Back

Nawal

•

SELF • 1y

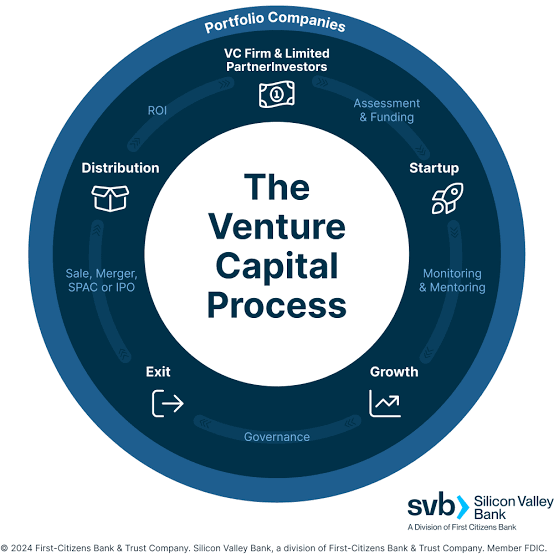

🚀Today we gonna talk about Mastering Metrics for Consumer Ventures 1. Growth Targets : - Aim for 15% month-over-month growth. - Prioritize organic growth with an 80:20 ratio. 2. Tracking Strategies: - Meticulously track user acquisition channels and costs. - Focus on retaining users and optimizing profitability. 3. Unit Economics and NPS: - Measure unit economics for profitability. - Aim for a Net Promoter Score (NPS) of at least +50. 4. User Retention: - Identify and maximize "magic moments" for retention. 5. Adaptability: - Adapt metrics for sustainable growth and profitability. Remember, these benchmarks ensure scalable growth and profitability

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreKarnivesh

Simplifying finance.... • 2m

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreHemant Prajapati

•

Techsaga Corporations • 1y

Checkout our profile How to Verify Your Startup's Growth 1. 📊 Monitor Key Metrics - Revenue Growth: Track consistent increases in revenue. - User Growth: Watch the rise in active users/customers. - Engagement: Measure traffic, time spent,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)