Back

Vrishank

Startups/VC/tech • 1y

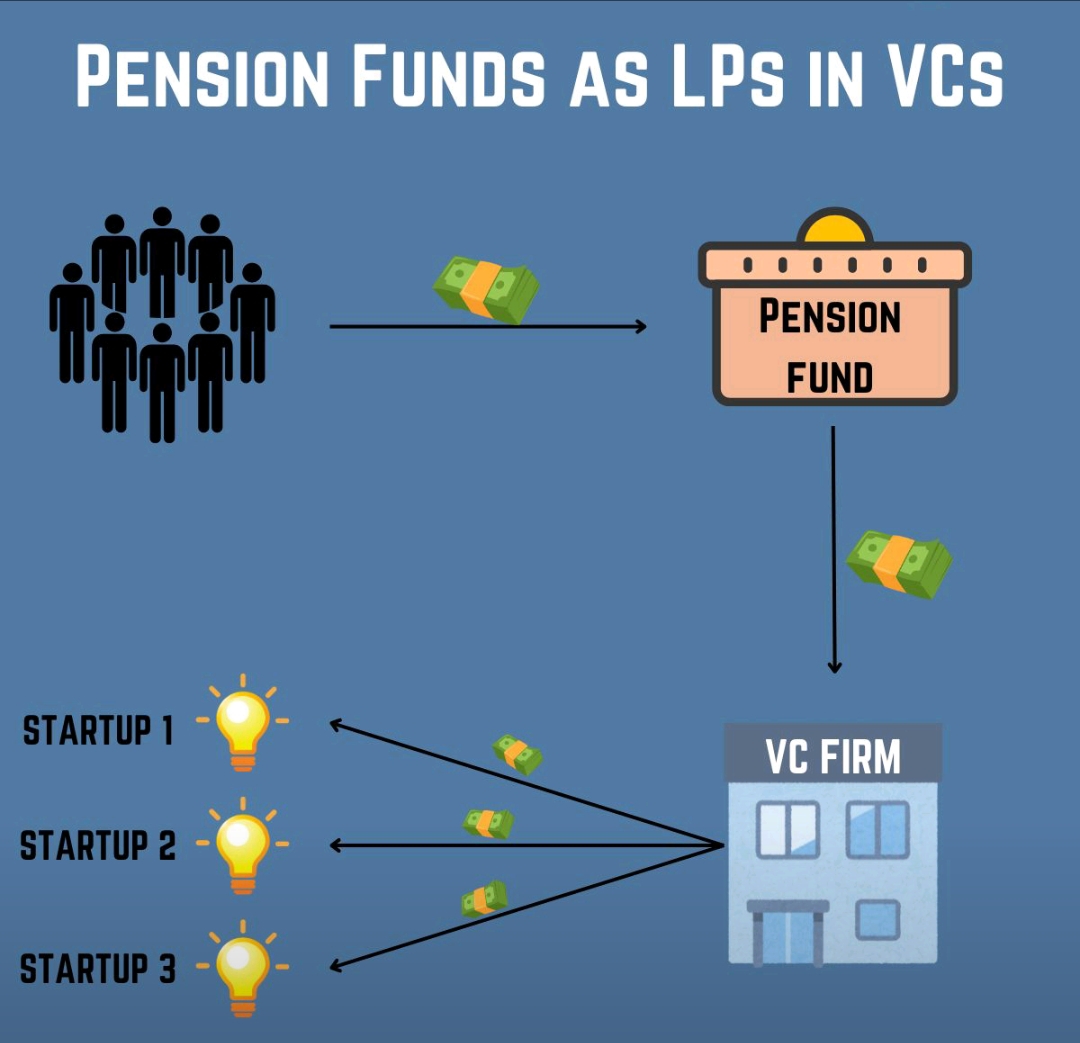

This is how the VC ecosystem works. - People from Canada and the USA contribute their money every month to a pension fund with the aim of receiving a pension once they retire - The pension fund, aiming to generate returns, allocates its money to various avenues, including private equity and venture capital. - Since India is an emerging market, they want to take advantage of this situation. These pension funds act as limited partners (LPs) for Indian VC firms, investing significant amounts of money ranging from $5 million to $100 million. - Indian VC firms then invest this capital in various Indian startups, hoping to generate some returns. - When Indian startups generate returns, they return the money to the VCs. - These VC firms then take their cut and return the profits to the pension fund manager. - The fund manager then takes their cut, and the money is distributed among the subscribers of the pension fund as planned.

Replies (8)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY 6 📌Who is G.P & their Role in VC? G.P means a General Partner who looks after investments in Startups & works closely with the Founders. Basically, The VC you meet is a G.P. 🎯Role of G.P'S- Deal Sourcing: They need to find favourab

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-16 🎯What is High Watermark in VC? 🎯What are Distributions/Waterfall? Apart from hurdle rate, Some consider also “high watermark” This is more common practice in hedge funds. This market denotes the highest value recorded by the f

See MoreVijay Pawar

Real Estate Consulta... • 11m

Hello Guys i just want to know how does VC Firms make Money ? Some of the ways which i know is Through Acquisitions and whenever they help startup to raise new round they charges 2% of the total raised amounts Is there any other options that VC make

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-17 🎯Types of Waterfalls in VC? 🎯What is Clawback? Two types that are “European & American Waterfall”-Under European Waterflow, 100% of all Investment Cash is paid out to Investors on a pro-rata basis & therefore preferred returns

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 📌What is Management Fees? 📌What is a Expense for VC? 🎯Management Fees- Management Fees & Expenses contributed to the fund as per investment agreement between fund & Investment Manager.No SEBI Regulations in this Matter. It

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)