Back

Atharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the interest rates, the RBI has to strike a balance between growth and inflation. In a nutshell – if the interest rates are high, the borrowing rates are high (particularly for corporations). If corporate can’t borrow easily, they cannot grow. If corporations don’t grow, the economy slows down. On the other hand, borrowing becomes easier when the interest rates are low. This translates to more money in the hands of corporations and consumers. With more money, there is increased spending which means the sellers tend to increase the prices of goods and services, leading to inflation.

Replies (1)

More like this

Recommendations from Medial

Atharva Deshmukh

Daily Learnings... • 1y

About Rates in the market... To strike a balance in market, the RBI has to consider all economic factors and carefully set the key rates. Any imbalance in these rates can lead to economic chaos: 1)Repo Rate:-The rate at which RBI lends money to oth

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Brief History of RBI The Reserve Bank of India (RBI) was established on April 1, 1935, based on the Hilton Young Commission's recommendations and the Reserve Bank of India Act, 1934. Initially, the RBI took over the functions of the Controller of

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreTushar Aher Patil

Trying to do better • 9m

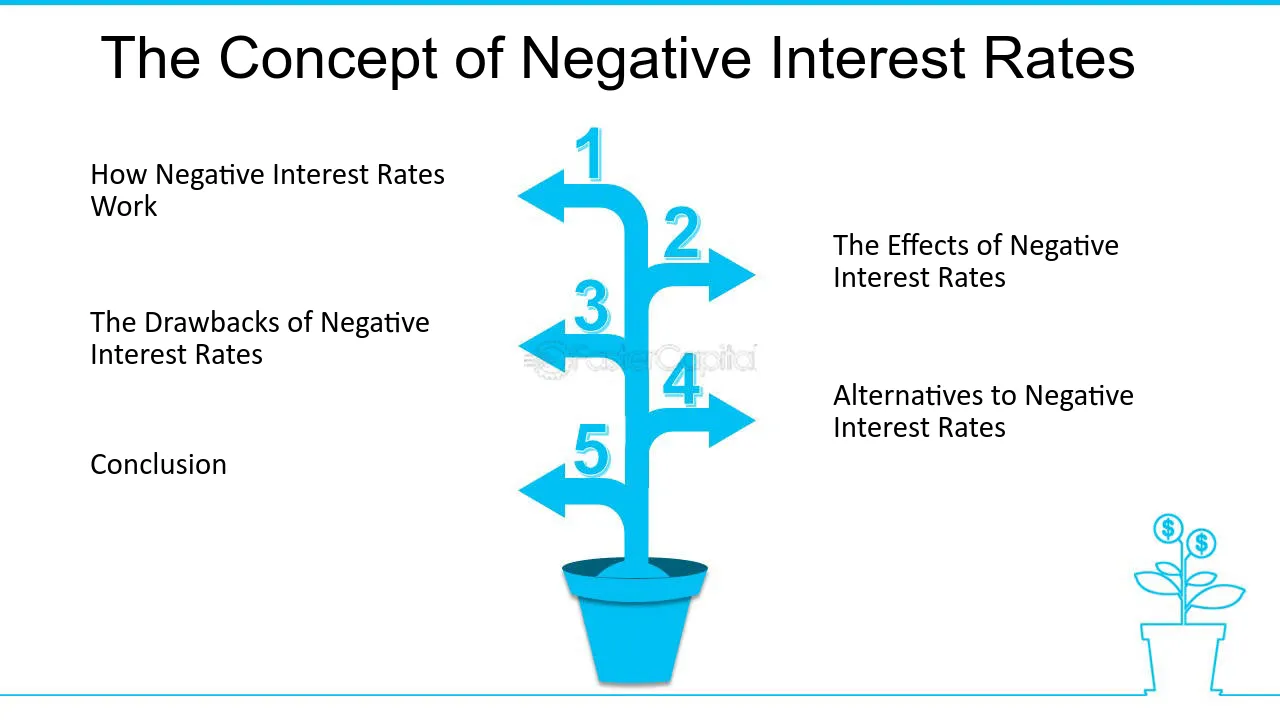

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

financialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreNeophile Nexus

Trying new things ,.... • 7m

Just watched RBI Unlocked on Hotstar. Shaktikanta Das said – "Chakravyuh mein ghusna aasan hota hai, par nikalna mushkil." He was talking about inflation & interest rates... But bro, that hit different. Felt like he’s talking about corporate life 💀

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)