Back

Account Deleted

Hey I am on Medial • 1y

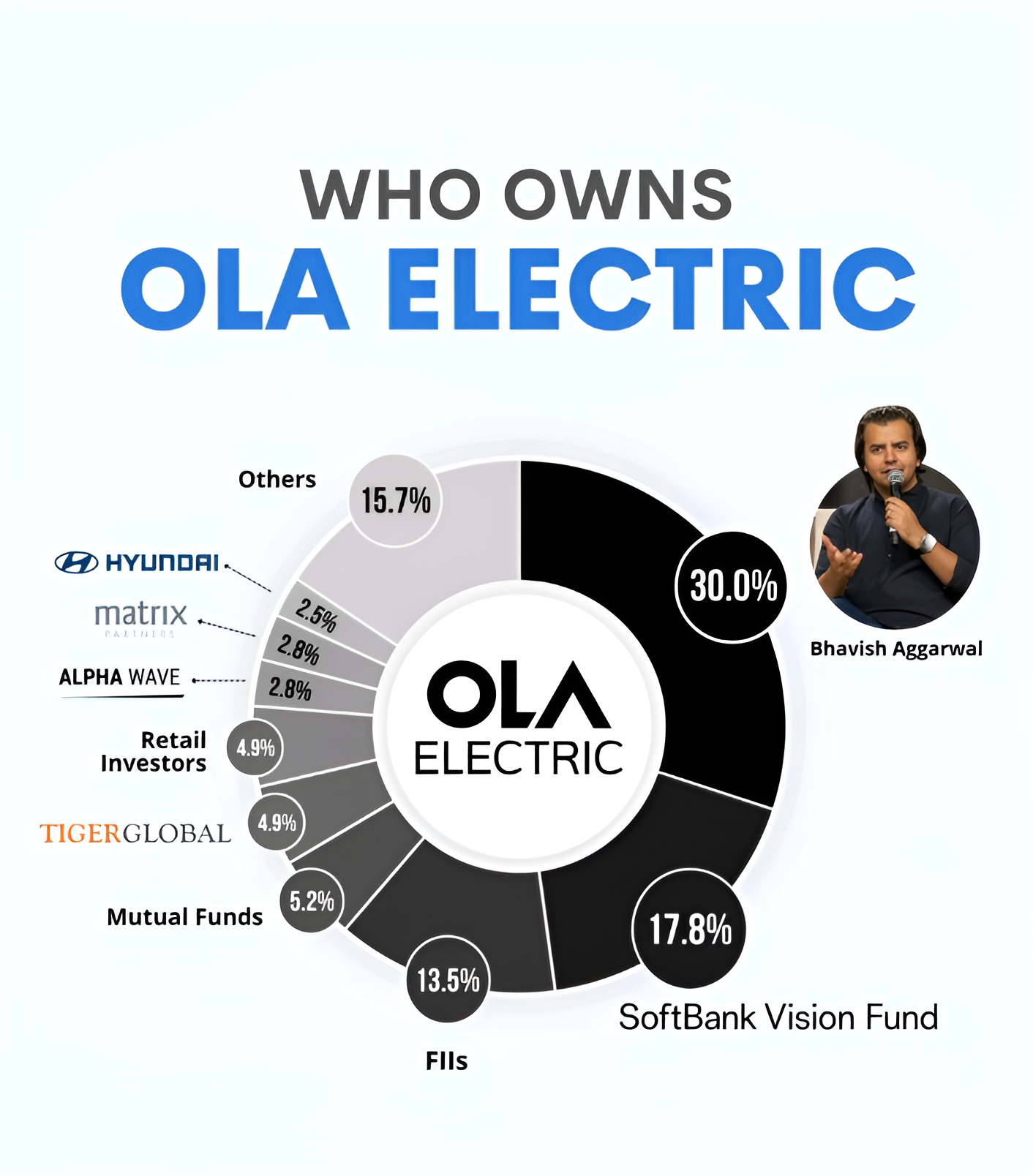

Bhavish Aggarwal leads the charge with a 30% stake in Ola Electric

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Interesting One : • Bhavish Aggarwal, CEO of Ola Electric, called MapMyIndia's legal notice "opportunistic." • MapMyIndia says Ola Electric misused its mapping data for the Ola Maps platform and broke their licensing agreement. • Aggarwal stated t

