Back

Vivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new deals. * Valuation Corrections: "Growth at all costs" is out. VCs demand profitability, leading to more realistic valuations. * LP Pressure: Limited Partners want returns, making new fundraise tougher for VCs. * Macro Volatility: Global instability, inflation, and interest rates create unpredictability, increasing risk aversion. Impact on Startups: * Flight to Quality: VCs are highly selective, favoring startups with proven traction & robust models. * Longer Funding Cycles: Fundraising takes more time; founders need greater resilience. * Focus on Fundamentals: Startups must demonstrate profitability & efficient burn rates much earlier. * "Show Me the Money": Pitches need tangible results, not just potential.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

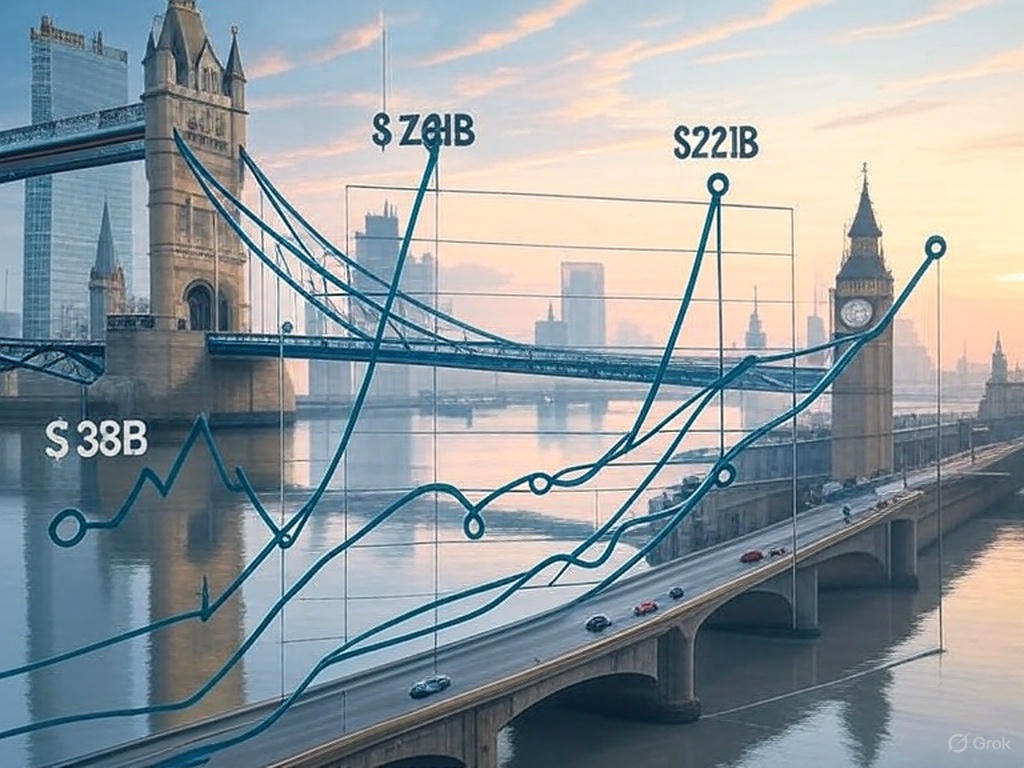

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Adithya Pappala

250Tn Global Impact Ventures • 3m

Insaneeeee! 99% of Indian-founders think VCs are cash-rich In reality, It's not. For those who aren't well aware about- Startups raise from VC VC raises from L.P'S & L.P's do the business 🔁Repeat VCs are not cash-rich. I had a line that struck

See MoreNimesh Pinnamaneni

•

Helixworks Technologies • 11m

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VC

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

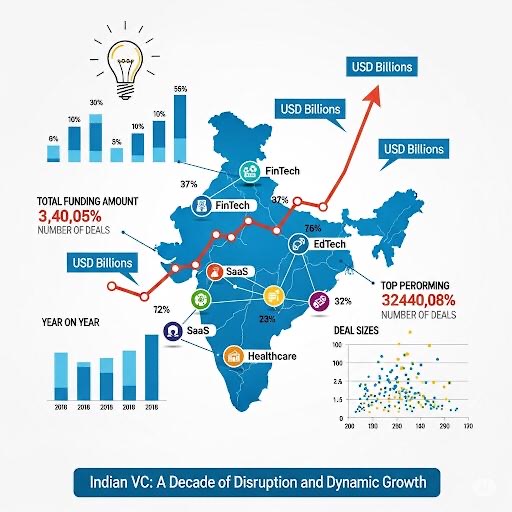

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)