Back

vishakha Jangir

•

Set2Score • 11m

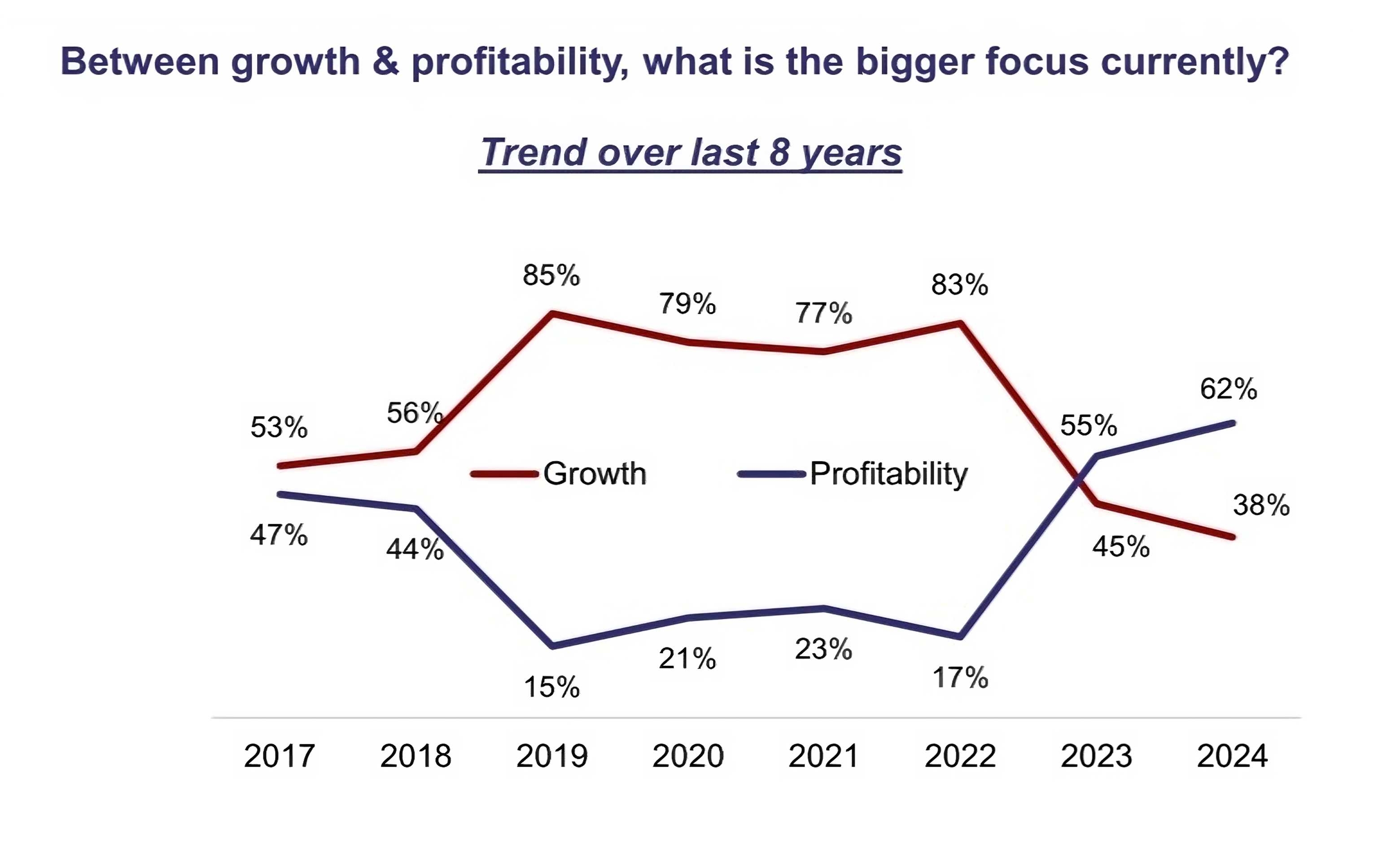

𝗔 𝘀𝘁𝗮𝗿𝘁𝘂𝗽 𝗶𝘀 𝗻𝗼𝘁 𝗷𝘂𝘀𝘁 𝗮𝗯𝗼𝘂𝘁 𝗯𝘂𝗿𝗻𝗶𝗻𝗴 𝗰𝗮𝘀𝗵 !! A startup should focus on sustainable growth, not just rapid expansion fueled by heavy spending. Blindly burning cash on customer acquisition without retention strategies leads to failure. Many startups fail because they prioritize vanity metrics (user growth, app downloads) over profitability. Bootstrapping or lean operations force startups to focus on core value propositions. Efficient capital allocation ensures longevity and better investor confidence. Companies that solve real problems with strong unit economics thrive without excessive spending. Scaling too fast before achieving product-market fit can lead to financial disaster. Smart startups invest in organic growth channels like referrals, word-of-mouth, and SEO. Case Study: (1) 𝗪𝗲𝗪𝗼𝗿𝗸 𝘃𝘀. 𝗭𝗼𝗵𝗼 WeWork raised billions but focused on aggressive expansion over sustainable business fundamentals. When investor confidence declined, the business collapsed under its own expenses. Zoho focused on profitability and organic growth from the beginning, never relying on external funding. Today, it's a global software giant without any VC dependency. (2) 𝗕𝗬𝗝𝗨’𝗦 𝘃𝘀. 𝗭𝗲𝗿𝗼𝗱𝗵𝗮 BYJU’S aggressively spent on marketing, acquisitions, and discounts to drive user growth without ensuring profitability. As debt mounted and investor confidence declined, it faced financial struggles despite being a market leader. Zerodha, in contrast, built a profitable business from day one, focusing on low-cost brokerage and organic customer acquisition. Without VC funding, it remains one of India's most successful bootstrapped startups. Long-term success comes from a strong business model, not just deep pockets. Follow vishakha Jangir for more such business insights.

Replies (5)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

PepperTap: A Startup's Rapid Rise and Fall PepperTap, an online grocery delivery startup in Gurgaon, experienced a meteoric rise but abruptly shut down within two years due to: * Overexpansion: Rapid growth without a sustainable foundation. * Fina

