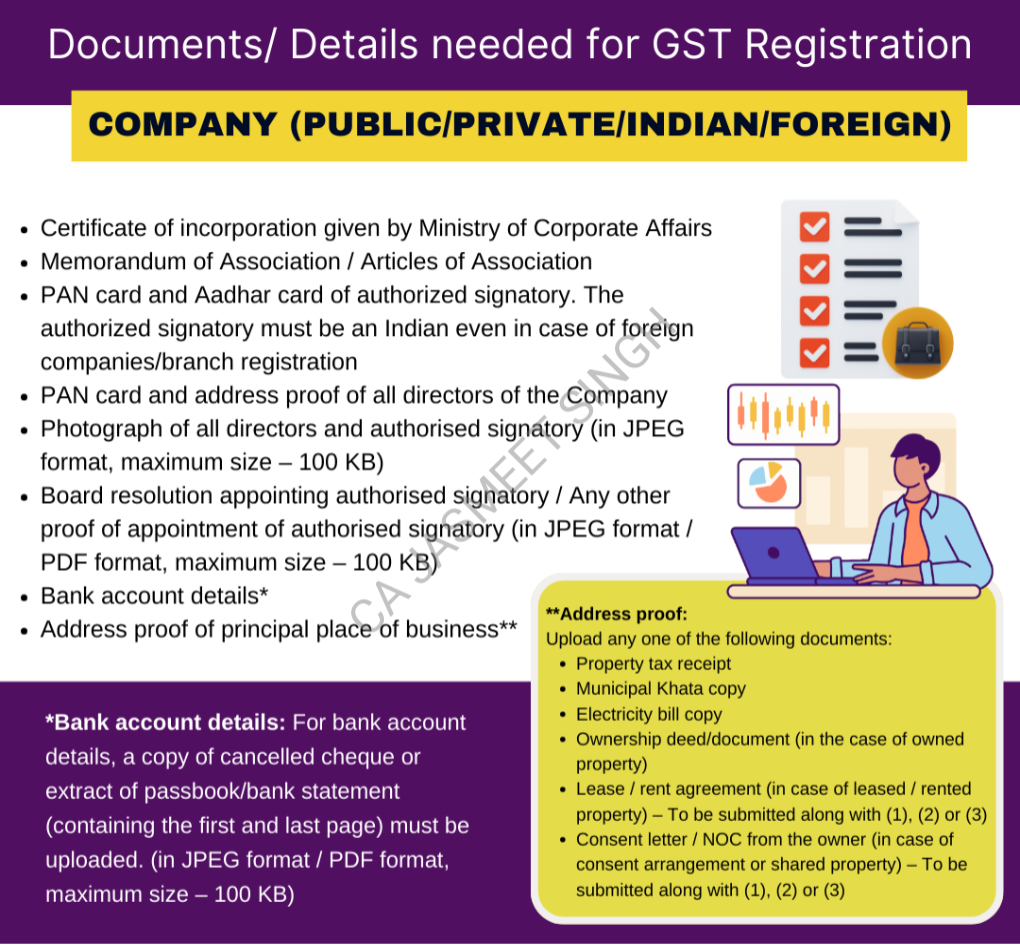

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Nawal

Entrepreneur | Build... • 10m

Come on, just stop already - 🔥 Deeptech takes years to build, and here Indian VC give 10 mins to pitch. They don't understand the essence of R&D and want immediate results. No one wish to spend on R&D. So companies like Swiggy, Zomato fly but DeepT

See More

Aniket Agarkhed

Hey I am on Medial • 1y

Sarla Aviation, an aerospace startup developing electric flying taxis, has secured $10M in funding led by Accel, with angel investors like Binny Bansal and Nikhil Kamath, to establish an R&D center in Bengaluru and launch its prototype, Shunya, on Ja

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)