Back

Vrishank

Startups/VC/tech • 1y

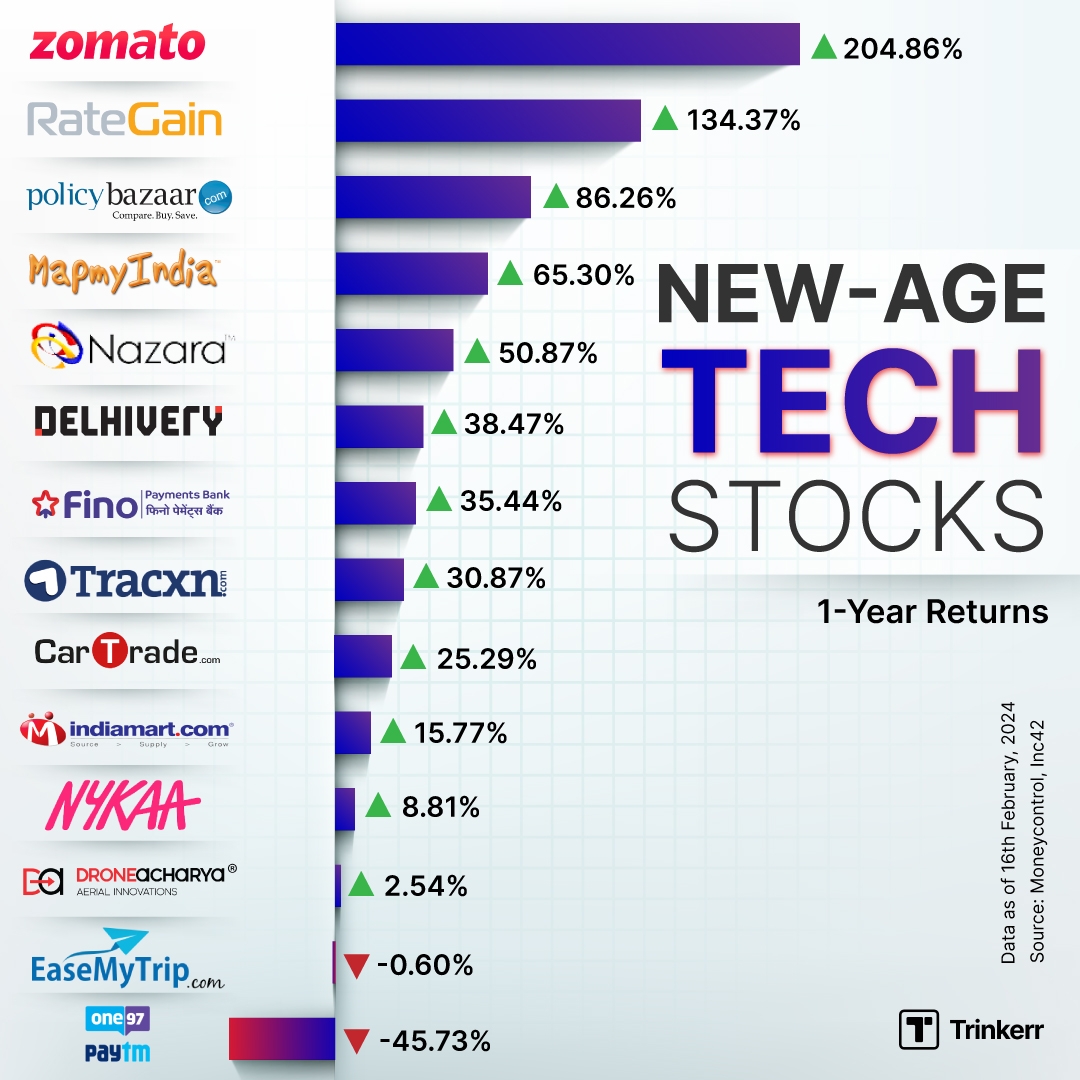

Ola electric has already given 44% returns in 2 days, despite being a loss making company. Ola electric incurred a loss of rs.267 cr last financial year. It has a negative ROE. Ola electric is a fundamentally weak company, but it is still giving returns because of Nationalism wave? If you guys have observed, Bhavish Aggarwal was trying to build a very nationalist image since a few months, replacing Google maps, launching India's own gpt "krutrim", shitting on westerners for having a good work life balance and many more things Now these all things, deffo shaped his image in a good light. Retailers, high on the "India story" bought the stocks of ola electric, despite it being a fundamentally bad stock. If Institutional investors sell the stocks now in huge quantity, the stock will come falling down to the ground. Ps: not an investment advice, I am just trying to understand a retailer's mindset when they invest in such companies.

