Back

Vedant SD

Finance Geek | Conte... • 1y

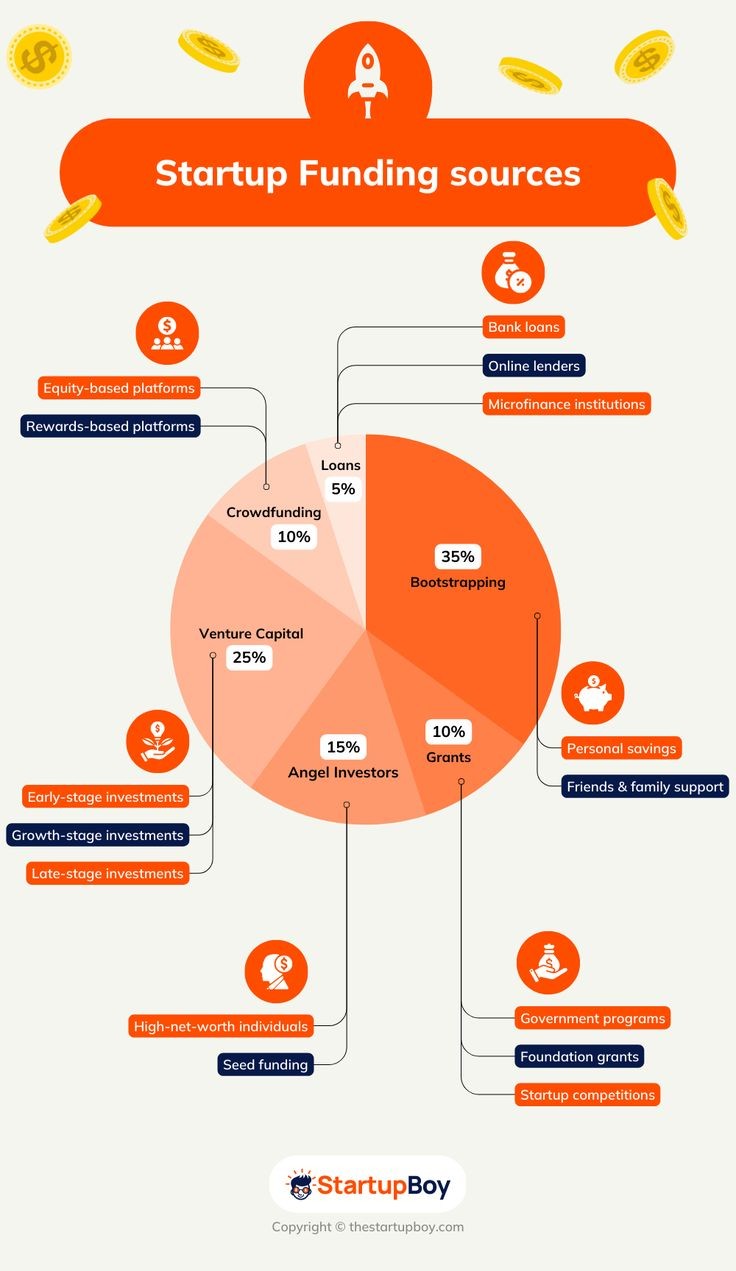

Day 59: BLR Startup Funding: Beyond the Angel Investors Angel investors are the fairy godmothers of the startup world, but they're not the only funding option in Bengaluru. Here's a look beyond: * Bootstrapping Magic: Self-funding your startup with personal savings or revenue. It's a lean journey but offers full control. * Government Grants: Explore government schemes like Startup India for financial assistance and support. * Crowdfunding Campaigns: Engage your community and raise funds through platforms like Kickstarter or Indiegogo. * Venture Debt: A hybrid of debt and equity financing, providing capital without diluting ownership too much. * Corporate Venture Capital: Partnerships with large corporations can provide funding and strategic support. * Pre-Seed Funding: Early-stage investments for startups with just an idea or a basic prototype. Remember, funding is a journey, not a destination. Explore different options and choose the path that aligns.

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

Day 7: Securing Funding for Your Bangalore Startup Funding is the lifeblood of many startups, and Bangalore offers a vibrant ecosystem for founders seeking capital. This post explores various funding options for Bangalore-based startups, including:

See MoreDhruv Shukla

I'm available • 6m

We are a B2G trading firm supplying products and services to government institutions through the GEM portal. Since our model requires upfront capital for procurement before payment release, what would be the best ways to raise funding—should we appro

See MoreAccount Deleted

Hey I am on Medial • 5m

Grow Your Startup Without Giving Away Equity Every founder's dilemma: How to fuel growth without diluting ownership too early? While seed funding is crucial, it's not the only path. At Opslify, we help you explore strategic, non-dilutive funding ro

