Back

Kimiko

Startups | AI | info... • 9m

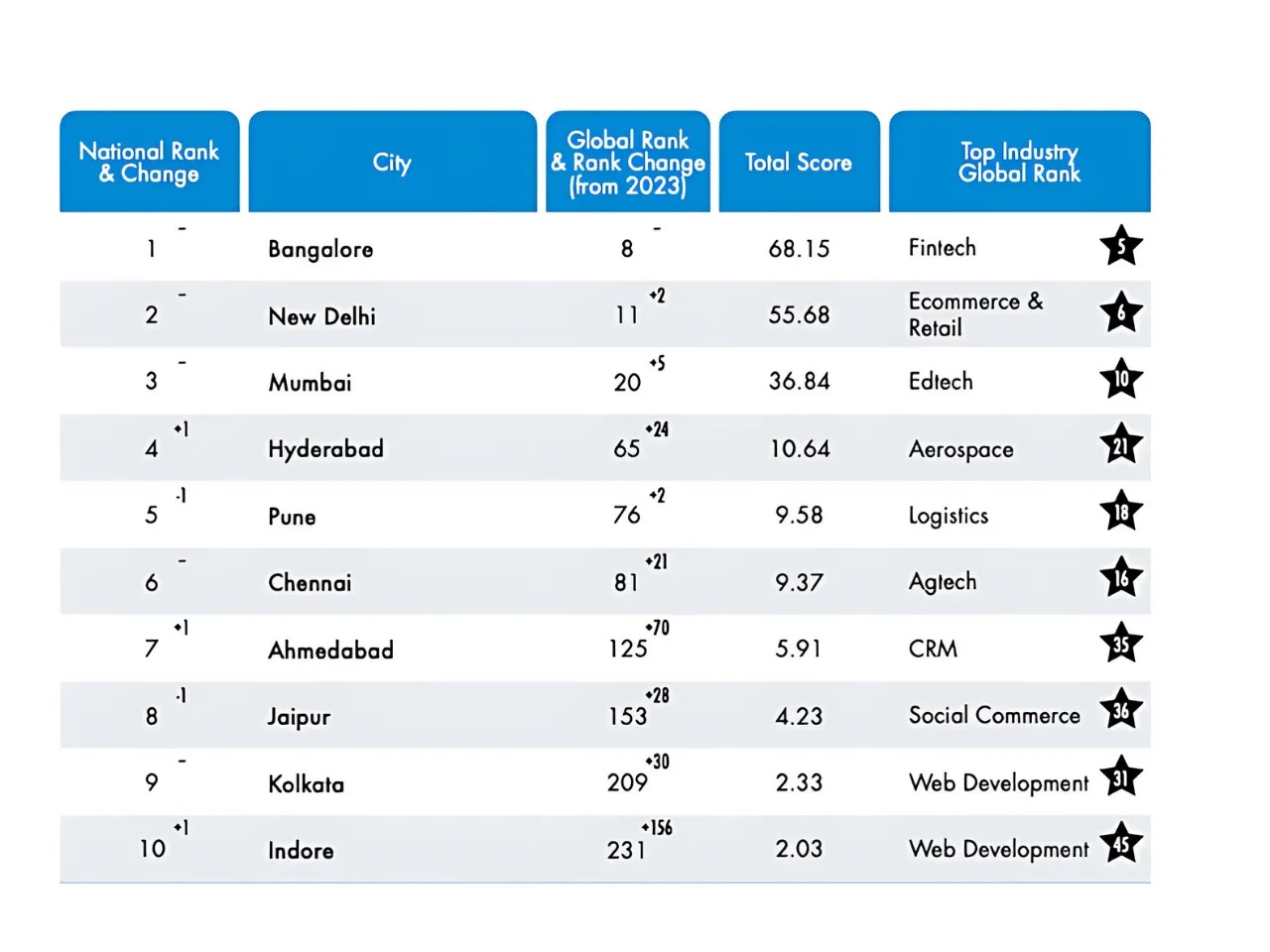

INDIA'S UNICORN COUNT IN 2025 Total: 125+ Top Sectors: Fintech SaaS E-commerce Healthtech India ranks 3rd globally in unicorn count!

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 9m

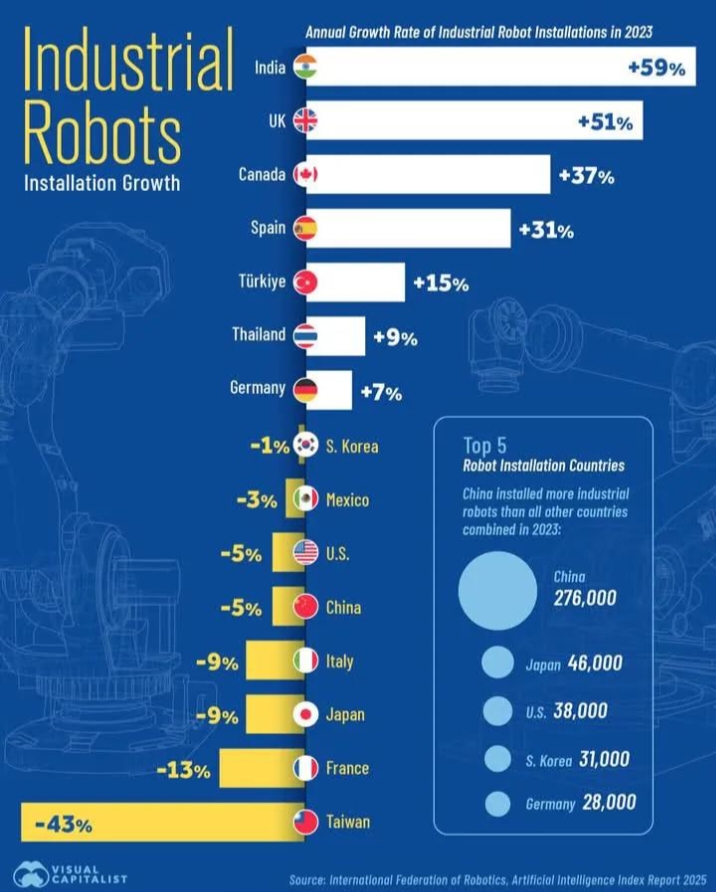

India now ranks 7th globally in annual robot installations .. Globally, there were nearly 4.3 Million operational industrial robots in 2023, with China installing 276,300 that year alone. While , India has seen the fastest annual growth in industri

See More

Ashish Singh

Finding my self 😶�... • 1y

In 2024, six Indian startups achieved unicorn status, crossing the $1 billion valuation mark: 1. **Krutrim** - India's first AI unicorn, founded in 2023, secured $50 million in January. 2. **Ather Energy** - An electric two-wheeler manufacturer, bec

See MoreMayank Kumar

Strategy & Product @... • 1y

Ending the day with this. Happy reading! The Rise of Unicorn Startups: What’s Next? Unicorn startups—those valued at over $1 billion—are reshaping industries. Companies like Airbnb, Stripe, and ByteDance have set new standards. But what's next?

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)