See MoreVatan Pandey

Founder & CEO @Zyber... • 10m

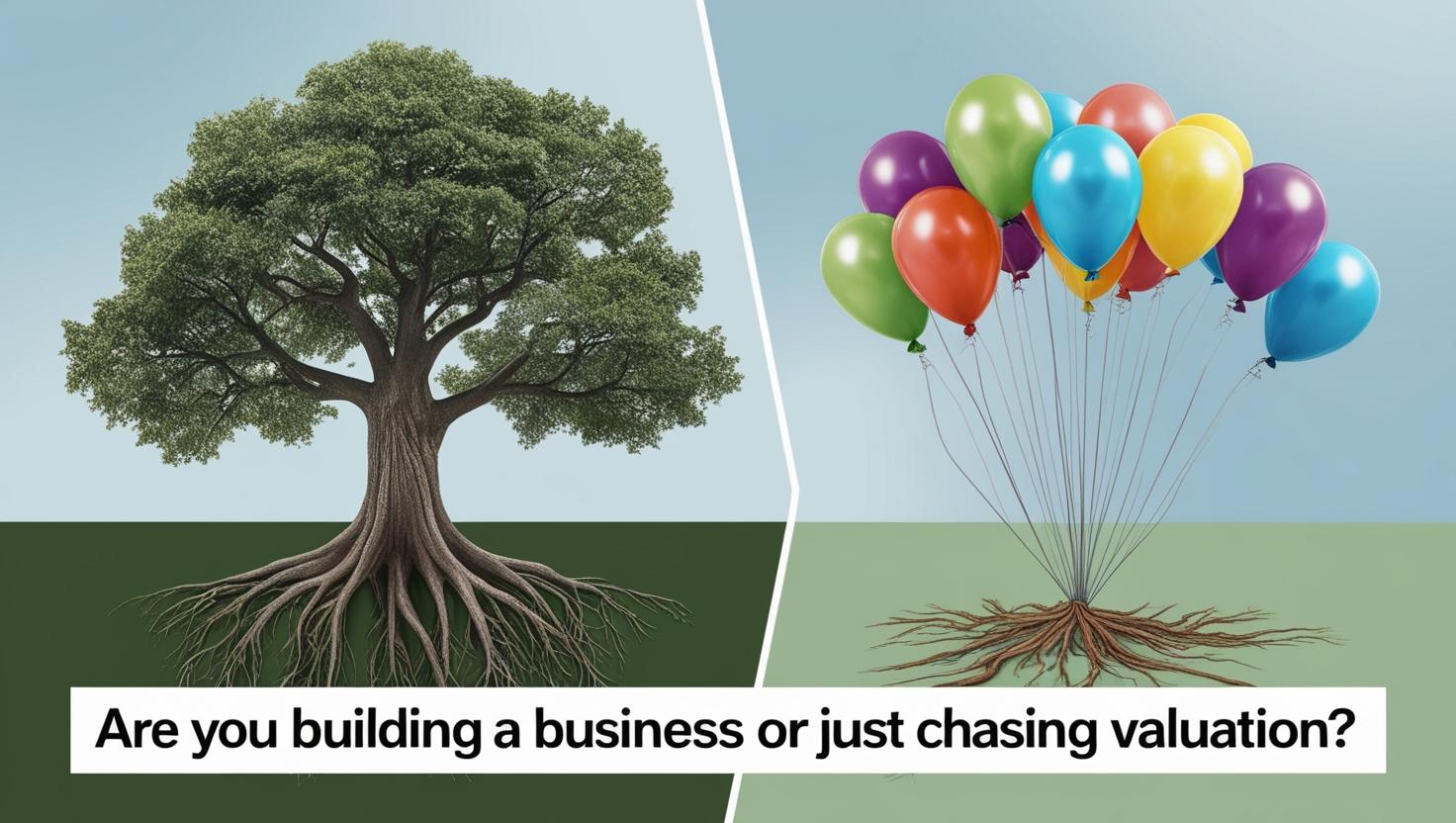

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Karnivesh

