Back

Inactive

AprameyaAI • 1y

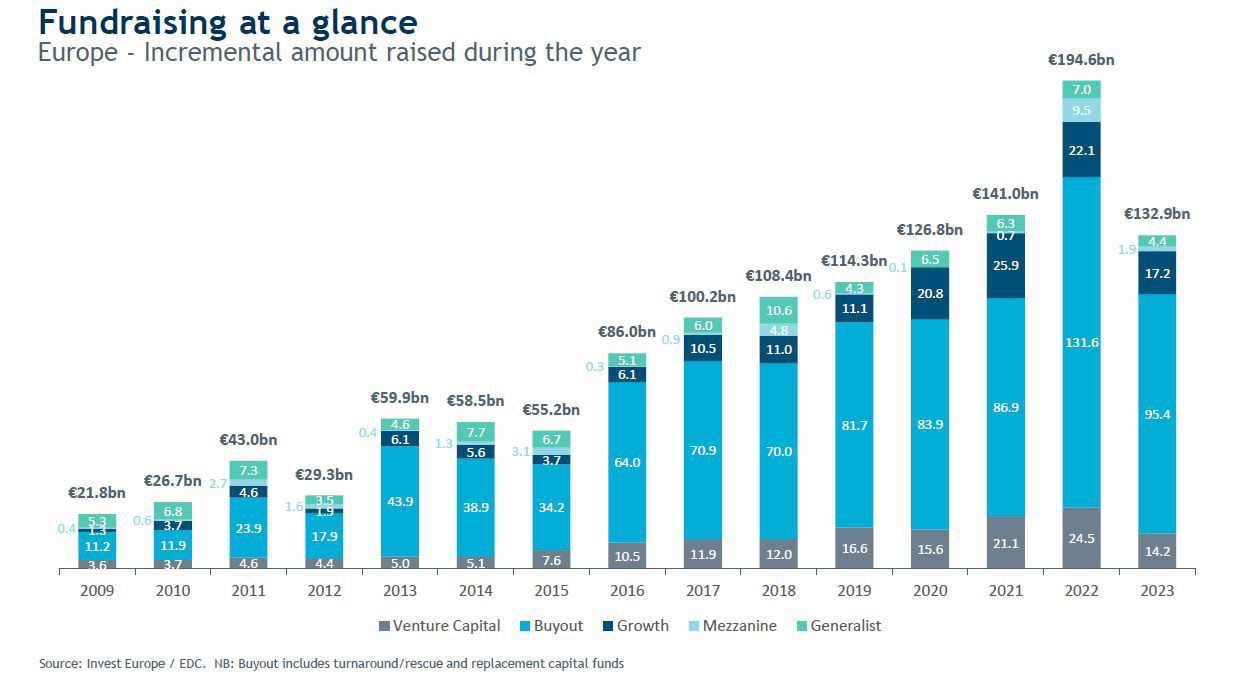

Today in the Cafe! EBITDA: Earnings before interest, taxes, depreciation, and amortization, a method for measuring a company's financial health and ability to generate cash. Mezzanine Financing: A hybrid form of financing that is often a mix of debt and equity, used by companies looking to expand. Hedge Funds: Investment funds that employ diverse, often aggressive strategies to achieve high returns for their investors. Micro Venture Capital: A type of venture capital fund that specializes in small, early-stage investments

Replies (4)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)