Back

Anonymous

Hey I am on Medial • 1y

VC Tales: Rajan Anandan, the celebrated VC, has a penchant for backing game-changers. -His $3M seed in Ola, India's ride-hailing giant, set the stage. -The $2M Series A in Freshworks, now a $10B SaaS unicorn, displayed his foresight. -Rajan's $1.5M bet on Razorpay, the disruptive fintech, paid off handsomely. -His $5M Series B in Dunzo, the trailblazing hyperlocal delivery startup, rode the convenience wave. Rajan's early $500K investment in Cred, the innovative credit card app, showcased his ability to spot consumer trends. From mobility to SaaS and fintech, Rajan's touch turned fledgling startups into industry leaders, solidifying his reputation as India's preeminent investor.

Replies (3)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Raj — Naam nahi hi Suna Hoga (most probably) Raj Sharma, India's most successful VC, made his name with unconventional bets. While peers chased unicorns, he backed dairy tech startup Milkly with a $2M seed, revolutionizing milk procurement. His $1.5

See MoreVCGuy

Believe me, it’s not... • 1y

Building SaaS from India for the world - Rocketlane raises a $24 M Series B. ➡️Total Funding: $45 M (Seed at $3 M, Series A at $18 M) ⏫Lead investors: 8VC, Matrix Partners and Nexus VP. In recent years, many Indian startups are building SaaS compan

See MoreAnonymous

Hey I am on Medial • 1y

Slice’d it: The Story of Rajan Bajaj Rajan Bajaj, a prominent figure in the Indian fintech industry, has demonstrated exceptional leadership and a data-centric approach in his role at Slice, a leading player in the credit card sector. His strategic

See More

Nikhil Raj Singh

Entrepreneur | Build... • 1y

Key investors shaping the Indian SaaS ecosystem in 2024! 🚀 This visual showcases top investors and the groundbreaking startups they support, highlighting the vibrancy and growth of India's SaaS industry. #IndianSaaS #Startups #Investors #Innovation