See MoreNikhil Raj Singh

Entrepreneur | Build... • 1y

🚀 Ready to launch your startup? Here’s a quick guide to funding sources to fuel your journey! 💡💰 Whether you're bootstrapping, seeking venture capital, or exploring grants, there’s a path for every dream. 🌟 DM me 'Fund' and I’ll share a curated

See More

Shubham Shrivastava

Let's make the chang... • 11m

Ways to Raise Funds for the First Time🥇💸🪙 1. Bootstrapping (Self-Funding) 2. Friends & Family 3. Grants & Government Schemes 4. Crowdfunding (Kickstarter, Indiegogo, Ketto, etc.) 5. Angel Investors 6. Startup Incubators & Accelerators 7. Bank Loa

See MoreCA Jasmeet Singh

In God We Trust, The... • 1y

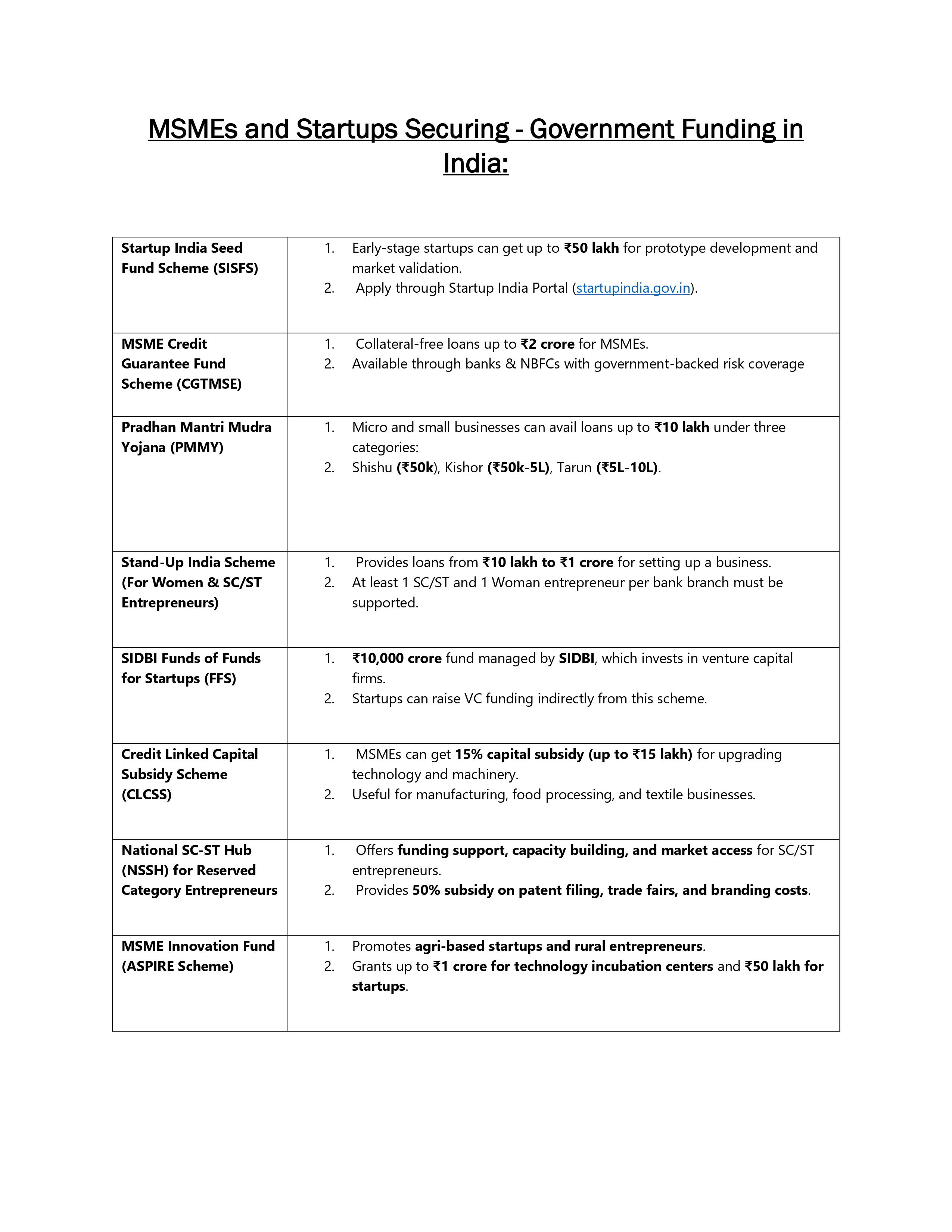

🚀 Unlocking Growth: Funding Strategies for Startups & MSMEs 💰 Access to capital is one of the biggest challenges for startups and MSMEs. Whether you're launching a new venture or scaling your business, the right funding can be a game-changer. But

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)