Back

Account Deleted

Hey I am on Medial • 1y

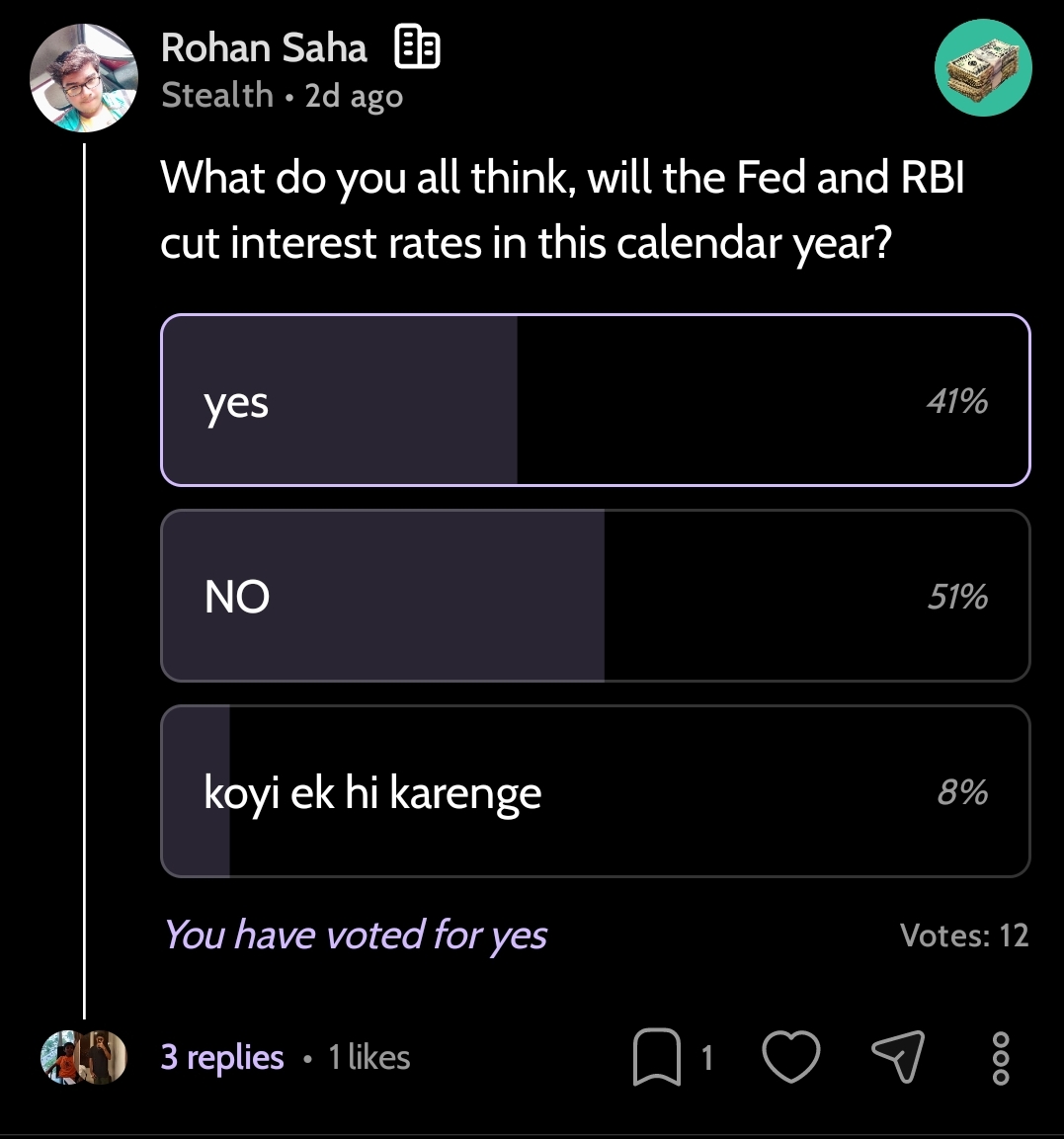

Hello Everyone 🖐️, FED is now trying to cut their interest rates from 5.5% to maybe 3-4% . Now , Inflation is in control so that they will cut fed rates till June . Due to this , companies don't have high interest on loans so that I think recession is no longer will exist. What do you think, let's Discuss with this today 🤔💬🤑

Replies (1)

More like this

Recommendations from Medial

RootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See MoreAccount Deleted

Hey I am on Medial • 2y

Hello Guys, What do you think, the main reason behind the recession is going on around the world and what are the reasons behind startups can't able to raise funds or decline in funding? 1.FED Interest Rates 2.Over Hiring In Covid Time 3.Russia - Uk

See MoreTushar Aher Patil

Trying to do better • 5m

SUMMARY OF FED CHAIR POWELL'S SPEECH (9/17/25): 1. Unemployment rate has risen along with downside risks to employment 2. Inflation has risen and remains "somewhat elevated" 3. Growth in economic activity has "moderated" 4. Job creation rate is "bel

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See Morefinancialnews

Founder And CEO Of F... • 11m

The Federal Reserve's 2025 Meeting Schedule and Interest Rate Outlook The Federal Open Market Committee (FOMC) has seven remaining meetings in 2025, with the next one scheduled for March 19. Current market expectations suggest that the Federal Res

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)