Back

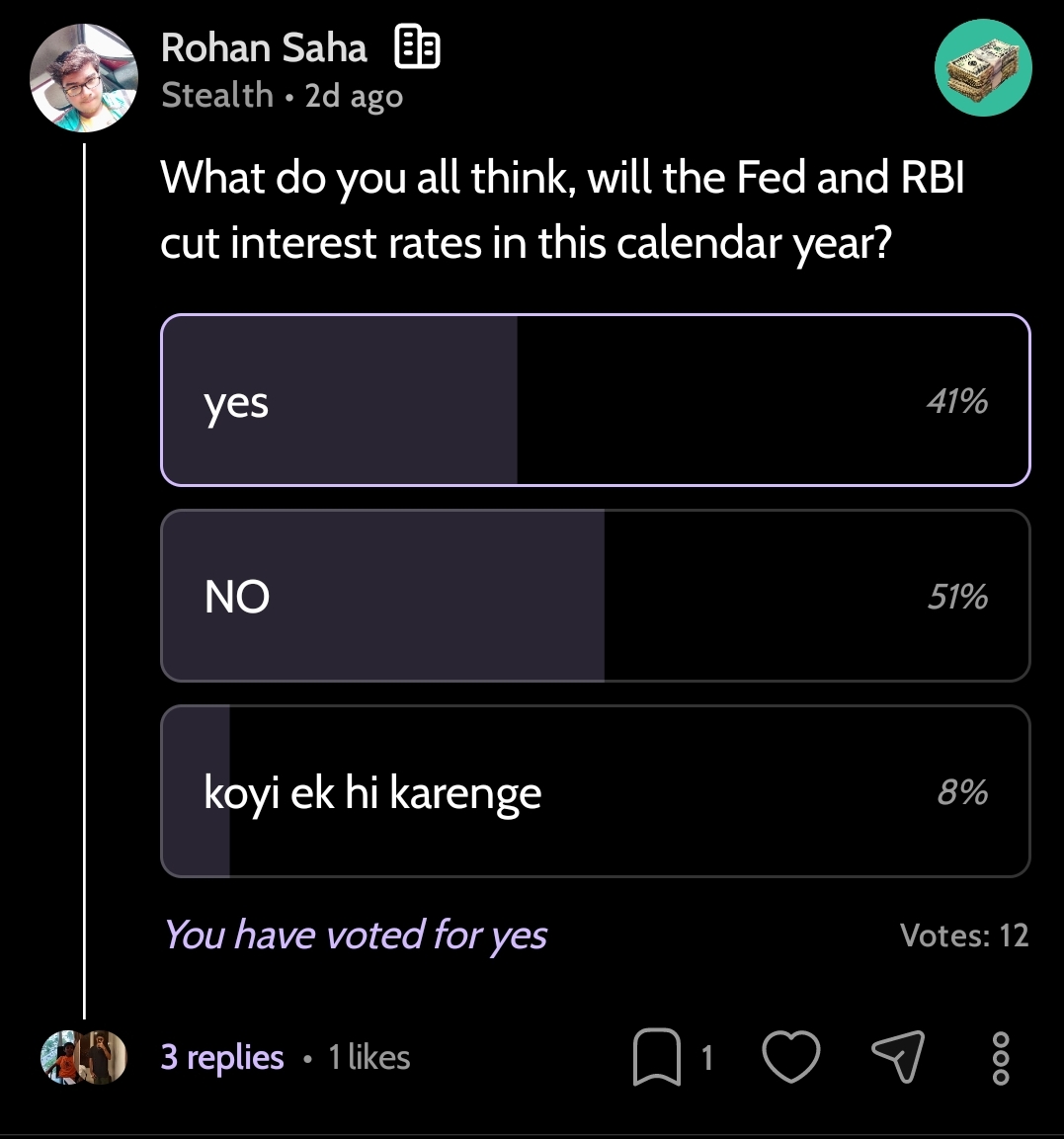

Rohan Saha

Founder - Burn Inves... • 8m

Everyone was expecting the rate cut to stop at 5.75%, but the RBI went a step further and brought it down to 5.5% People on floating interest rates are definitely celebrating now. Plus, the extra push on liquidity this time is a really positive move.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

Tomorrow, the RBI's interest rate decision is scheduled. Some believe the rate could be cut to as low as 5.75%. But that's not the main issue right now the key question is what decision the RBI takes regarding liquidity. Today, the market is performi

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAccount Deleted

Hey I am on Medial • 1y

Hello Everyone 🖐️, FED is now trying to cut their interest rates from 5.5% to maybe 3-4% . Now , Inflation is in control so that they will cut fed rates till June . Due to this , companies don't have high interest on loans so that I think recession

See More

Poosarla Sai Karthik

Tech guy with a busi... • 3m

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreRohan Saha

Founder - Burn Inves... • 1y

The RBI has made a 25 basis points rate cut. However, there is still some tension in the market regarding what the RBI will do about banking liquidity and how it will manage future inflation. Due to these concerns, the market is somewhat sideways and

See MoreTushar Aher Patil

Trying to do better • 8m

📢 **RBI MPC Delivers "Hat-trick" Rate Cut; Shifts Stance to 'Neutral'** The Reserve Bank of India (RBI) today announced its bi-monthly monetary policy outcome, with significant decisions impacting the Indian economy. **Key Announcements & Insights

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)