More like this

Recommendations from Medial

Nikhil Karun

Hey I am on Medial • 1y

Stocks will be suggested to get high returns on investments Fundamental analysis would be the prioritised to know the performance of the stock Recommend for people who text me Profit within 7-15 trading days. Target and stop loss would be provided

See MoreAccount Deleted

Hey I am on Medial • 1y

• Let's Decode OLA Electric Today ♥️🚀🤩 • Ola Electric is one of India's leading EV startups, founded in 2017 by Bhavish Aggarwal . It has become a unicorn company, valued at over $5.4 billion. • Investors: •Raised almost $5 billion from top inve

See More

Soumya Ranjan Dash

Hit & Trial • 1y

When I started investing in stock markets, I cared about: 100x returns Multibagger stocks Sharing profit screenshots What peers thought about me After getting grilled in the Market, I care about: Risk per investment Overall consistent annual retur

See MoreRohan Saha

Founder - Burn Inves... • 1y

Okay, I was just checking the valuation of our Indian stock market and I noticed something interesting. Despite the heavy sell-off in October, FMCG, IT, and small-cap stocks are still overvalued. I understand why IT stocks are overvalued because the

See MoreEVINDIA

Stay updated with th... • 8m

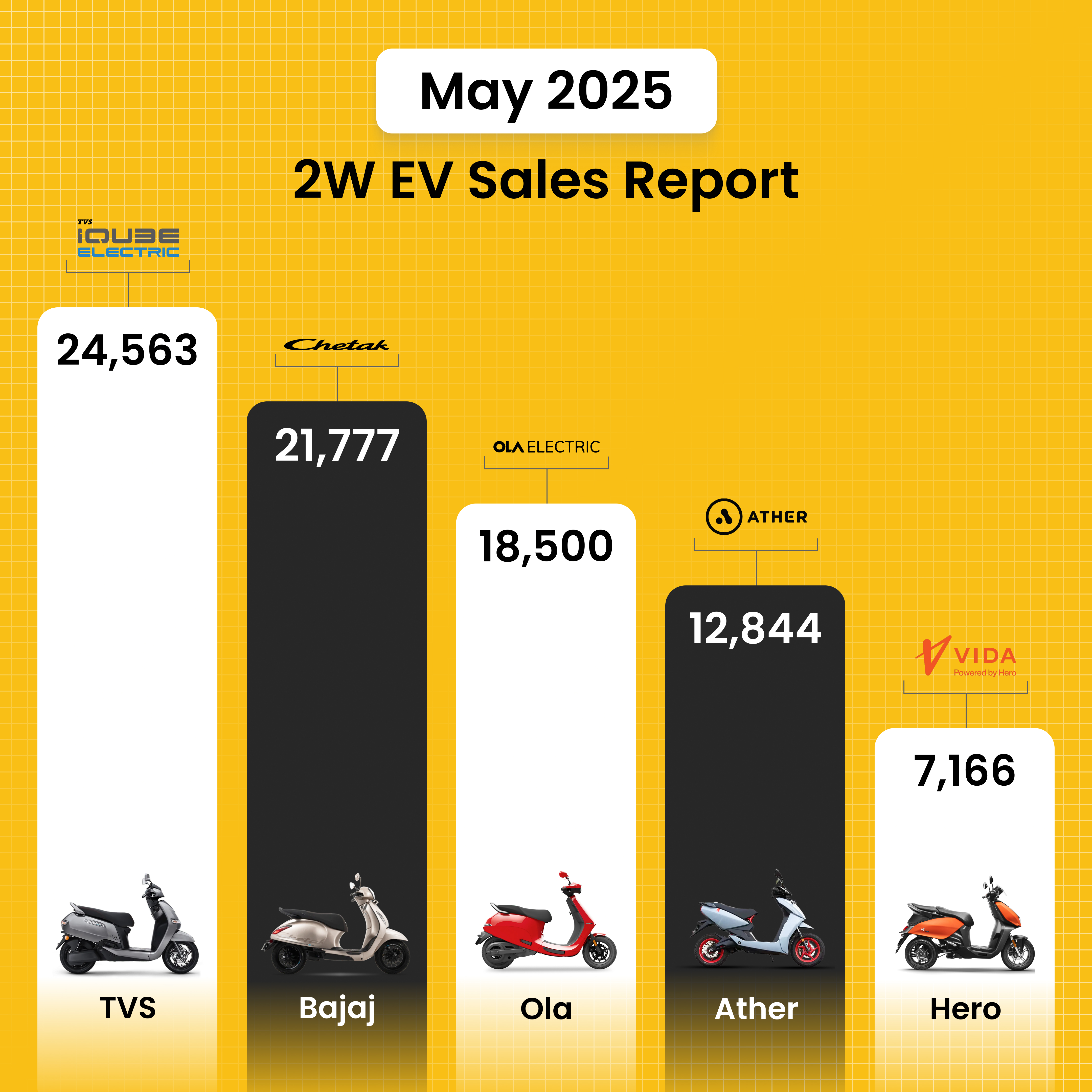

May 2025 2W EV Sales: TVS Leads, Ola Slips to 3rd Spot India’s electric scooter market saw a significant shift in May 2025. TVS Motor Company secured the top position with 24,563 units sold, while Bajaj Auto climbed to second with 21,777 units. Surp

See More

Hemanth Varma

''Money can't buy ha... • 1y

Ola Electric shares crashed 51% from record high level; here's what investors can do The Centre has intensified its scrutiny of Ola Electric's handling of consumer complaints, following a showcause notice issued by the Central Consumer Protection Au

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)