Back

Account Deleted

Hey I am on Medial • 1y

• Let's Understand: SoftBank an investment Giant 🤑🚀📈 • SoftBank was started by Masayoshi Son in 1981. Key businesses:📈 •Telecommunications (SoftBank Corp.) •Semiconductors (Arm Holdings) •Massive tech investments Vast Tech Investment Portfolio: •Invests mostly in technology and internet companies worldwide Major investments:🤑 •Alibaba •Uber •WeWork •DoorDash •Opendoor •Boston Dynamics The Vision Fund:📈 Established in 2017 with over $100 billion to invest One of the biggest investment funds focused on cutting-edge tech. Areas of focus:🤓 •Artificial Intelligence (AI) •Robotics •Internet of Things (IoT) Notable investments: •Uber •WeWork •DoorDash •Opendoor • OYO • Flipkart • Blinkit • Plans to launch another massive investment fund like Vision Fund. • Lost significant money on WeWork investment. • Aggressive investing in high-growth, disruptive tech startups. This is all about SoftBank, let's Discuss 🚀♥️ and don't forget to follow me 🤩📈.

Replies (5)

More like this

Recommendations from Medial

Havish Gupta

Figuring Out • 10m

In 2018, WeWork tried to raise $20 billion from SoftBank's Vision Fund. The deal was almost finalized, but major investors in the fund, including Saudi Arabia opposed it, causing the deal to collapse. Now, in 2025, OpenAI has raised a $40 billion rou

See More

Account Deleted

Hey I am on Medial • 1y

Masayoshi Son, the visionary behind SoftBank, is betting big on AI, predicting that by 2035, AI will be 10,000 times smarter than humans. His company owns 90% of chipmaker Arm and is aggressively investing in AI research, planning to deploy $500 bi

See More

Ashish Singh

Finding my self 😶�... • 10m

List of the top 10 companies by SoftBank’s investment amounts, based on total known funding . 1.Arm Holdings - ~$32B (acquisition) - Chip designer. 2.WeWork - ~$10.5B - Co-working spaces. 3.Didi Chuxing - ~$10.5B - Chinese ride-hailing. 4.Uber -

See More

Account Deleted

Hey I am on Medial • 1y

I have made some analysis on Recent trends and hope you guys like it 🤩 🚀 💯 • In 2024, most startups are focusing on profits because they are aiming for an initial public offering (IPO). The winter funding round hit startups very badly, and there

See More

Account Deleted

Hey I am on Medial • 1y

SoftBank's Vision Towards India! • In mid-2024, SoftBank Investment Advisers resumed its investments in India after an 18-month long pause. • SoftBank's portfolio has shown significant growth, with a value of $14 billion, including all Vision Funds

See More

Ashish Singh

Finding my self 😶�... • 10m

📈Short story of wework WeWork started in 2010 when Adam Neumann and Miguel McKelvey saw a chance to rethink office space. After the 2008 recession, empty buildings were plentiful, and freelancers needed affordable places to work. They leased floors

See More

Nandishwar

Founder @StudyFlames... • 1y

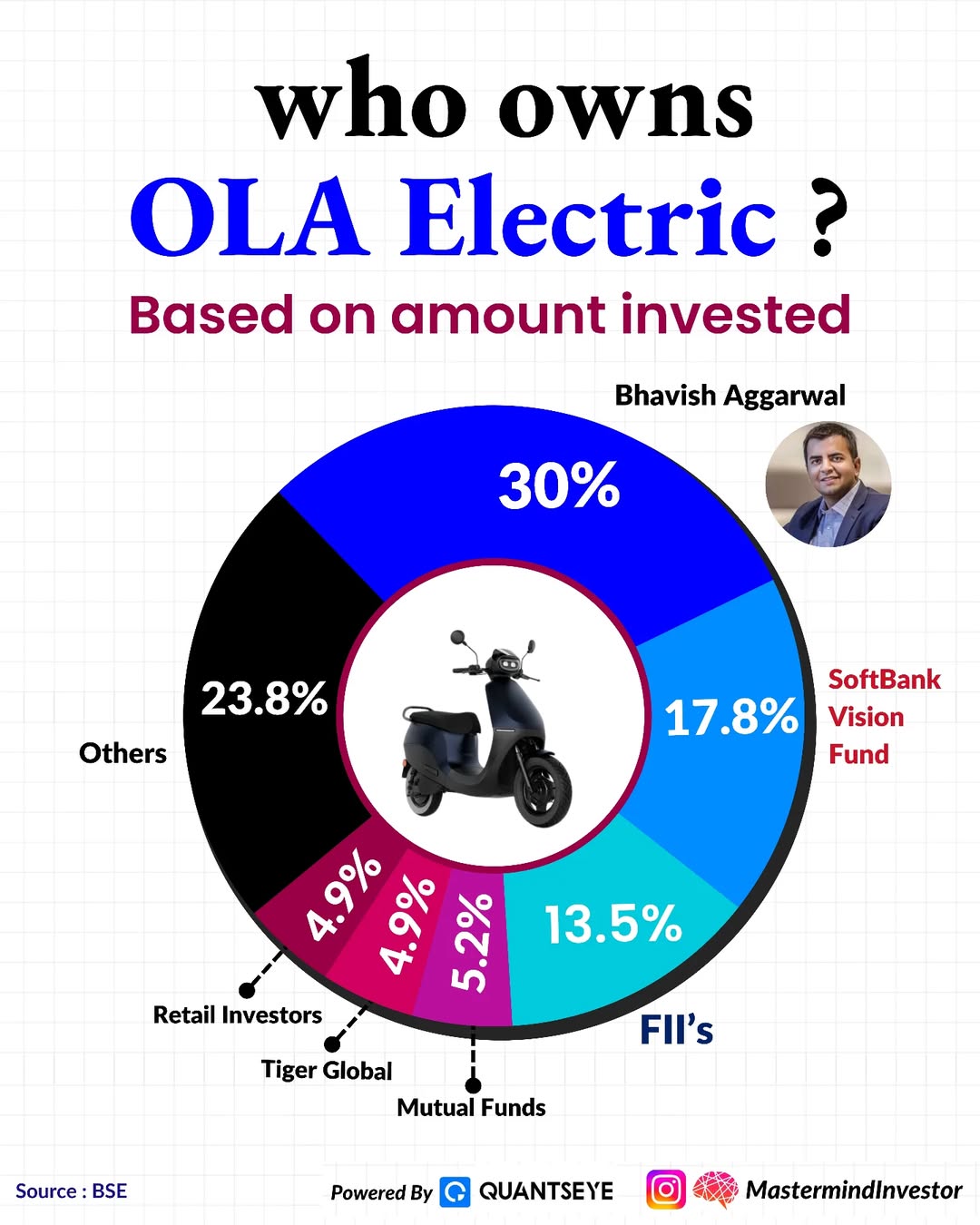

🚀 Who Owns Ola Electric? 🛵 Here’s a quick breakdown based on investment stakes: 1️⃣ Bhavish Aggarwal: 30% 🏆 2️⃣ SoftBank Vision Fund: 17.8% 🌏 3️⃣ Foreign Institutional Investors (FIIs): 13.5% 📈 4️⃣ Others: 23.8% 🧩 5️⃣ Mutual Funds: 5.2% 💰 6️

See More

Account Deleted

Hey I am on Medial • 1y

Let's Decode Ather Energy 🤯📈💲 Today I saw various Ather Energy Scooters like 450 Plus and 450X and decided to make on Ather Energy 📈🤯🚀. Introduction: • Ather Energy, established in 2013 in Bangalore, India, specializes in electric scooters.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)