Back

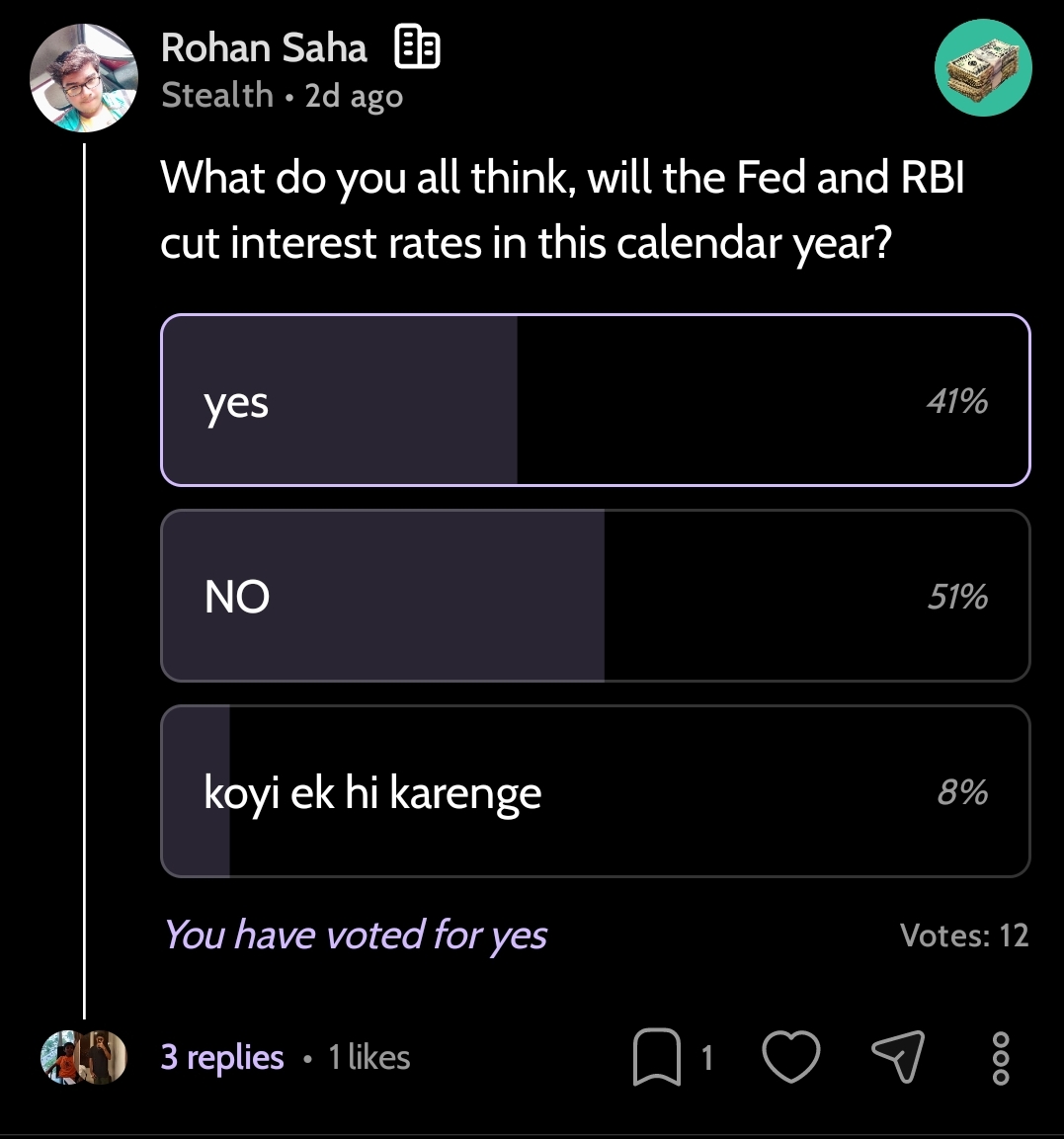

Rohan Saha

Founder - Burn Inves... • 1y

What do you all think, will the Fed and RBI cut interest rates in this calendar year?

Replies (3)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Hello Everyone 🖐️, FED is now trying to cut their interest rates from 5.5% to maybe 3-4% . Now , Inflation is in control so that they will cut fed rates till June . Due to this , companies don't have high interest on loans so that I think recession

See More

Account Deleted

Hey I am on Medial • 2y

Hello Guys, What do you think, the main reason behind the recession is going on around the world and what are the reasons behind startups can't able to raise funds or decline in funding? 1.FED Interest Rates 2.Over Hiring In Covid Time 3.Russia - Uk

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)