See More

gray man

I'm just a normal gu... • 9m

Legacy automaker TVS Motor and Bhavish Aggarwal-led Ola Electric have emerged as the top two players in India’s fast-growing electric two-wheeler (E2W) market for April, overtaking Bajaj Auto in total registrations. According to Vahan data as of May

See More

Nandishwar

Founder @StudyFlames... • 1y

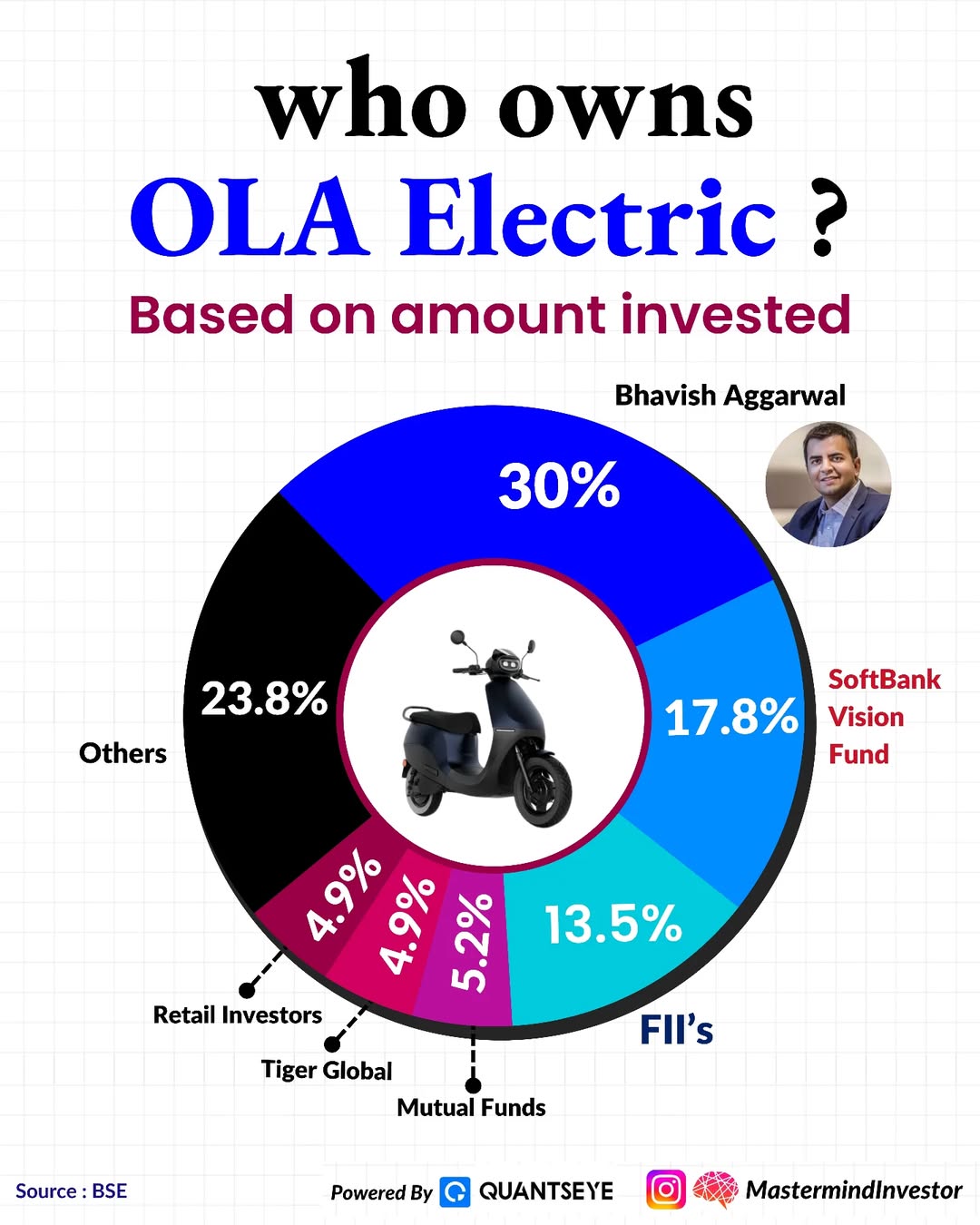

🚀 Who Owns Ola Electric? 🛵 Here’s a quick breakdown based on investment stakes: 1️⃣ Bhavish Aggarwal: 30% 🏆 2️⃣ SoftBank Vision Fund: 17.8% 🌏 3️⃣ Foreign Institutional Investors (FIIs): 13.5% 📈 4️⃣ Others: 23.8% 🧩 5️⃣ Mutual Funds: 5.2% 💰 6️

See More

Account Deleted

Hey I am on Medial • 1y

• Let's Decode OLA Electric Today ♥️🚀🤩 • Ola Electric is one of India's leading EV startups, founded in 2017 by Bhavish Aggarwal . It has become a unicorn company, valued at over $5.4 billion. • Investors: •Raised almost $5 billion from top inve

