Back

Vivek kumar

On medial • 1y

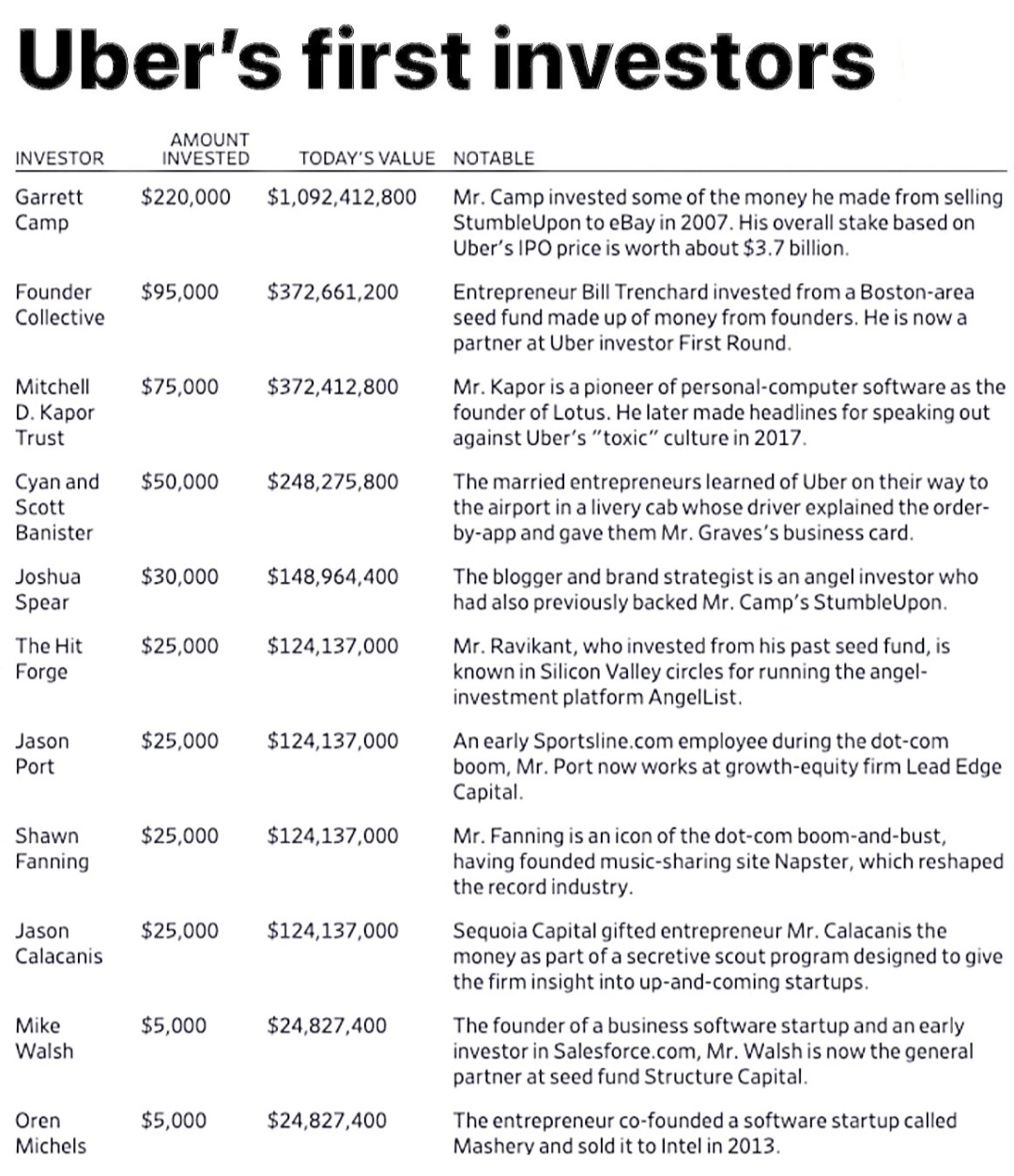

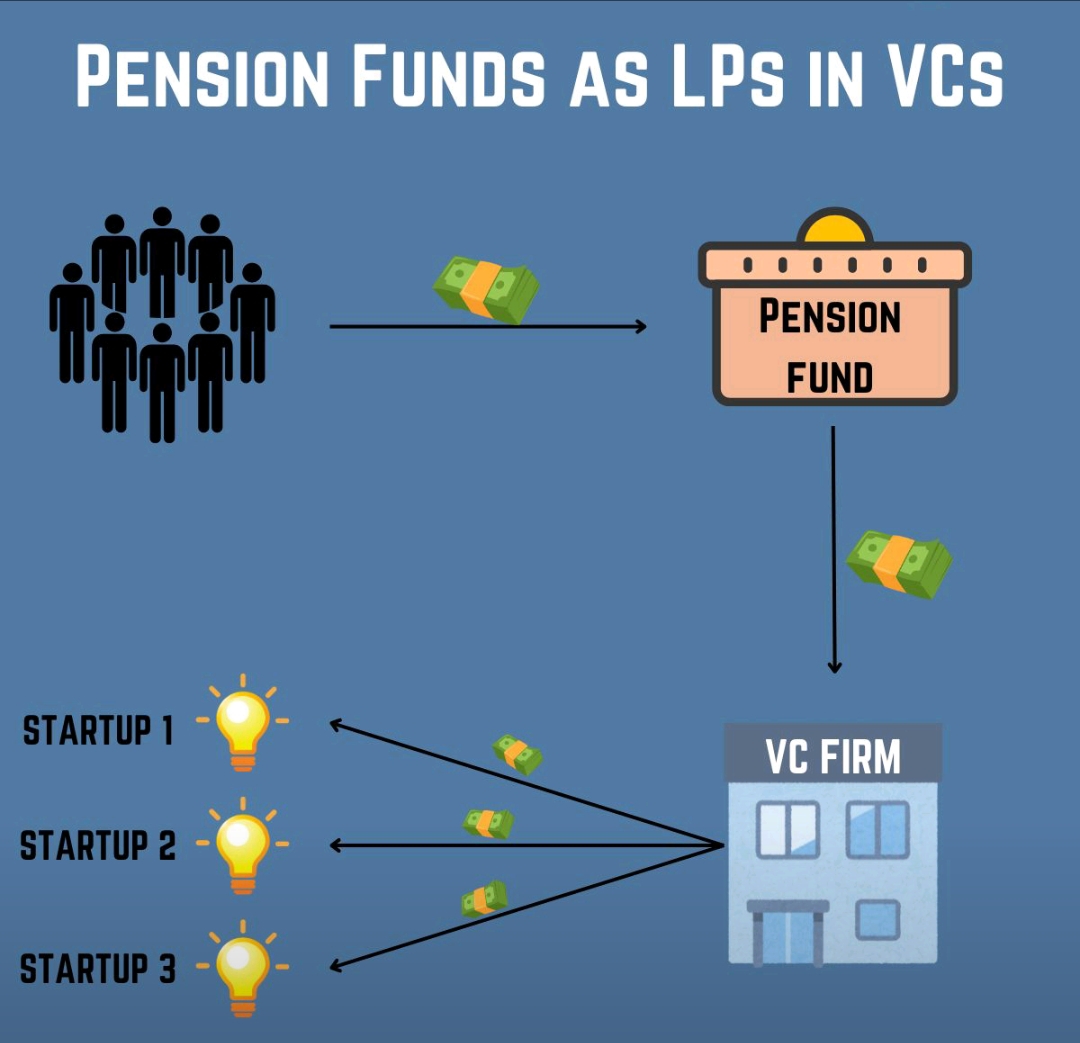

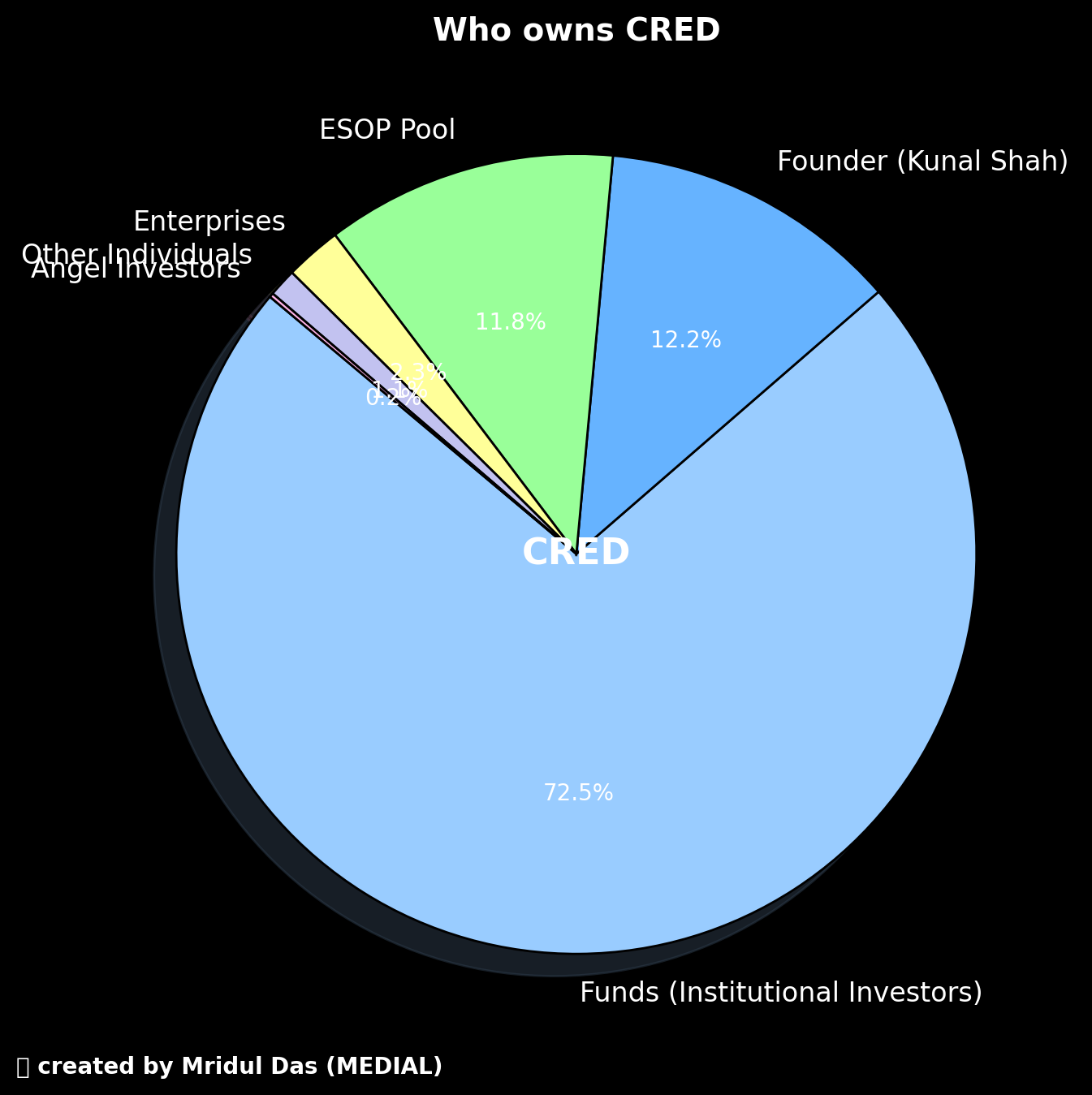

Here’s a short overview of major funding agencies and their operations: 1. Sequoia Capital (USA) Invested In: Apple, Google, Airbnb, WhatsApp. Source of Funds: High-net-worth individuals, pension funds. Returns: WhatsApp investment generated $6.3 billion. 2. Benchmark Capital (USA) Invested In: Uber, eBay, Twitter. Source of Funds: Institutional investors. Returns: Uber investment earned $11 billion. 3. SoftBank Vision Fund (Japan) Invested In: Uber, WeWork, OYO Rooms. Source of Funds: Saudi Arabia’s sovereign wealth fund. Returns: Uber provided $10 billion, but WeWork faced losses. 