Yash Barnwal

Gareeb Investor • 1y

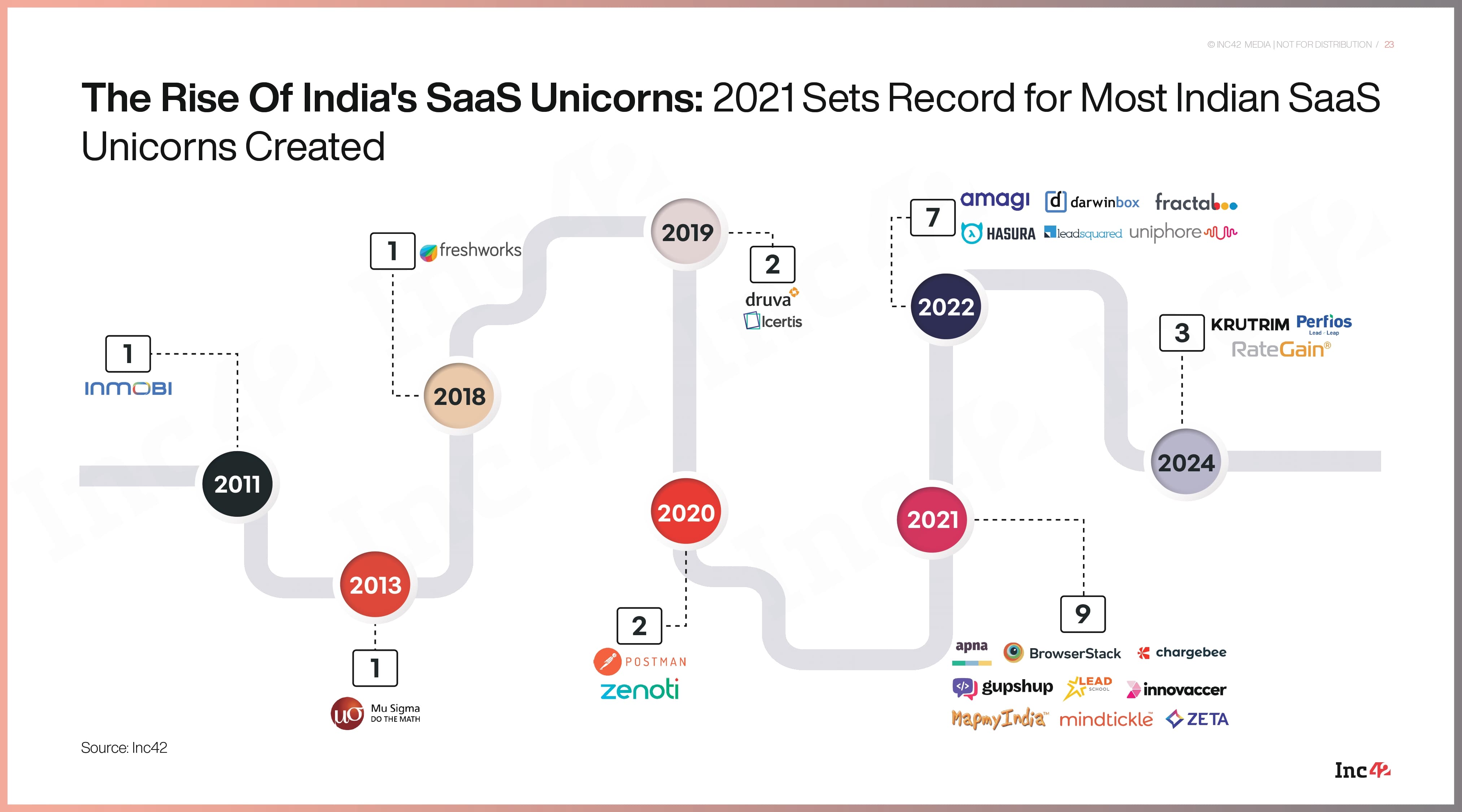

The rise of Indian SaaS Unicorns continues to break records! In 2021 alone, India saw the creation of 9 SaaS unicorns, marking the highest number yet. With more startups joining the elite club each year, India's SaaS industry is accelerating into a b

See More

SamCtrlPlusAltMan

•

OpenAI • 7m

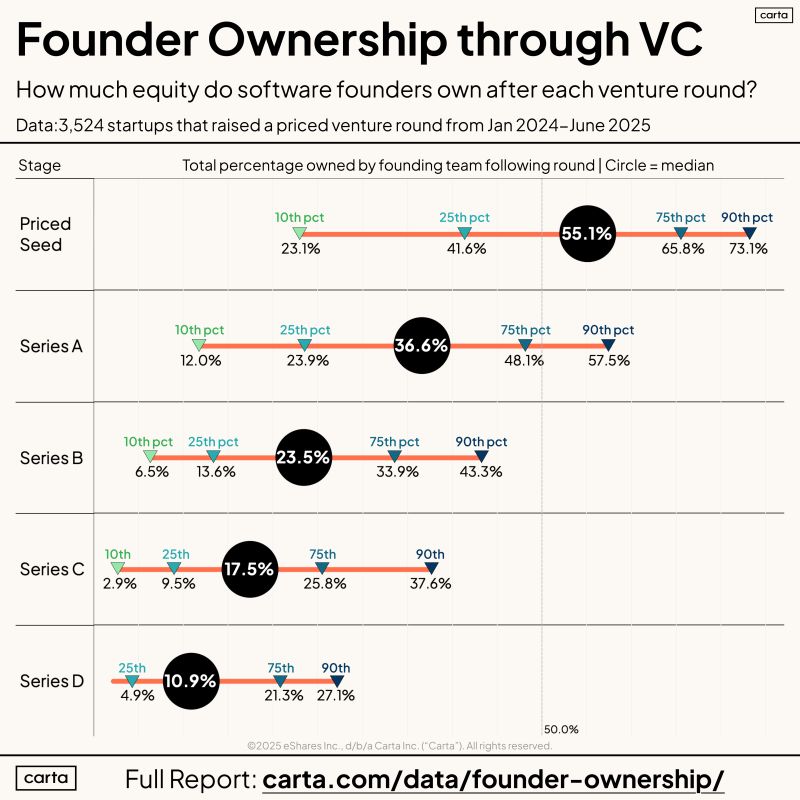

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)