Back

Vrishank

Startups/VC/tech • 1y

When A VC firm is investing capital in your startup, how much money do they expect in return? I was having a talk with a very senior VC recently, I asked him the same question. He gave me the following data: Pre-seed/seed - 100x returns Series A - 30x Series B - 10x Series C - 3x Pre-Ipo - 2x The later they invest, the less return they expect. This is because in early stage of a startup, it is a very risky bet. so if a VC firm is taking a huge financial bet on a startup in it's early days, they want a huge return too. Indians VCs in general don't have the risk taking ability because they have the pressure to return LPs their money, this is the reason why we don't see many pre-seed focused VC firms in India. Most VC firms in India either invest at seed or series A round. I hope this changes soon. We need more VCs investing at pre-seed stage, which is also the most crucial stage for a startup.

Replies (15)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

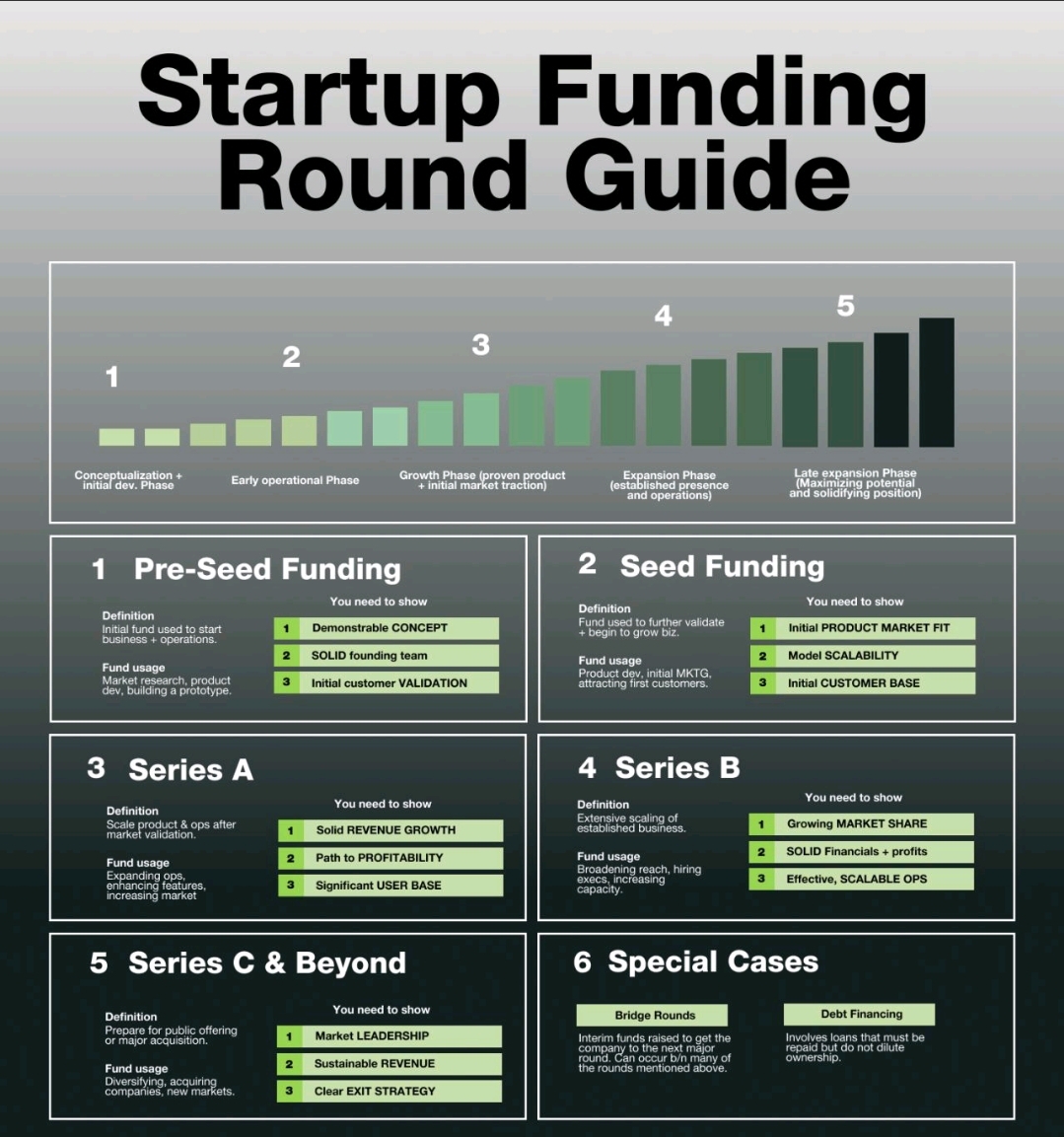

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Kavish Goyal

Aspiring Entrepreneu... • 1y

Top 10 accelerators that you can apply at a super early stage 👇 1. Y Combinator | Pre-Seed, $500k for ~10% 2. Entrepreneur First | No team, $250k for ~9% 3. South Park Commons| Pre-Idea, $1M 4. Antler Global | Pre-Seed, $250k for 9% 5. Sequoia

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)