4. Andreessen Horowitz (USA) Invested In: Facebook, Lyft, Coinbase. Source of Funds: Wealthy individuals, institutional investors. Returns: Facebook gave $10 billion. 5. Accel Partners (USA) Invested In: Facebook, Dropbox, Flipkart. Source of Funds: Pension funds, institutional investors. Returns: Facebook investment earned $15 billion.

Replies (3)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

• Let's Understand: SoftBank an investment Giant 🤑🚀📈 • SoftBank was started by Masayoshi Son in 1981. Key businesses:📈 •Telecommunications (SoftBank Corp.) •Semiconductors (Arm Holdings) •Massive tech investments Vast Tech Investment Portfoli

See More

Mohit Singh

19yo ✨ #developer le... • 1y

Meta, formerly Facebook, has unveiled two new open-source AI models called Llama 3 8B and Llama 3 70B, with 8 billion and 70 billion parameters respectively. 🚀 These models outperform some rivals and spark debate over open versus closed source AI de

See MoreMohammad Ali Shah

Co Founder & CEO at ... • 8m

🚨 Alert: 16 Billion Credentials Leaked-Is Your Account at Risk? A massive leak has exposed 16 billion credentials from past data breaches – including accounts from Gmail, Facebook, Instagram, Apple & more. 📰 Source: https://timesofindia.indiatime

See MoreRajan Paswan

Building for idea gu... • 1y

WhatsApp's $19 Billion Acquisition by Facebook Explained!! On February 19, 2014, Facebook acquired WhatsApp for $19 billion, making it the largest purchase of a venture-capital-backed company at that time. This acquisition followed WhatsApp's $1.5 b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)