Back

Nandishwar

Founder @StudyFlames... • 1y

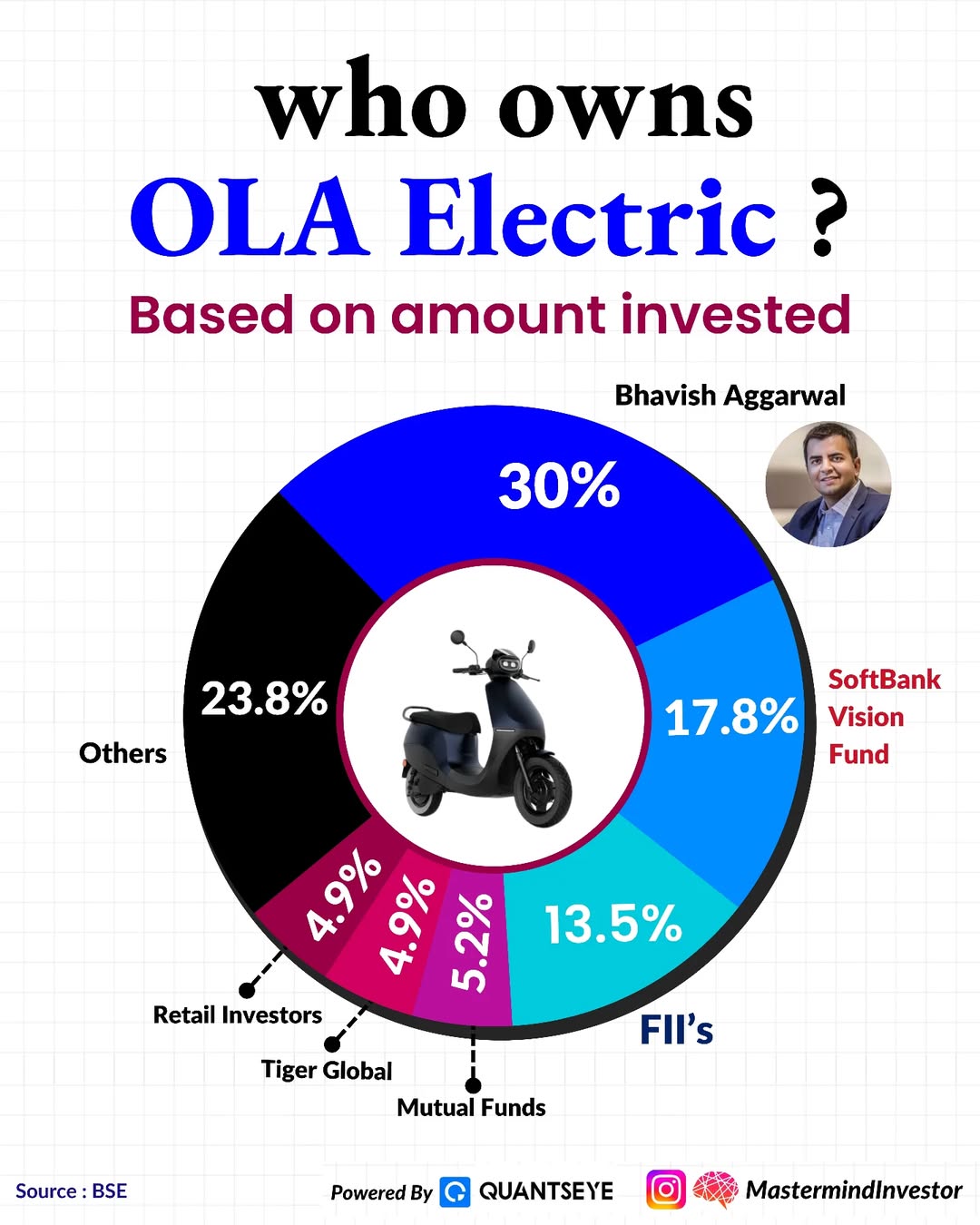

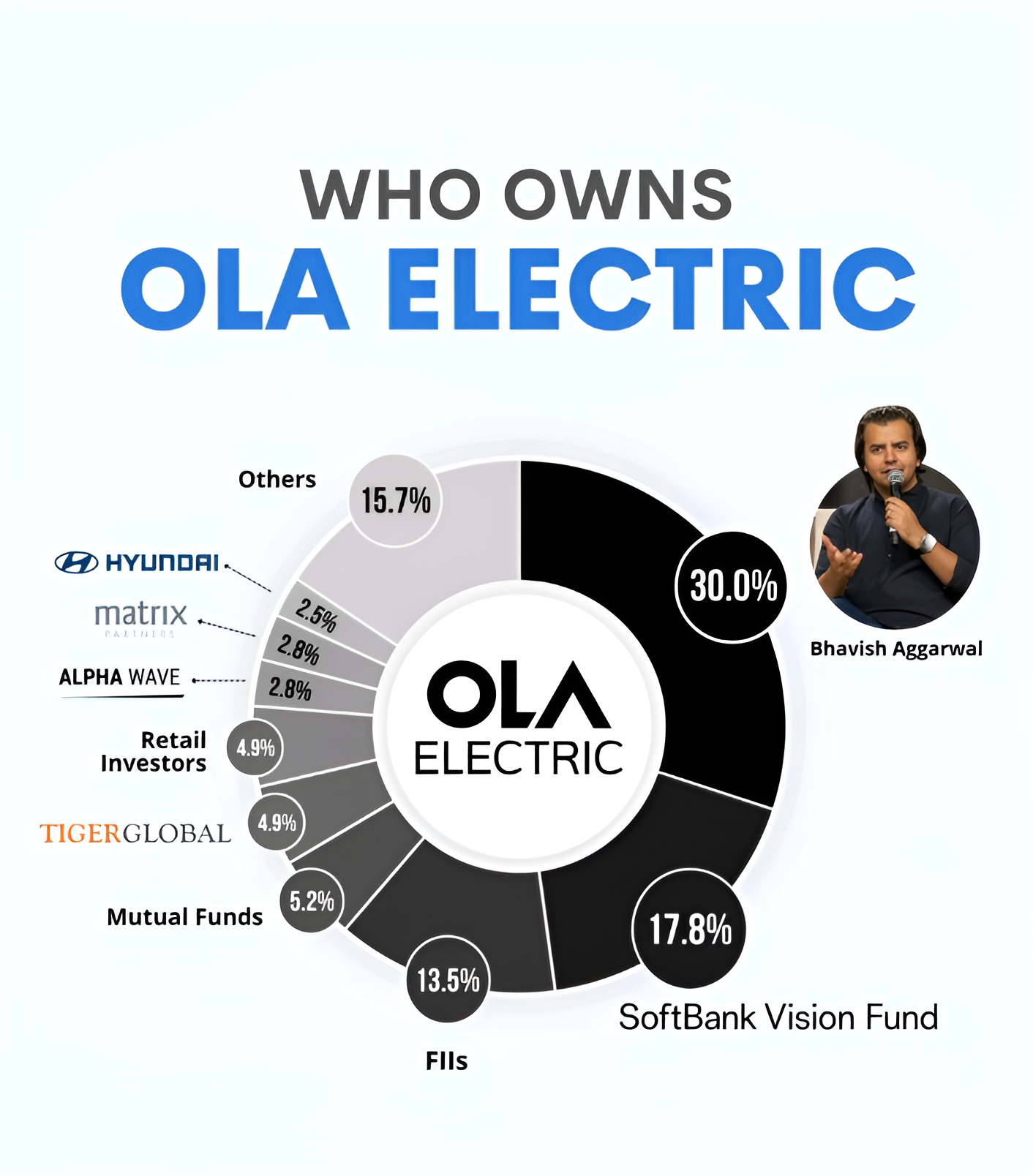

🚀 Who Owns Ola Electric? 🛵 Here’s a quick breakdown based on investment stakes: 1️⃣ Bhavish Aggarwal: 30% 🏆 2️⃣ SoftBank Vision Fund: 17.8% 🌏 3️⃣ Foreign Institutional Investors (FIIs): 13.5% 📈 4️⃣ Others: 23.8% 🧩 5️⃣ Mutual Funds: 5.2% 💰 6️⃣ Tiger Global: 4.9% 🐯 7️⃣ Retail Investors: 4.9% 🤝 Ola Electric is revolutionizing mobility with cutting-edge electric scooters while backed by a strong and diverse investor base. ⚡✨ Who’s ready to ride the future of transportation? 🛴💨

Replies (7)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

• Let's Decode OLA Electric Today ♥️🚀🤩 • Ola Electric is one of India's leading EV startups, founded in 2017 by Bhavish Aggarwal . It has become a unicorn company, valued at over $5.4 billion. • Investors: •Raised almost $5 billion from top inve

See More

gray man

I'm just a normal gu... • 9m

Bhavish Aggarwal is reportedly planning to transfer the intellectual property (IP) rights for the Ola brand to a new holding company controlled by his family office. The proposed transfer has raised concerns among ANI investors, who fear losing out

See More

Hemanth Varma

''Money can't buy ha... • 1y

Ola Electric shares crashed 51% from record high level; here's what investors can do The Centre has intensified its scrutiny of Ola Electric's handling of consumer complaints, following a showcause notice issued by the Central Consumer Protection Au

See More

Rohan Saha

Founder - Burn Inves... • 1y

Ola Electric investors, how are you all? As soon as the lock-in period ended, the company’s share price dropped. To justify a valuation of ₹39,000 crore, at least ₹3,000 crore in revenue and a profit of ₹50 crore or ₹100 crore will be needed. Then, m

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Attrition at Ola Electric is 2.5x of Ather, 5x of TVS and 12x of Hero 📛📛 The employee attrition woes at Bhavish’s company are simply too big to ignore, now that it is a public company. .. At 47.48%, for those who may not get it, this implies tha

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)