Back

Siddharth Shahu

FMVA • 1y

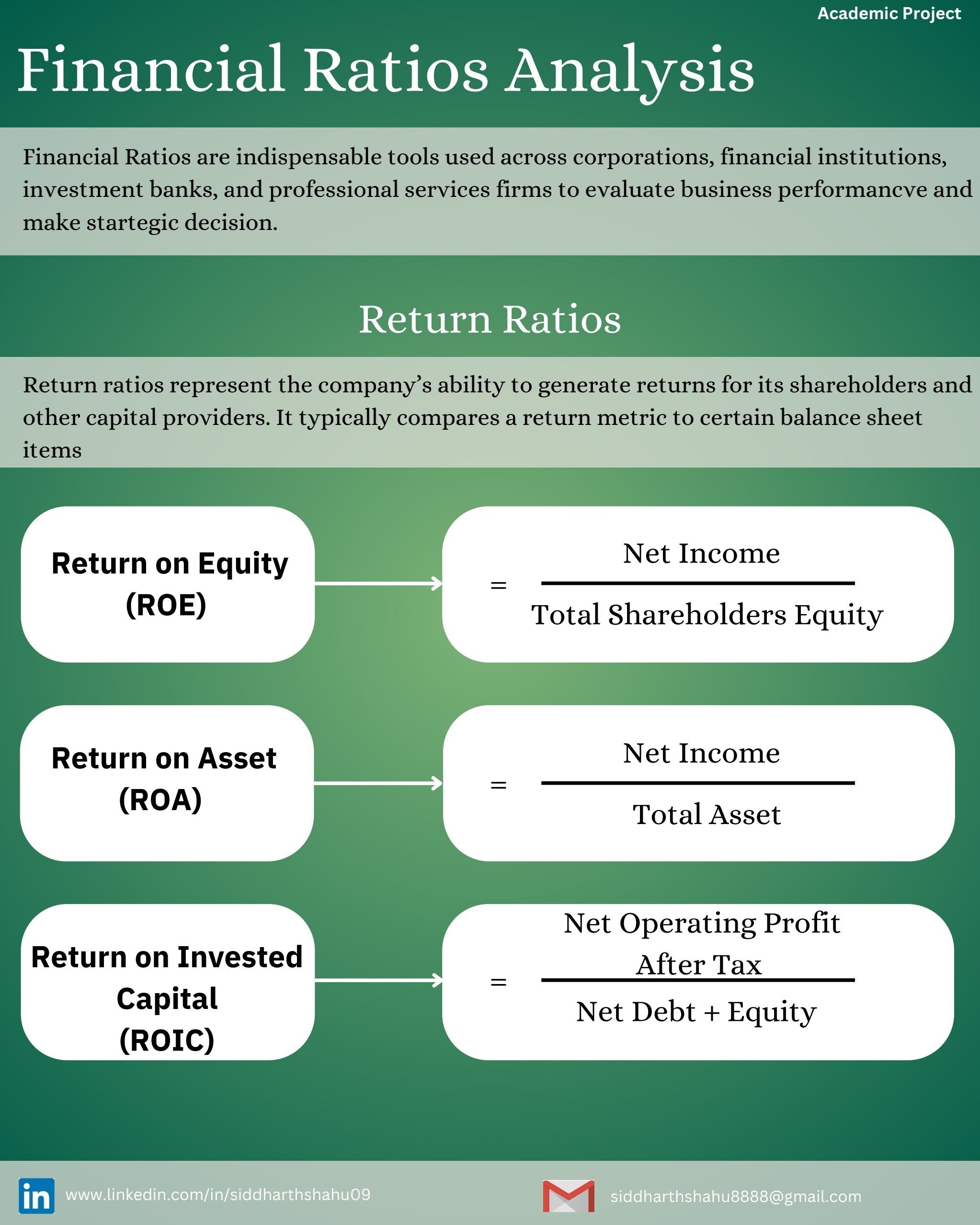

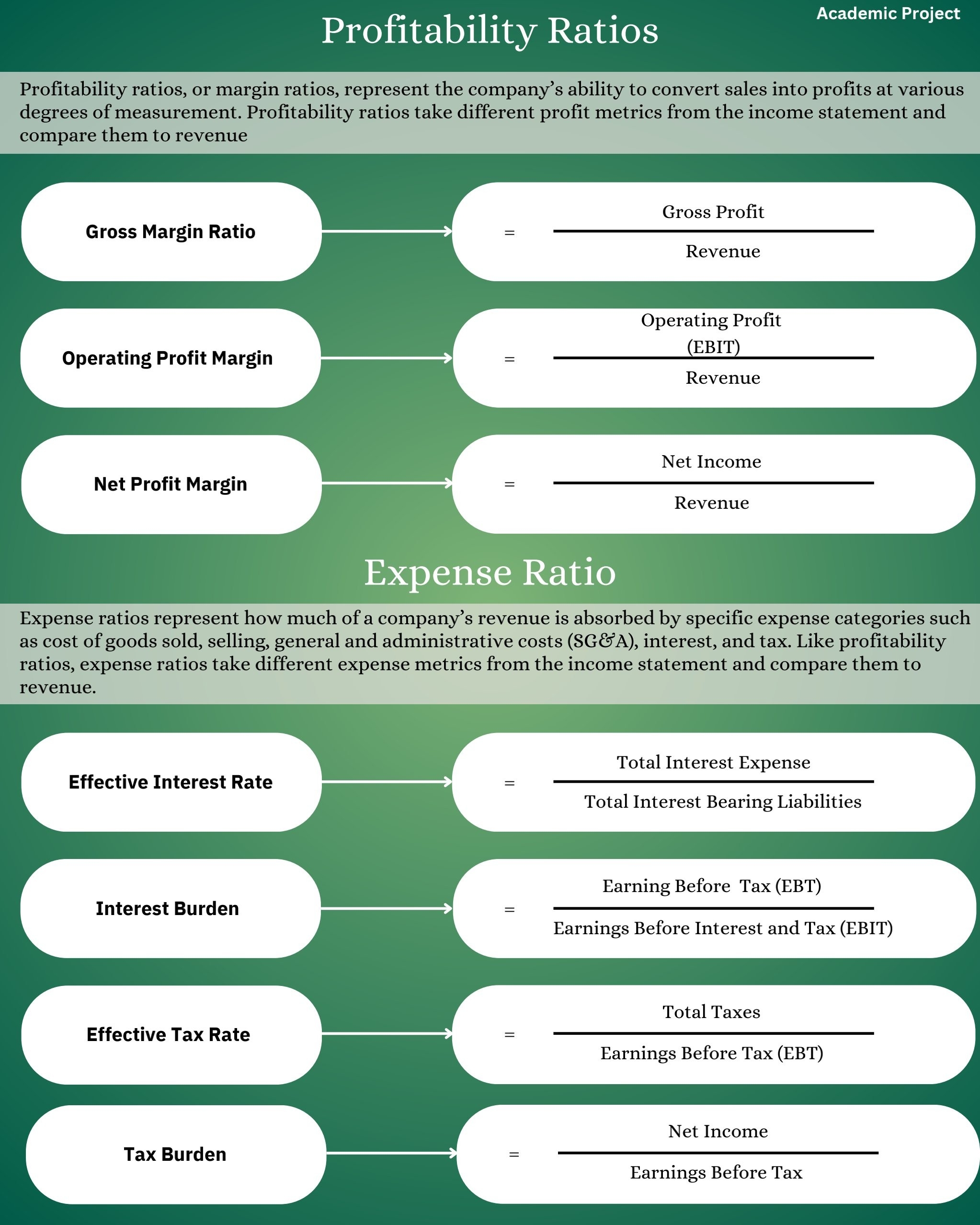

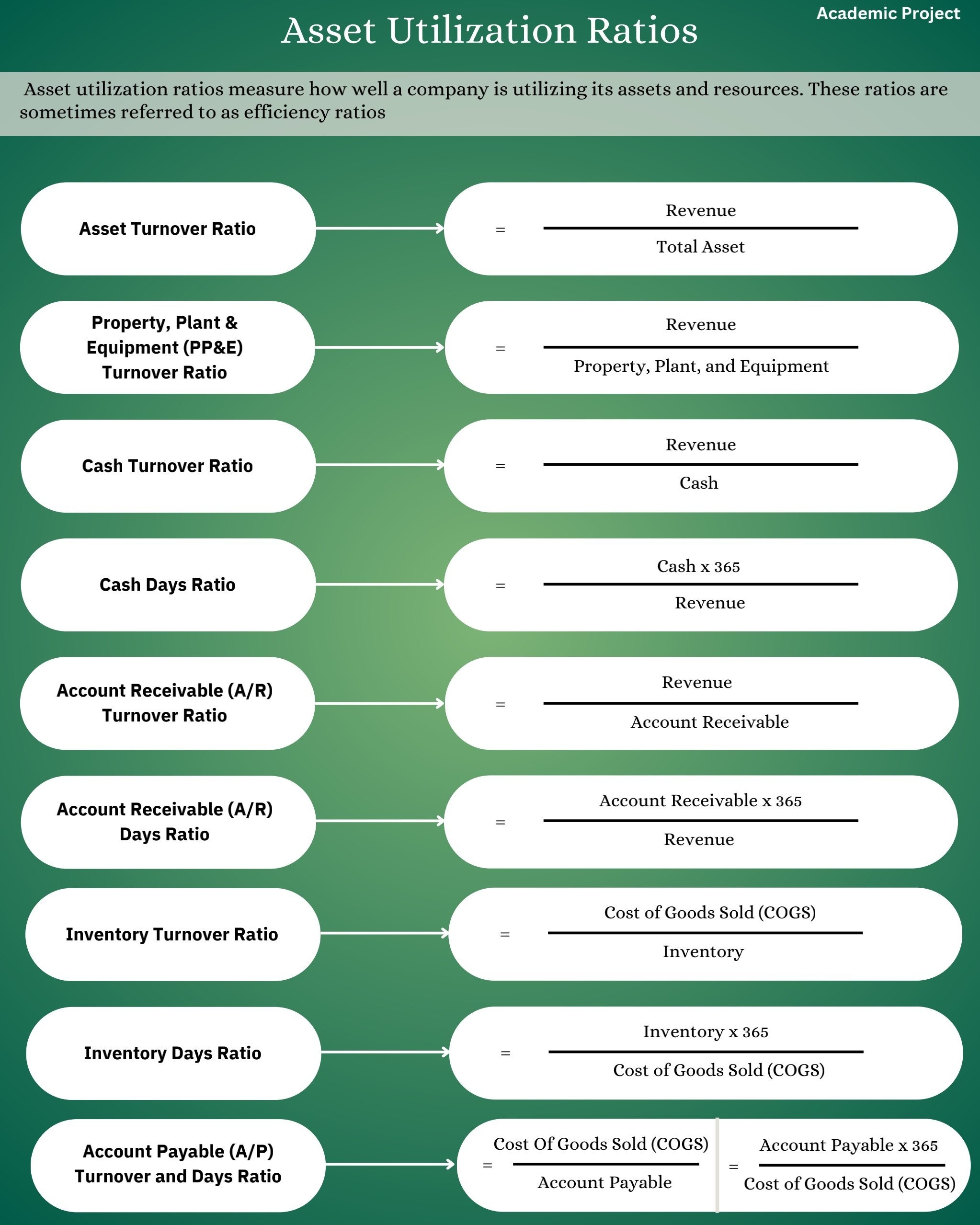

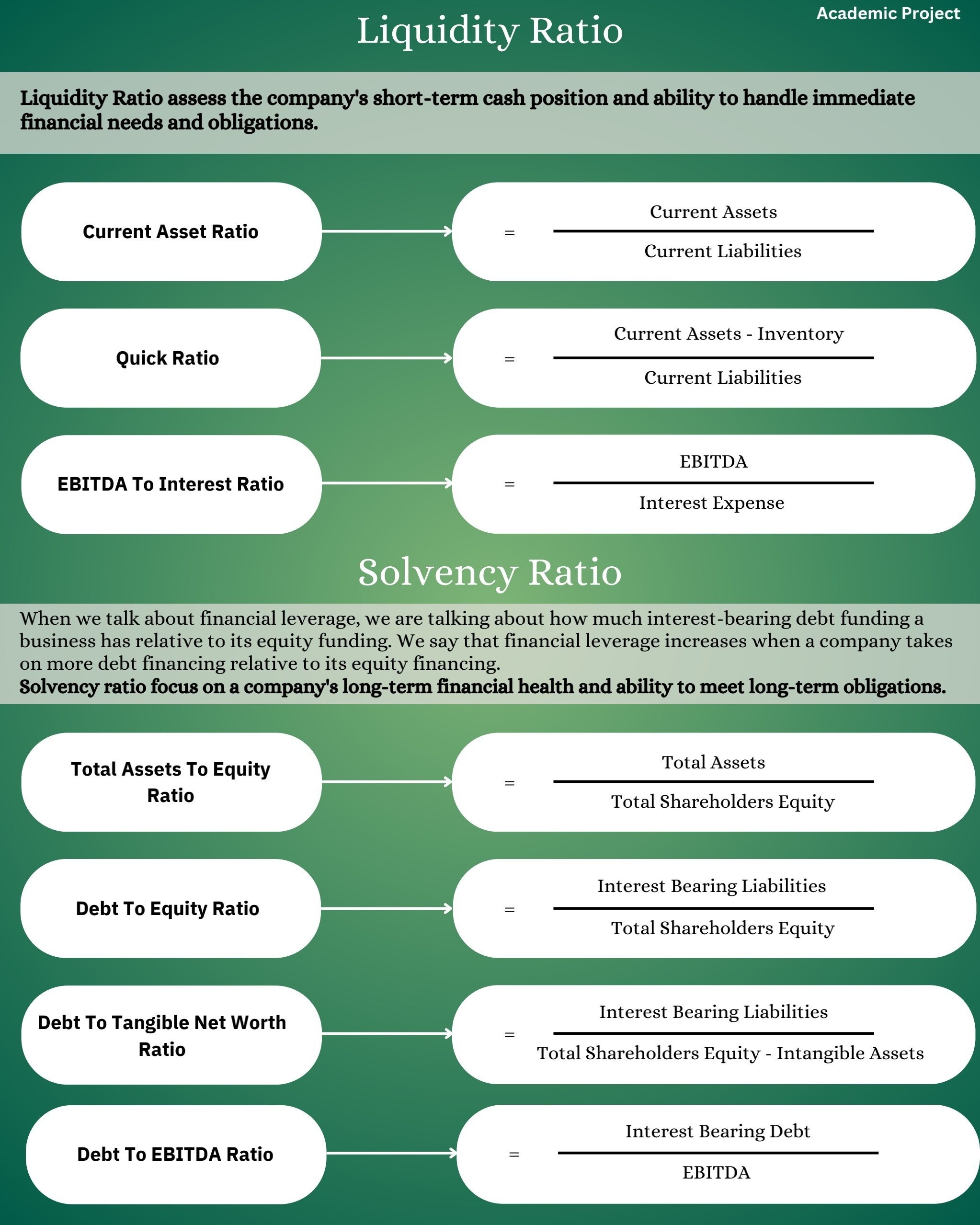

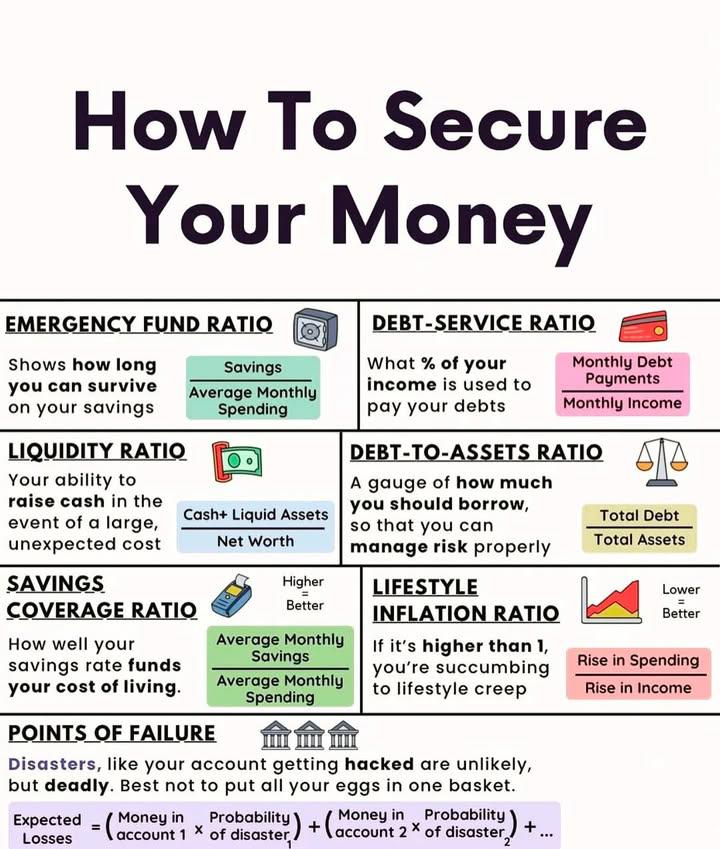

Hello Community, As part of my academic journey, I recently completed an