Back

Anonymous 1

Hey I am on Medial • 1y

Yeah hahaha, startups run on hope at every stage. The only difference is whether it’s backed by dreams, decks, or dollars.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 10m

🚀 Growth-stage Indian startups & ventures eyeing VC funding? 🇮🇳 Excess Edge Experts Consulting invites you to share your decks at [email address removed]. All domains welcome! Let's fuel your next phase of expansion. #VCFunding #IndianStartups #

See More

Account Deleted

Hey I am on Medial • 1y

Let's decode one pattern : • Companies were backed by Softbank such as OYO, OLA Electric and FirstCry are continuously filing for IPO but some IPO's approved or some failed for IPO. • Startups backed by Softbank such as OLA Electric and OYO are ra

See More

Anonymous

Hey I am on Medial • 1y

Today, I pitched my startup to jury of a program. They will judge whether I get grant or not. My startup is very early stage and without grant the business is going to stay at that stage. Just wanted to share that I am beginning to feel like startups

See MoreRakshit Bondwal

Startup Founder • 4m

Every time I open Twitter or LinkedIn, I see startups raising $1M–$2M. But when it’s your turn, investors say, “You’re pre-revenue, come back later.” But seriously, where are the investors who fund early-stage startups? Niket Raj Dwivedi Man Please

See MoreManu

Building altragnan • 10m

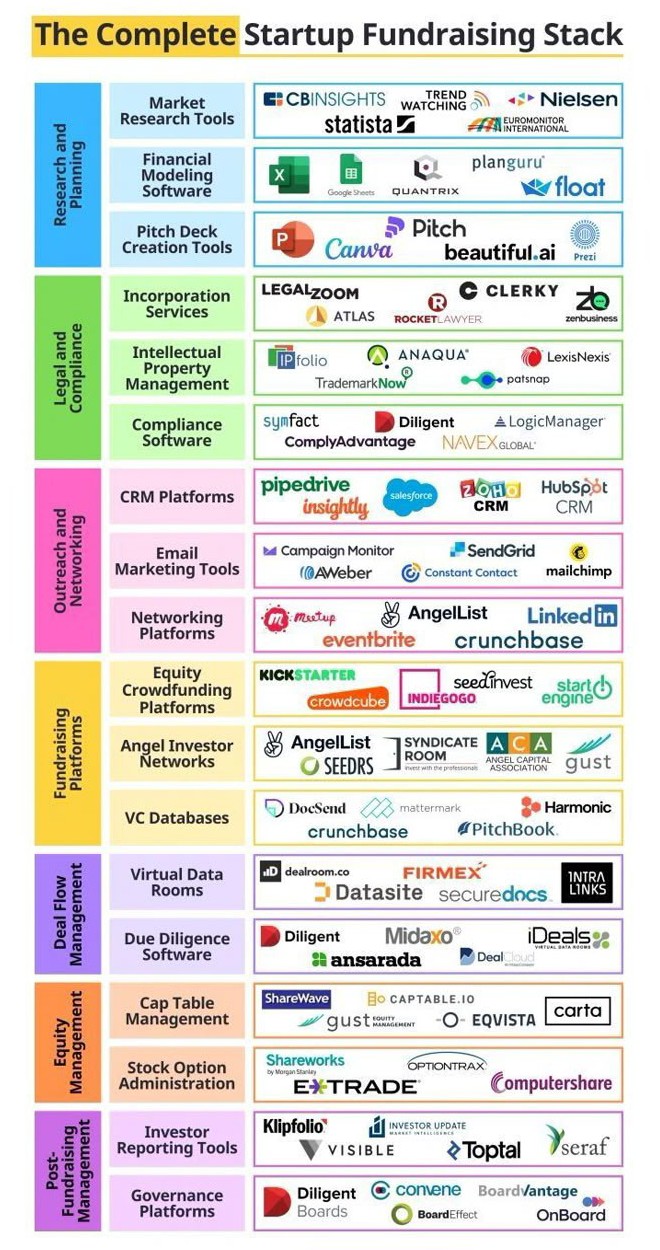

The Complete Startup Fundraising Stack is a handy guide for founders navigating the fundraising journey. It breaks down all the tools you might need—from researching your market and building a killer pitch deck, to managing investor relationships and

See More

Mohammed Zaid

building hatchup.ai • 1y

Quick commerce Zepto claimed the number one spot on LinkedIn's 2024 Top Startups list, a data-backed ranking of the 20 emerging companies growing fast, gaining attention and recruiting top talent in India. Whether it's enabling battery-swapping for e

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)