Back

Account Deleted

Hey I am on Medial • 9m

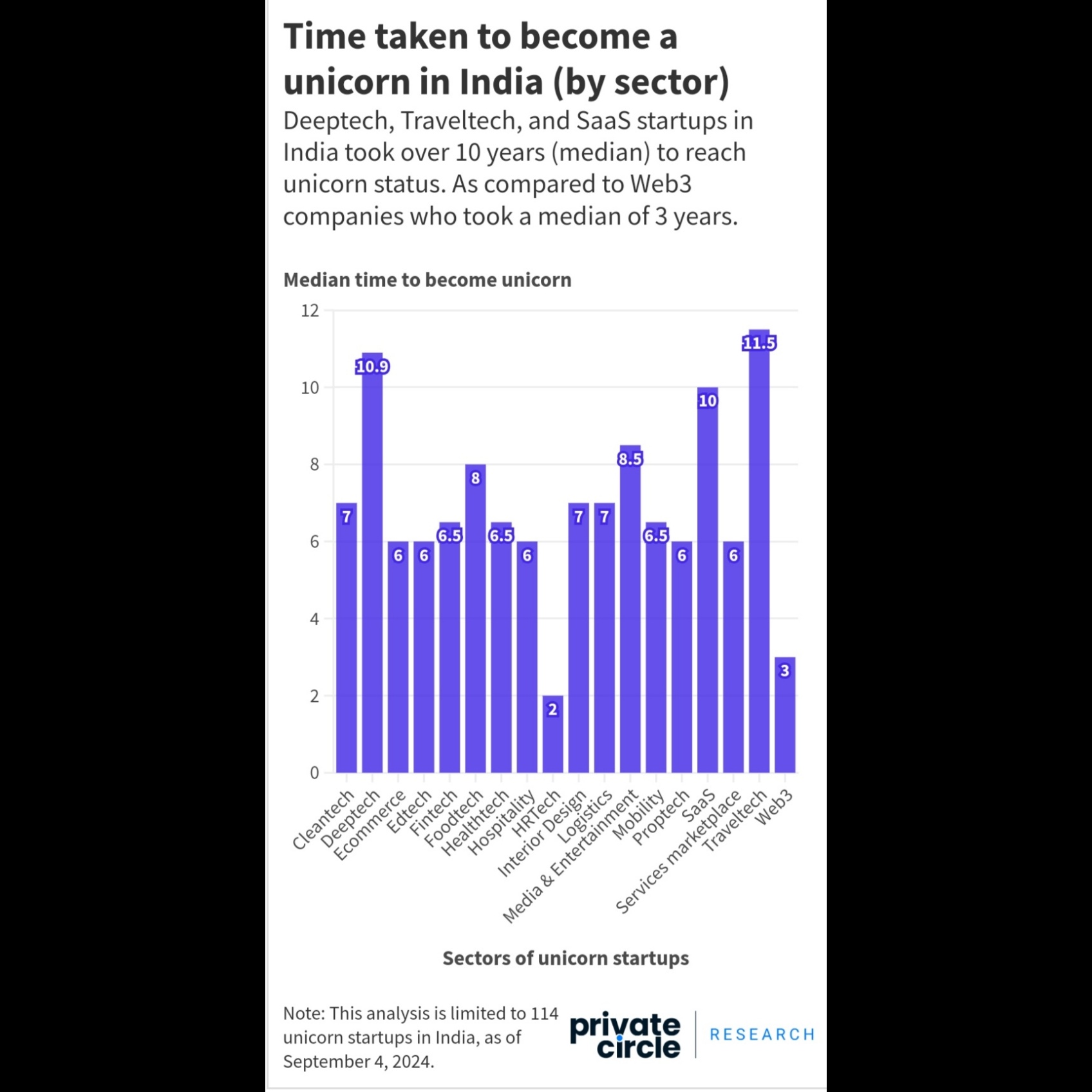

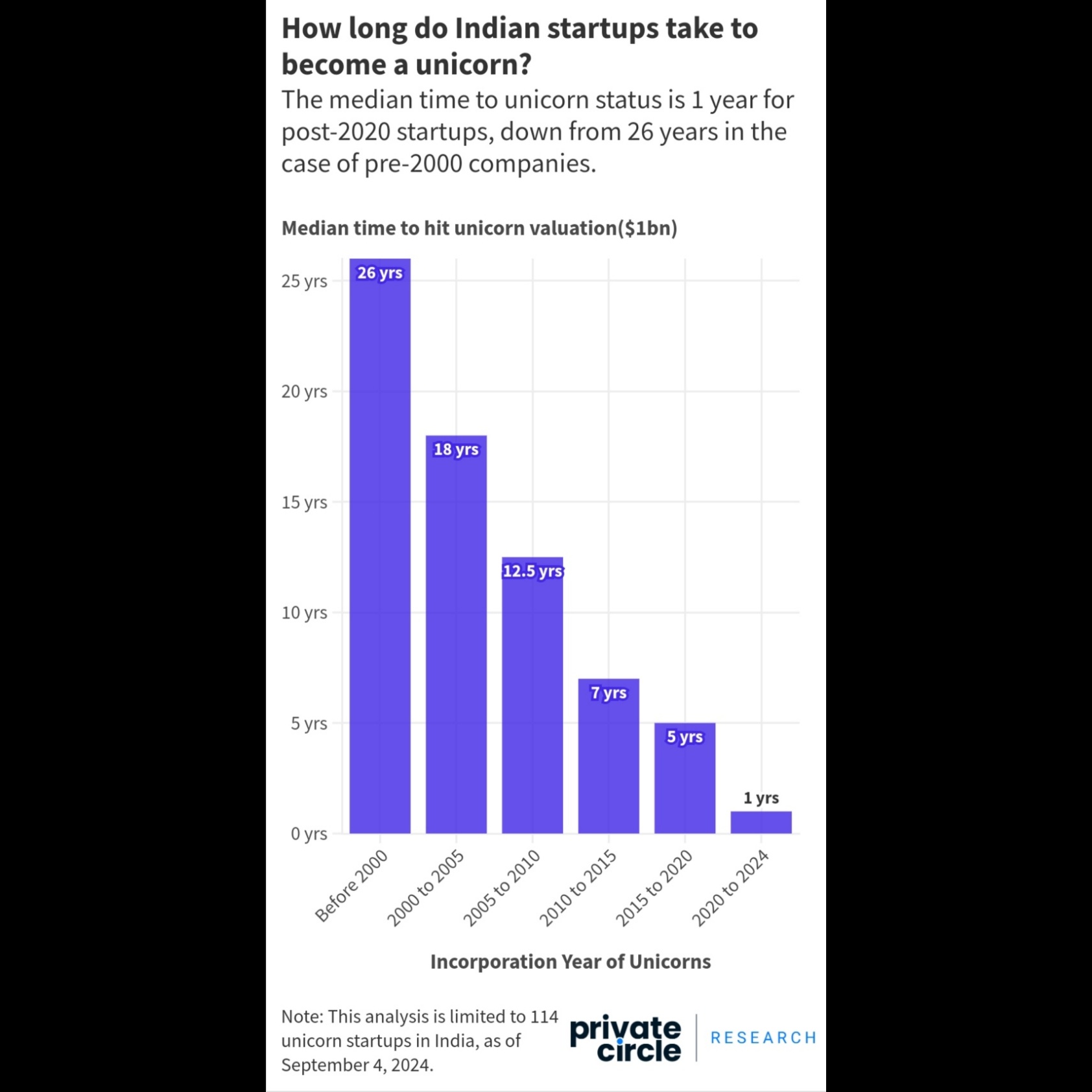

Median time to profitability for Indian startups: 5–7 years VCs chase growth, but sustainability takes patience.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

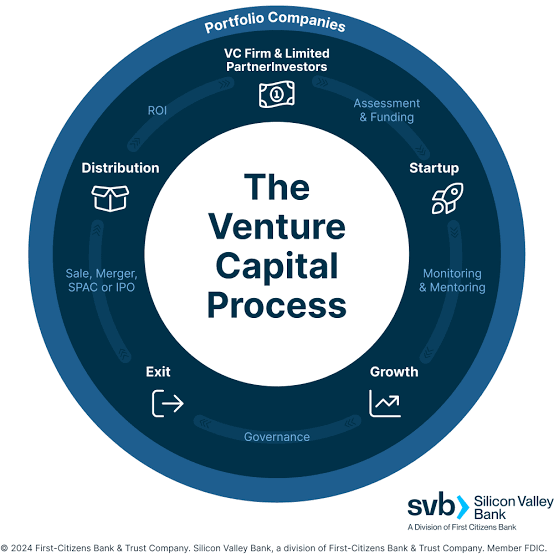

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Vatan Pandey

Founder & CEO @Zyber... • 10m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Anonymous

Hey I am on Medial • 1y

Unpopular Opinion: Mega Tech Platform cannot scale with regular Indian VC. What do you think about VCs and their recent chase for profitability? Especially, for companies like Koo, Sharechat. I mean, we know and we've seen in the history of start-up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)