Back

Sairaj Kadam

Student & Financial ... • 1y

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid growth and have a scalable business model, this might be the path for you. What is Venture Capital? Venture capital involves raising funds from professional investors—often organized as firms—who provide capital in exchange for equity in your company. These investors are looking for high-growth potential and are willing to take on the risk in hopes of substantial returns. Why Consider Venture Capital? Large Capital Injection: Venture capital can provide the significant funding you need to scale quickly, enter new markets, and enhance your product development. Strategic Guidance: Along with funding, VCs bring industry expertise, mentorship, and valuable connections that can help steer your startup in the right direction. Growth Acceleration: With VC backing, startups can move faster and more aggressively in the market, often outpacing competitors. Challenges of Venture Capital Equity Dilution: To secure VC funding, you’ll need to give up a portion of your ownership, which means sharing control and profits. High Expectations: VCs are in it for significant returns, so they’ll push for rapid growth, which can sometimes lead to intense pressure. Potential Misalignment: Your vision may not always align with your investors’ expectations, leading to possible conflicts down the line. Is Venture Capital Right for Your Startup? Venture capital is best suited for startups with a proven product, a clear path to market leadership, and a scalable business model. If you’re ready to grow quickly and are comfortable with giving up some control, VC could be the fuel your startup needs. My Take on Venture Capital Venture capital can be a game-changer for startups with big ambitions, but it’s not a decision to take lightly. The pressure to deliver fast growth can be intense, and the loss of equity and control may not be for everyone. But if you’re aiming to build the next unicorn, VC might be your best bet. Example:Take Airbnb as an example. Airbnb raised its first round of VC funding from Sequoia Capital in 2009, which allowed them to scale rapidly and become a global giant in the hospitality industry. Today, Airbnb is valued at over $100 billion, demonstrating the power of strategic VC backing.So, could venture capital be the right path for your startup? Weigh the pros and cons, consider your goals, and decide if this method aligns with your vision. Until next time, Kadam

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreMayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 7: Securing Funding for Your Bangalore Startup Funding is the lifeblood of many startups, and Bangalore offers a vibrant ecosystem for founders seeking capital. This post explores various funding options for Bangalore-based startups, including:

See MoreMehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

CA Jasmeet Singh

In God We Trust, The... • 1y

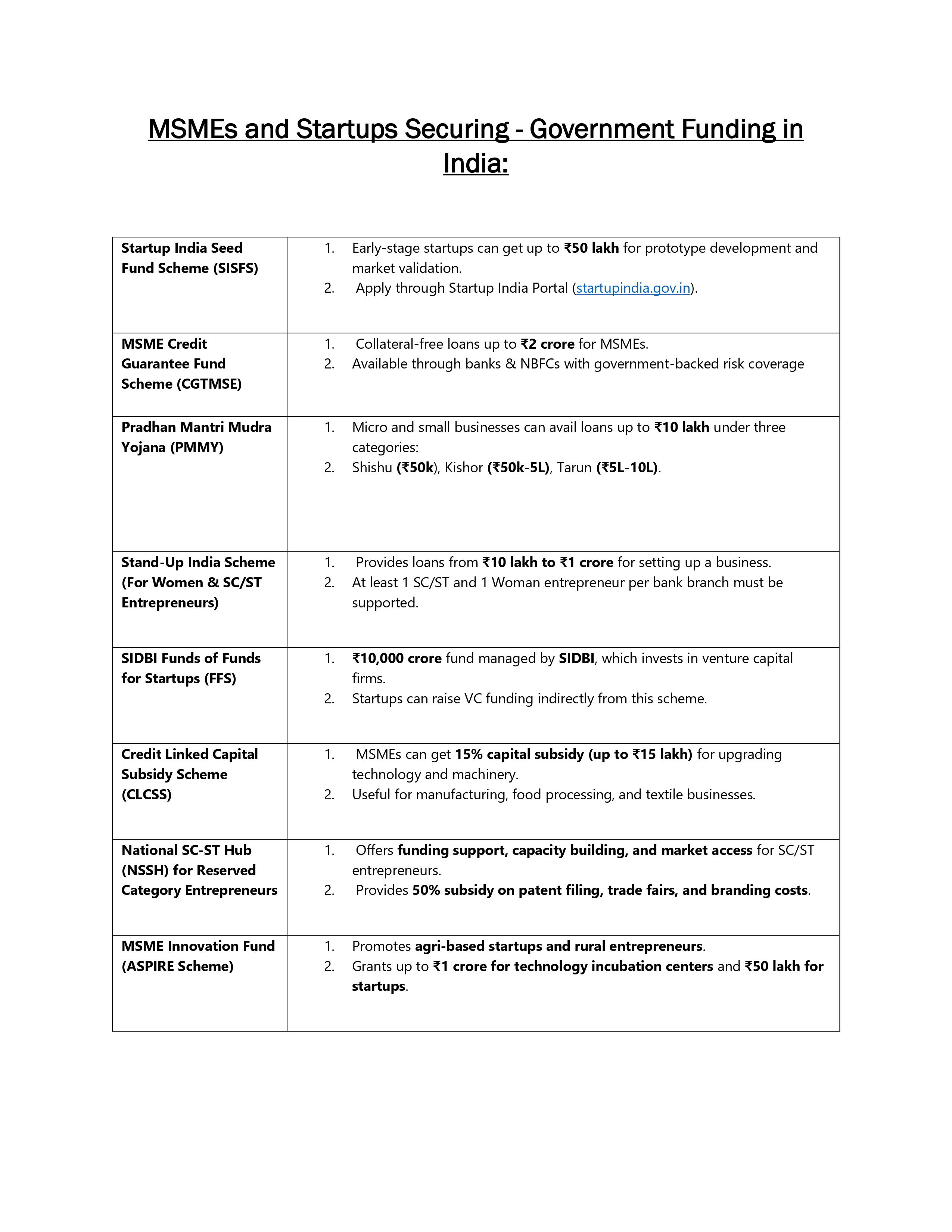

🚀 Unlocking Growth: Funding Strategies for Startups & MSMEs 💰 Access to capital is one of the biggest challenges for startups and MSMEs. Whether you're launching a new venture or scaling your business, the right funding can be a game-changer. But

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)