in-depth analysis of financial ratios. These ratios provide valuable insights into a company’s performance, liquidity, and profitability. Let me share some insights of my project: 1. Return Ratio 2. Profitability Ratio 3. Expense Ratio 4. Asset Utilization Ratio 5. Liquidity Ratio 6. Solvency Ratio Remember, these ratios are powerful tools for decision-making, whether you’re an investor, analyst, or aspiring finance professional. 🚀 Feel free to connect with me if you’d like to dive deeper into this topic! #Finance #FinancialAnalysis #InvestmentInsights #Innovation #AcademicProject #Growth

Replies (4)

More like this

Recommendations from Medial

Rishabh Jain

Building Myself l UG... • 1y

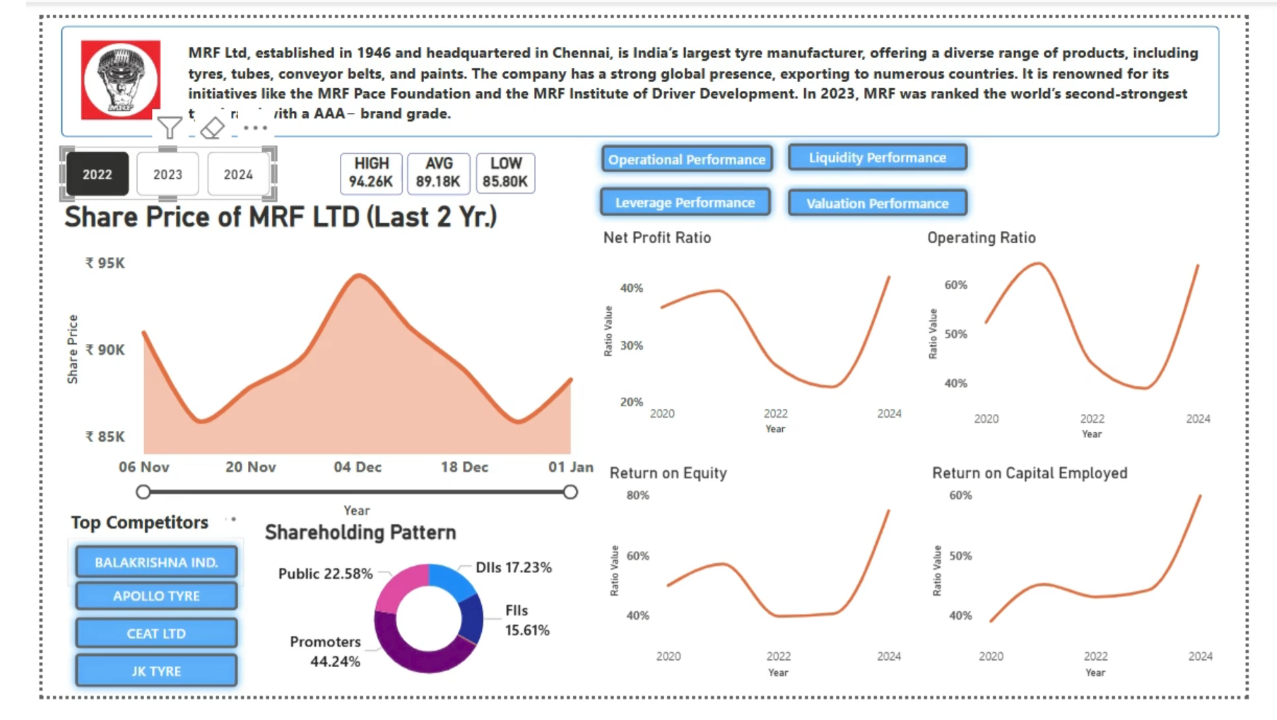

Excited to share my latest Power BI project: A comprehensive Financial Dashboard that provides deep insights into company performance! 📊 From multi-year trend analysis and shareholding patterns to key financial ratios (Operational, Liquidity, Lever

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily(irregular 😅) dose of financial ratios by Anirudh Gupta Lets learn these two ratios 1.Capital turnover ratio: =Sales or Cost of goods sold/Capital employed Capital employed=Shareholders funds+ Non-current liabilities Purpose: -To understa

