Back

Manu

Building altragnan • 10m

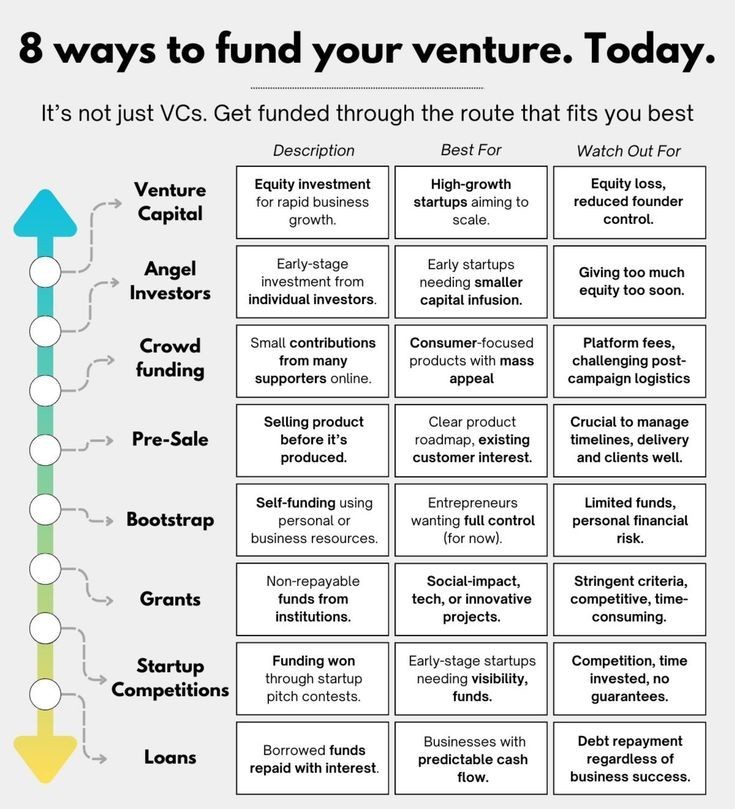

Looking to fund your startup but not sure where to start? This guide lays out 8 smart ways to finance your venture—beyond just venture capital. Whether you’re an early-stage founder or scaling up, there’s an option that fits. You can go for venture capital or angel investors if you're aiming big early, but be mindful of equity and control. Crowdfunding is great for products with mass appeal, but comes with logistical challenges. Got customer interest? A pre-sale could fuel development without giving away equity. If you’re playing it lean, bootstrapping with your own resources keeps control in your hands. Grants are golden for innovative or impact-driven ideas—just be ready to face strict criteria. Startup competitions offer visibility and prize money, though they’re competitive. Lastly, loans offer predictable cash flow but come with repayment obligations.

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid g

See MoreMayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Equity Funding for New Businesses Hello everyone, Let's talk about equity investment today, a crucial component of startup funding. Startups often use this strategy to accelerate growth and broaden their customer base. So, what exactl

See MoreAccount Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Vedant SD

Finance Geek | Conte... • 1y

Day 59: BLR Startup Funding: Beyond the Angel Investors Angel investors are the fairy godmothers of the startup world, but they're not the only funding option in Bengaluru. Here's a look beyond: * Bootstrapping Magic: Self-funding your startup wit

See More

Anonymous

Hey I am on Medial • 1y

✨ Ceo IQ test question ✨ You are the founder of a tech startup that has developed an innovative software platform. After several months of rapid growth, your company is facing a strategic decision: whether to continue bootstrapping or seek venture c

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)