Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

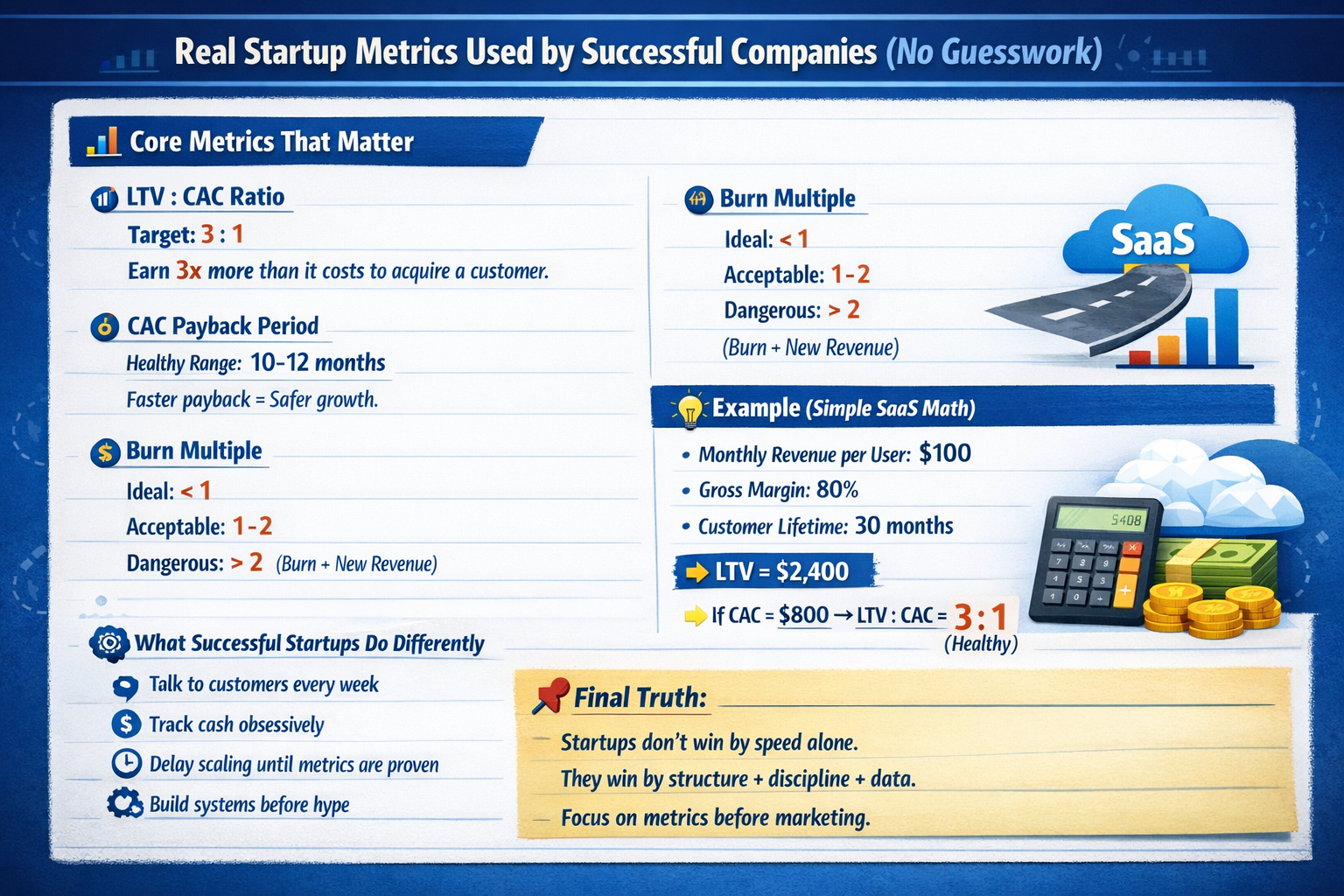

Why Metrics Matter More Than Ideas in VC Funding. 🚀✨️ Be good at your numbers. You’ve got a bold vision and a slick pitch deck. But the moment you step into a VC meeting, the conversation shifts from your idea to your numbers. Why? Because VCs don’t fund ideas -- they fund metrics. Your metrics tell a story: how efficiently you're operating, how fast you're growing, and whether your business is built to scale. Without strong numbers, even the best ideas struggle to survive. Here’s why metrics matter, and which ones matter most: ✅️ The Metrics That Make or Break Funding Conversations 1. Customer Acquisition Cost (CAC): How much does it cost to get a customer? Efficient startups drive CAC down over time. Healthy CAC:LTV ratios are 1:3 for SaaS, 1:5 for e-commerce. 2. Customer Lifetime Value (LTV): How much value do you earn from a customer over their lifetime? If LTV < CAC, you’re bleeding money. Great businesses grow LTV through retention, upselling, and stickiness. 3. Average Revenue Per User (ARPU): A higher ARPU shows you’re monetizing users effectively. It’s a sign your pricing matches your value. 4. Net Dollar Retention (NDR): How much revenue are you retaining and growing from existing customers? 110-130%+ NDR is best-in-class for SaaS. 5. Net Logo Retention (NLR): How many customers are sticking around? 85-90% is a good target for B2B; 75%+ for SMBs. 6. MRR & ARR (Recurring Revenue): Predictable, growing revenue is a powerful signal. Early-stage SaaS targets: $1M ARR by Seed-Series A; $10M+ by Series B. 7. Annual Contract Value (ACV) & Total Contract Value (TCV): Big, long-term contracts = reliable cash flow. This is crucial in enterprise SaaS. 8. Burn Rate & Runway: Cash is king. Burn too fast without results and you're out. Aim for 12-18 months of runway. 9. Growth Rate: Growth isn’t optional. VCs expect rapid, compounding growth: 15-20% MoM early, 100%+ YoY by Series B. 10. Gross Margin: The higher, the better - SaaS should aim for 70-80%. Margins show your ability to reinvest in growth. 11. Total Addressable Market (TAM): No matter how great your execution, small markets cap your upside. VCs want massive TAMs. 12. Gross Merchandise Volume (GMV): For marketplaces and e-commerce, GMV matters- especially with a solid take rate (10-20%). 13. K-Factor: Is your product growing virally? A K-Factor >1 means each user brings in more users = organic growth engine. 