Back

Account Deleted

Hey I am on Medial • 1y

A startup’s financial model is simple: Pre-seed = hope. Seed = still hoping. Series A = hope with a pitch deck. Series B = hope with revenue. Series C = hope we IPO before running out of hope.

Replies (1)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

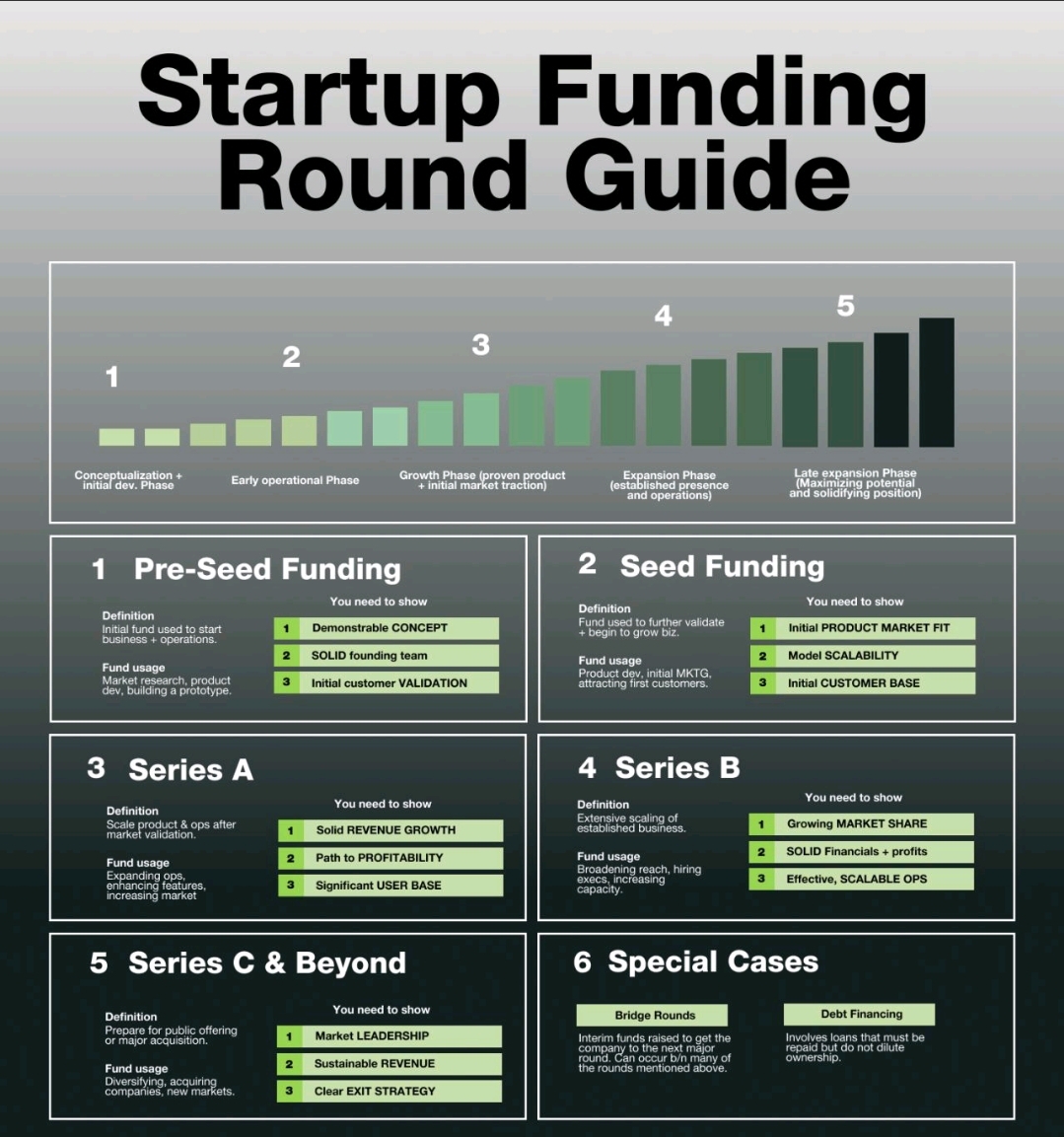

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Account Deleted

Hey I am on Medial • 8m

Breakdown of where Indian startup money moved on week June 09 to June 14 1) Growth-Stage Deals CRED - $72M FlexiLoans - $44M Series C Vecmocon Technologies - $8M (part of $18M Series A) Wow! Momo - $1M Series B Garuda Aerospace Private Limited - un

See MoreVCGuy

Believe me, it’s not... • 1y

Building SaaS from India for the world - Rocketlane raises a $24 M Series B. ➡️Total Funding: $45 M (Seed at $3 M, Series A at $18 M) ⏫Lead investors: 8VC, Matrix Partners and Nexus VP. In recent years, many Indian startups are building SaaS compan

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

5 Stages of Startup Funding 1. Pre-seed funding stage ★ Is your idea viable? ★ Has your idea been done before? ★ How costly is your venture? ★ What kind of business model will you use? ★ How will you get started? 2. Seed funding stage ★ Product

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)