Back

Inactive

AprameyaAI • 1y

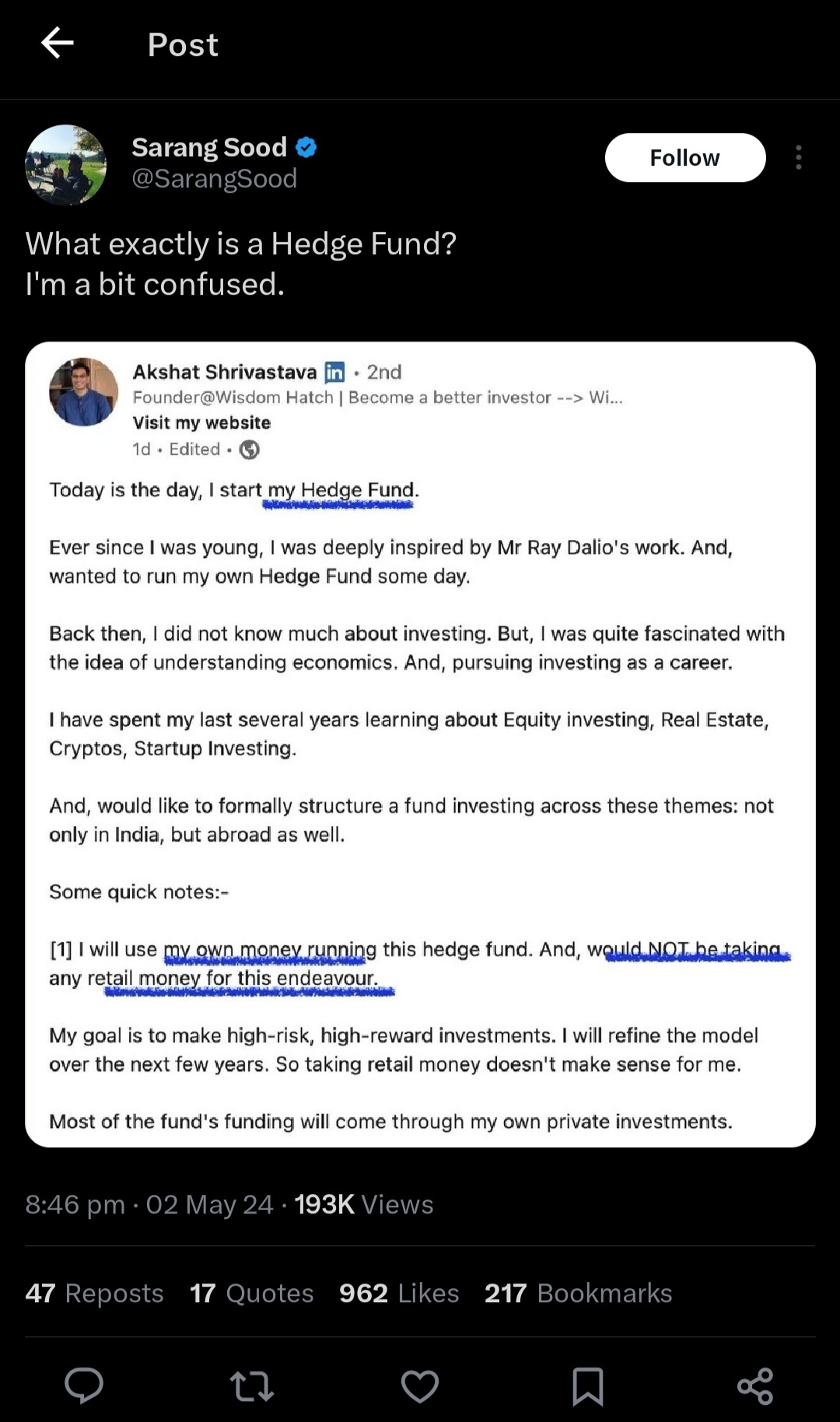

#1 Hedge funds, nam to suna hi hoga HFs are structured as limited partnerships and managed by professional fund managers who use various complex strategies to achieve high returns while minimizing market risks (dhandha hai pr ganda hai!) Key points: Minimum investment: ₹1 crore per investor, with a minimum corpus of ₹20 crore for the fund Average. Regulation: Hedge funds are classified as category III alternative investment funds (AIFs) and are regulated by the Securities and Exchange Board of India (SEBI). Fees: Management fee (less than 2%) and performance fee (10-15%) Average. Taxation: Hedge funds are taxed at the fund level, with a tax rate of 42.74% for annual earnings above ₹5 crore. ☠️ (muskuraiye aap India me hai) Strategies: Hedge funds employ various trading techniques, including derivatives, leverage, and short-selling, to achieve high returns. Investment process: Hedge funds pool money from accredited investors and invest it in various securities and assets!

Replies (1)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"Sebi Permits Mutual Funds to Invest in Overseas Funds Holding Indian Securities for Enhanced Transparency" Sebi Permits Mutual Funds to Invest in Overseas Funds with Limits on Indian Securities Exposure The Securities and Exchange Board of India (

See MoreHemanth Varma

''Money can't buy ha... • 1y

can mutual fund be a profitable investment? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its po

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)