14. DAU/MAU Ratio: User engagement is gold. 50%+ DAU/MAU = high retention. Below 20%? Churn problem. ✅️ Stage Matters: What VCs Want to See. Pre-Seed/Seed: TAM, CAC, retention, early traction (even anecdotal). Series A: ARR, CAC payback, retention, scalable GTM motion. Series B+: Burn efficiency, gross margins, growth velocity, revenue expansion. ✅️ Industry-Specific KPIs SaaS: ARR, MRR, NDR, CAC payback. E-commerce/Marketplaces: GMV, take rate, AOV. Consumer Apps: DAU/MAU, K-Factor, retention. Fintech: Volume, take rate, compliance. ❌️ Avoid Vanity Metrics Metrics like total signups, app downloads, or traffic without conversion look good but don’t mean much. Investors want signals of revenue, retention, and scalability- not surface-level vanity stats. ✅️ Pre-Traction? Focus on Signals If you lack deep metrics, focus on market size, team quality, early user love, and engagement signals (waitlists, testimonials, user behavior). Your story matters more here - frame early wins as signs of future momentum. ✅️ How to Improve the Right Metrics ❓️ Lower CAC: Sharpen targeting, improve funnels, go organic. Increase LTV: Boost retention, upsells, pricing tiers. Reduce Burn: Trim excess, automate, prioritize high-ROI tasks. Improve NDR: Add expansion paths, fight churn, drive referrals.

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreManu

Building altragnan • 10m

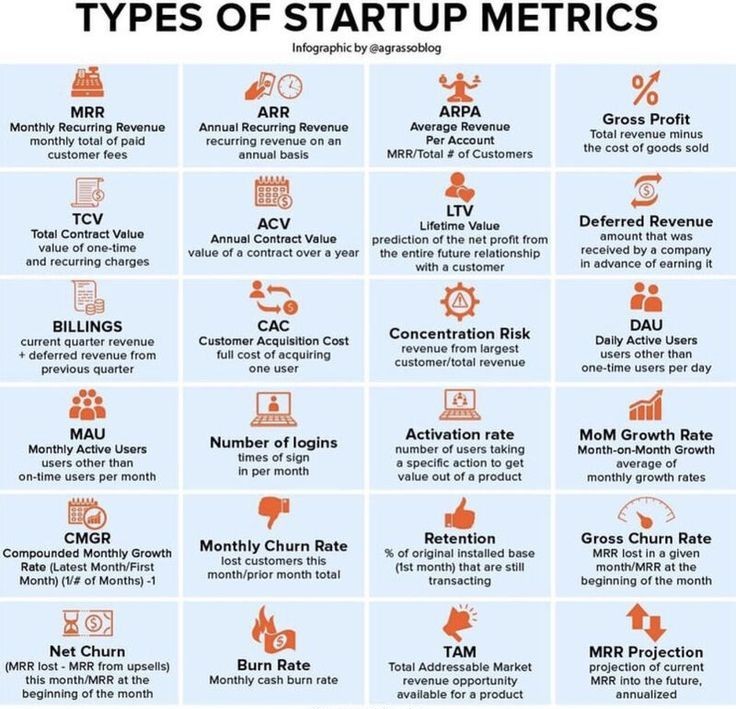

This infographic shows key startup metrics. MRR is monthly recurring revenue, while ARR is annual recurring revenue. ARPA shows average revenue per customer. Gross Profit is revenue minus costs. TCV and ACV measure contract values. LTV predicts total

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Crucial KPIs for founders, from inception to exit: Pre-Seed: Validate your idea! Focus on Problem-Solution Fit (qualitative user interviews, early sign-ups). Seed: Prove initial traction. Track Customer Acquisition Cost (CAC), Conversion Rates, and

See More

Centriagal performance marketing agency

24 karat pure meta a... • 2m

The Real Metrics That Grow a Business Most businesses fail because they run ads without tracking three critical metrics: 1️⃣ ROAS (Return on Ad Spend) ROAS tells you how much revenue you generated from every ₹1 spent on ads. For example, if you sp

See MoreAccount Deleted

Hey I am on Medial • 9m

7 Essential Metrics Every Startup Should Track 1. Customer Acquisition Cost (CAC) https://www.investopedia.com/terms/c/customer-acquisition-cost.asp 2. Lifetime Value (LTV) https://www.investopedia.com/terms/c/customer-lifetime-value-clv.asp 3. Bu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)