Back

Vivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration of startup valuations. Inflation raises startup operational costs, eating into margins, especially for early-stage companies. It also erodes LPs' returns, increasing scrutiny on fund performance. Higher inflation often leads to valuation compression as discount rates rise. Elevated interest rates make debt financing pricier for startups. This also makes safer assets like bonds more appealing to LPs, diverting capital from riskier venture investments. This leads to reduced investor risk appetite. The valuation reset means many startups face "down" or "flat" rounds, impacting VC portfolio performance. Investors now demand stronger unit economics and clear paths to profitability, shifting away from hyper-growth at any cost.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Atharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreOMPRAKASH SINGH

Founder of Writo Edu... • 1y

How do some stocks suddenly rise in the stock market? Let’s find out 🤯 Market and Economic Factors 1. Demand and Supply: When the demand for a stock increases and supply decreases, its prices rise. 2. Economic Growth: If a company's business is

See MoreAtharva Deshmukh

Daily Learnings... • 1y

PESTLE Framework:- The framework analyzes external factors influencing a business. 1] Political:- Government policies, regulations, stability, tax policies, trade traffic 2] Economic:- Economic growth, inflation, exchange rates, interest rates 3]

See MoreAccount Deleted

Hey I am on Medial • 1y

Hello Everyone 🖐️, FED is now trying to cut their interest rates from 5.5% to maybe 3-4% . Now , Inflation is in control so that they will cut fed rates till June . Due to this , companies don't have high interest on loans so that I think recession

See More

Neophile Nexus

Trying new things ,.... • 7m

Just watched RBI Unlocked on Hotstar. Shaktikanta Das said – "Chakravyuh mein ghusna aasan hota hai, par nikalna mushkil." He was talking about inflation & interest rates... But bro, that hit different. Felt like he’s talking about corporate life 💀

Sairaj Kadam

Student & Financial ... • 1y

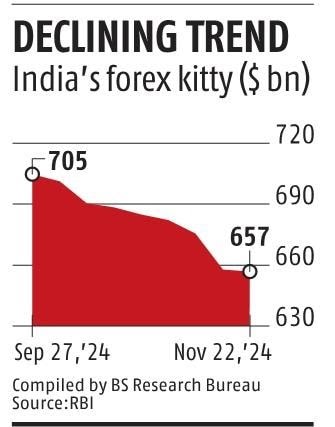

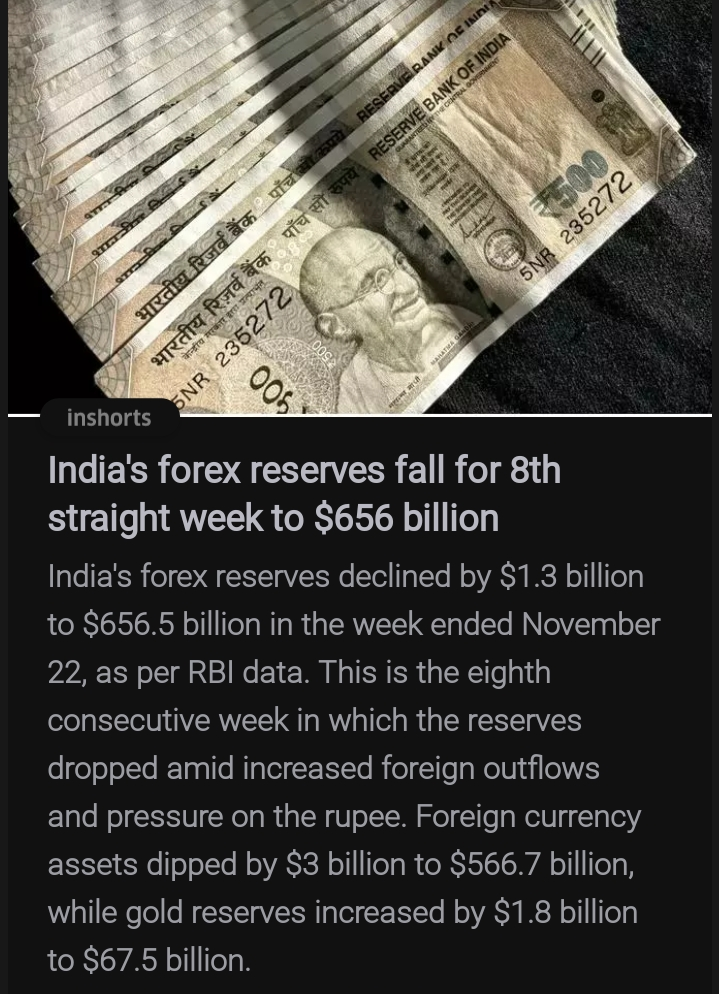

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gol

See More

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreRootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)