See More

gray man

I'm just a normal gu... • 9m

Bhavish Aggarwal is reportedly planning to transfer the intellectual property (IP) rights for the Ola brand to a new holding company controlled by his family office. The proposed transfer has raised concerns among ANI investors, who fear losing out

See More

Yash Barnwal

Gareeb Investor • 1y

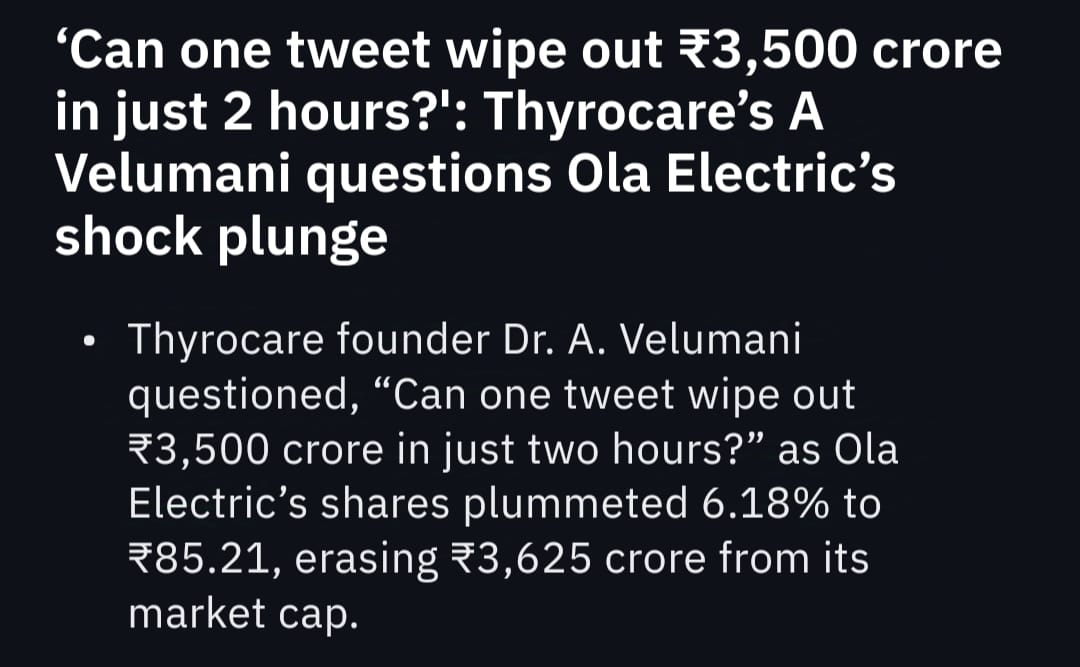

A tweet criticizing Ola Electric led to a 6.18% drop in its shares, wiping out ₹3,625 crore from its market value within two hours. This followed a public spat between Ola's CEO Bhavish Aggarwal and comedian Kunal Kamra, who criticized Ola’s scooters

See More

Download the medial app to read full posts, comements and news.