Back

Anonymous

Hey I am on Medial • 1y

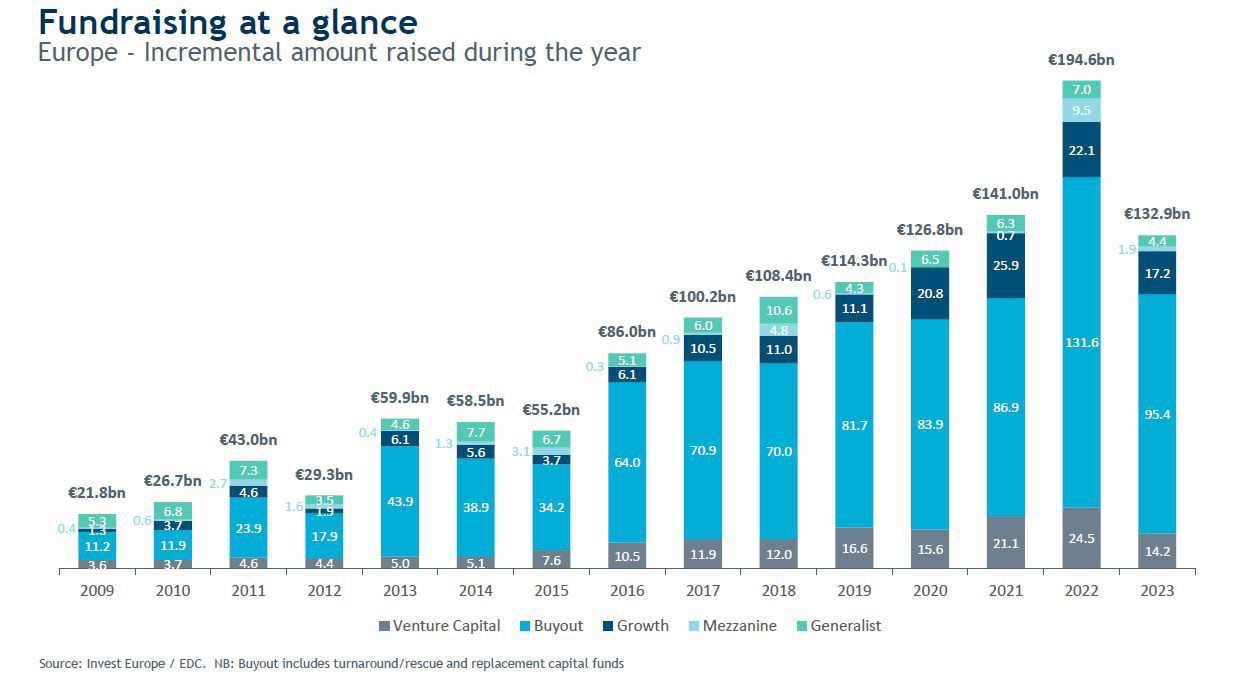

🔵 European VC and PE Fundraising in 2023: Resilience Amid Challenges ➡️ European private equity and venture capital fundraising in 2023 showed resilience despite a slight decline, reaching €132.9 billion, 3% below the five-year average. Venture capital saw a more significant drop, with €14.2 billion raised, down 21% from the five-year average. Buyout funds dominated, raising €95.4 billion, 5% above the five-year average. Growth capital remained stable at €17.2 billion. ➡️ Pension funds were the largest contributors overall, while North American investors provided the highest proportion of capital. Notably, 47% of funds came from outside Europe. For venture capital, government agencies were the primary source, contributing 37%. The France and Benelux region were a key capital source for venture funds, while North America led in buyout investments. This data underscores the importance of diversifying funding sources and considering international investors.

More like this

Recommendations from Medial

Mahendra Lochhab

Content creator • 1y

The food processing industry grew at an average annual rate of 8.3% in the last five years. In 2021-22, the gross value added (GVA) of the industry was US$ 27.95 billion. The food processing industry is expected to reach a market size of US$ 1,274

See MoreRajan Paswan

Building for idea gu... • 1y

WhatsApp's $19 Billion Acquisition by Facebook Explained!! On February 19, 2014, Facebook acquired WhatsApp for $19 billion, making it the largest purchase of a venture-capital-backed company at that time. This acquisition followed WhatsApp's $1.5 b

See MoreMayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)