Back

Manu

Building altragnan • 10m

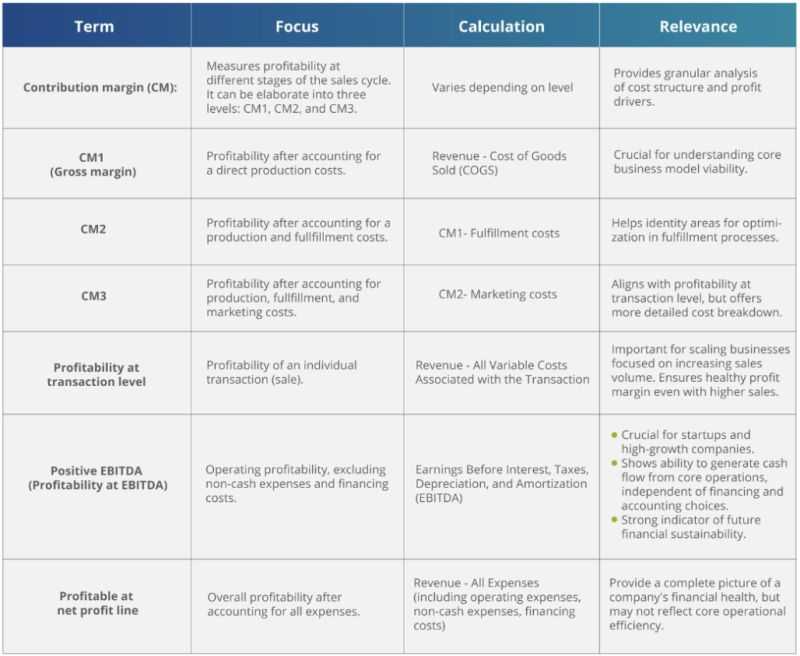

Definition: EBITDA is a financial metric that measures how much money a company earns from its operations before deducting interest, taxes, depreciation, and amortization. It's useful for evaluating a company's operational profitability. Why is EBITDA important for businesses? Helps businesses understand how much money they’re generating from core operations. Useful for investors and lenders to assess company profitability. Acts as a scorecard to measure how much money a company is making. How is EBITDA calculated? To calculate EBITDA: 1. Start with revenue. 2. Subtract cost of goods sold. 3. Subtract operating expenses (like salaries and rent). EBITDA vs Net Income EBITDA excludes depreciation, taxes, and interest. Net Income includes all those expenses and represents actual profit. EBITDA Formula (Expanded): EBITDA = Net Income Interest Expense Taxes Depreciation Amortization

Replies (2)

More like this

Recommendations from Medial

PRATHAM

Experimenting On lea... • 1y

📢 WTF is EBITDA ❓🤔 EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization ( Amortization in simple words is like repayment of installment/loans). It’s like looking at how much money a company makes from its core busine

See MoreSanskar

Keen Learner and Exp... • 11m

Complicated Business Terms Simplified PART: 1 ROI (Return on Investment): How much profit or value an investment generates compared to its cost. TAM (Total Addressable Market): The total demand for a product/service globally, assuming no competiti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)