Back

Vivek Joshi

Director & CEO @ Exc... • 10m

Crucial KPIs for founders, from inception to exit: Pre-Seed: Validate your idea! Focus on Problem-Solution Fit (qualitative user interviews, early sign-ups). Seed: Prove initial traction. Track Customer Acquisition Cost (CAC), Conversion Rates, and early Customer Lifetime Value (CLTV). Are you acquiring users efficiently? Series A: Demonstrate scalability. Monitor Revenue Growth Rate, Monthly Recurring Revenue (MRR), and Churn Rate. Can you grow sustainably? Series B: Optimize for efficiency. Analyze Gross Margin, Net Burn Rate, & Customer Retention Rate. Are you building a profitable, sticky business? Growth (Series C/D): Expand market share. Observe Market Penetration Rate, New Market Expansion, & Average Revenue Per User (ARPU). Are you capturing the market? Pre-Acquisition: Showcase value. Highlight Profitability Metrics (EBITDA), Customer Concentration, & Strategic Alignment. Is your company a compelling acquisition target? The core is to build a valuable, sustainable business.

Replies (3)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

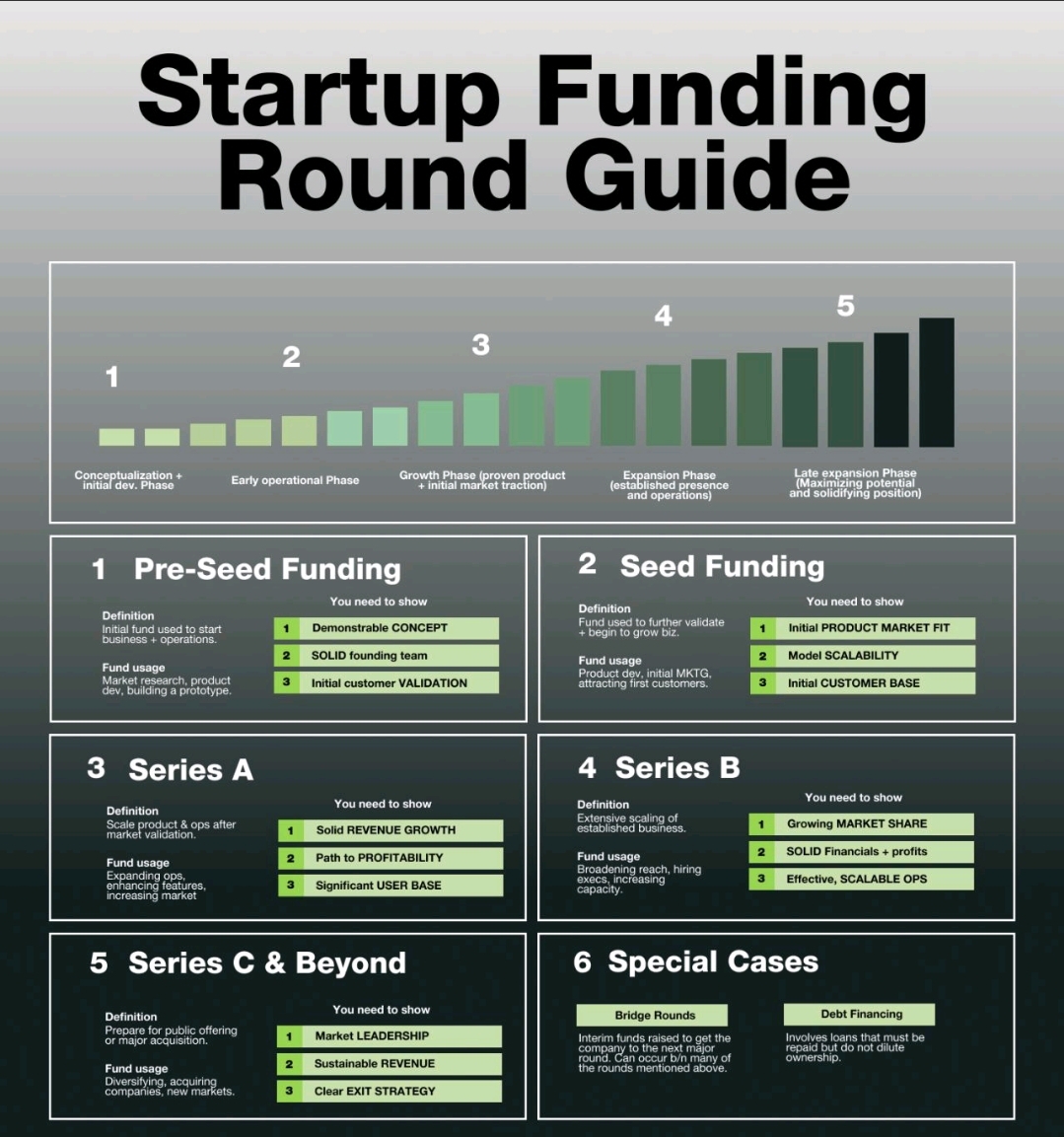

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreAccount Deleted

Hey I am on Medial • 9m

7 Essential Metrics Every Startup Should Track 1. Customer Acquisition Cost (CAC) https://www.investopedia.com/terms/c/customer-acquisition-cost.asp 2. Lifetime Value (LTV) https://www.investopedia.com/terms/c/customer-lifetime-value-clv.asp 3. Bu

See More

Swapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 49: BLR Data Dive: Demystifying Metrics for Startup Success Data is the new gold in Bengaluru's startup scene. But deciphering it can feel like reading ancient scrolls! Here's your decoder ring: * Website Traffic: Understand who's visiting your

See MoreAnup Thatal

IT enthusiastic | Fu... • 7m

Some glimpse of business full form ? GTM:- go to market LTV:- lifetime value MVP :- Minimum viable product GT:- General Trade SP:- selling price ROI:- return on investment ROAS:- Return on advertising spend DAU:- Daily Active user MAU:- Monthly A

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)