Back

Rohan Saha

Founder - Burn Inves... • 1y

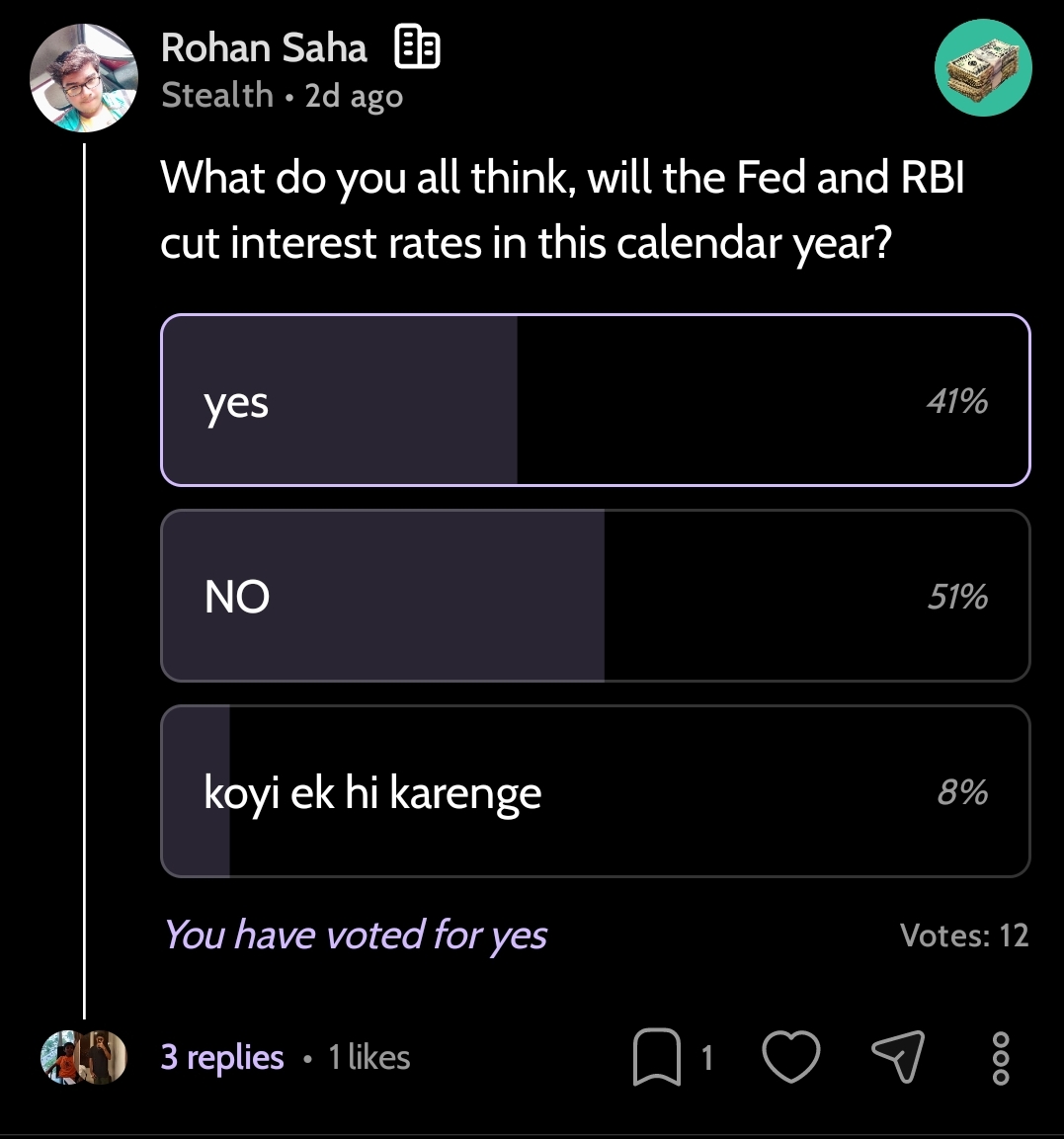

i think the RBI might cut its rates next season because companies earnings this season have been very poor. It’s the lowest in the last four years, and this is currently one of the biggest concerns for the Indian market.

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

The RBI has made a 25 basis points rate cut. However, there is still some tension in the market regarding what the RBI will do about banking liquidity and how it will manage future inflation. Due to these concerns, the market is somewhat sideways and

See MoreRohan Saha

Founder - Burn Inves... • 5m

investors and traders are currently very upbeat about the possibility of a GST cut which is why concerns around tariffs have started to ease however if the GST cut falls short of expectations for any reason the market could face a minor correction of

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreRohan Saha

Founder - Burn Inves... • 5m

The Indian market is still going through a correction phase with all the tariff news around i feel this might last for a few more days after which the market could just move sideways until the next earnings season there are hopes that Indian companie

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)