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreVIJAY PANJWANI

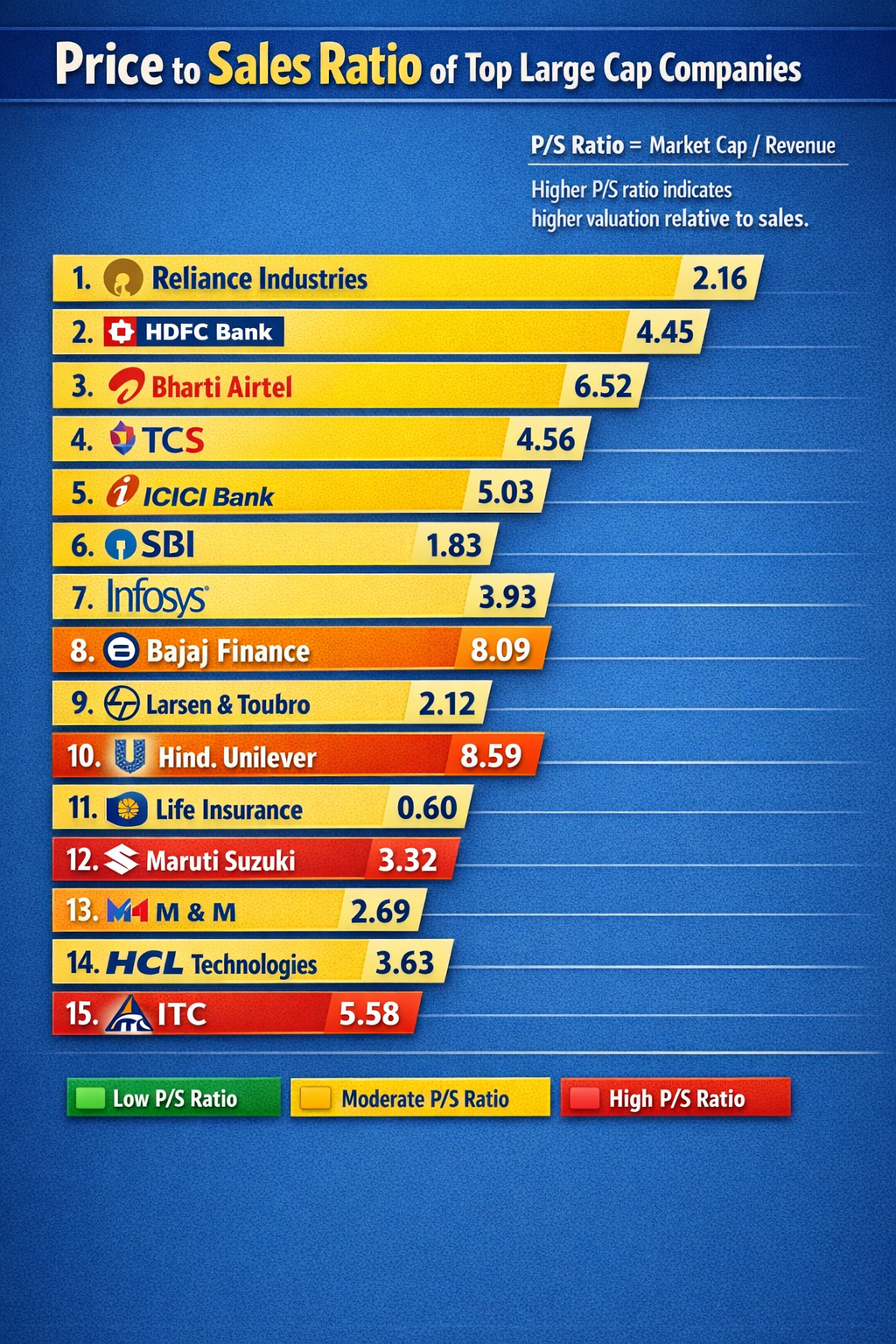

Learning is a key to... • 1m

Price to Sales (P/S) Ratio of India’s Top Large-Cap Stocks 🇮🇳 Ever wondered which big companies are cheap vs expensive relative to their sales? That’s where P/S Ratio helps 👇 🔹 Low P/S → Potentially undervalued 🟡 Moderate P/S → Fairly valued �

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Current ratio: =Current assets/current liabilities Purpose: -To evaluate the company's short-term financial health and liquidity. -This ratio tells us whether the company can meet its short term ob

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)