Simplifying finance.... • 2m

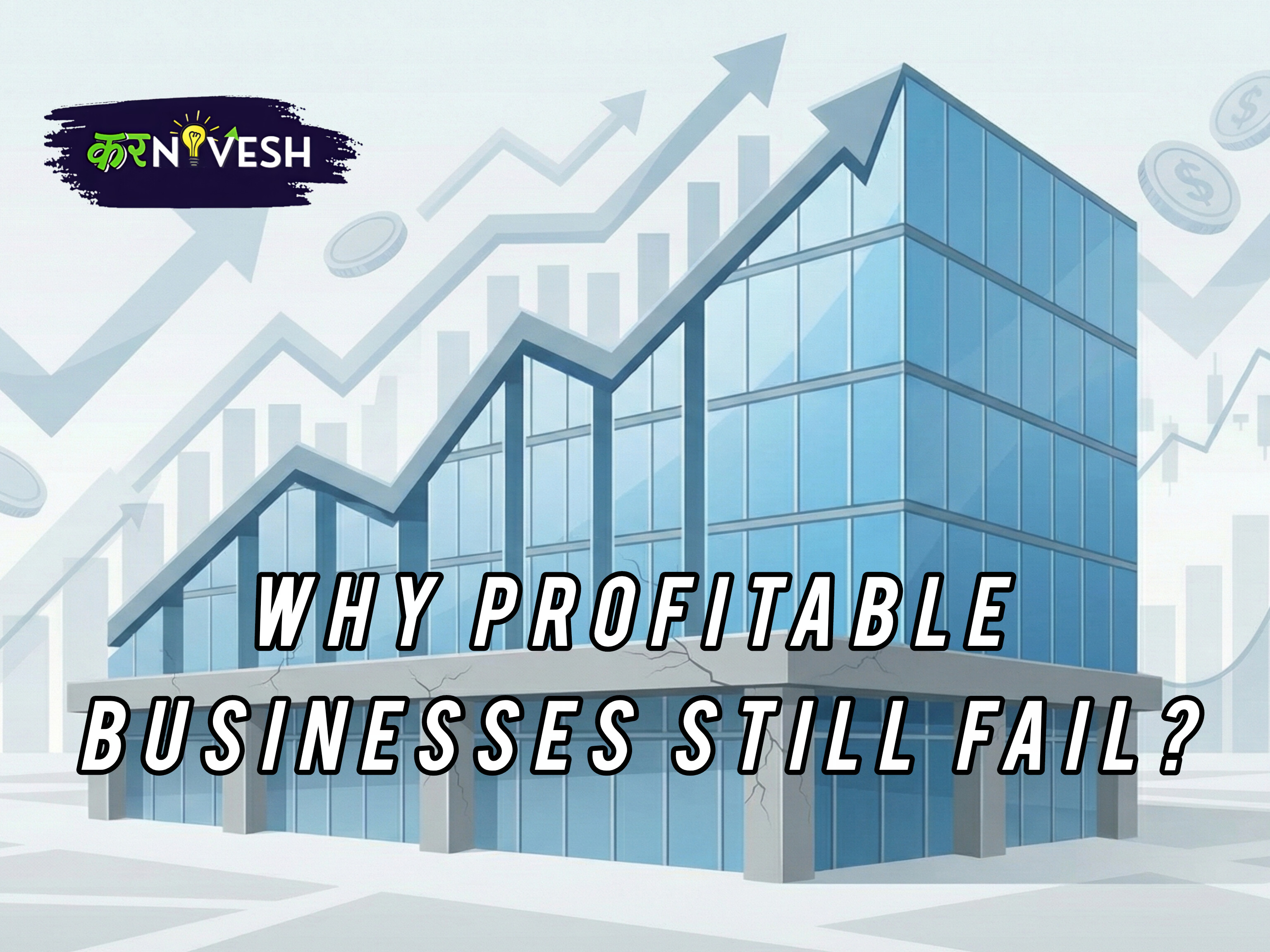

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper i

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)