Back

Poosarla Sai Karthik

Tech guy with a busi... • 2m

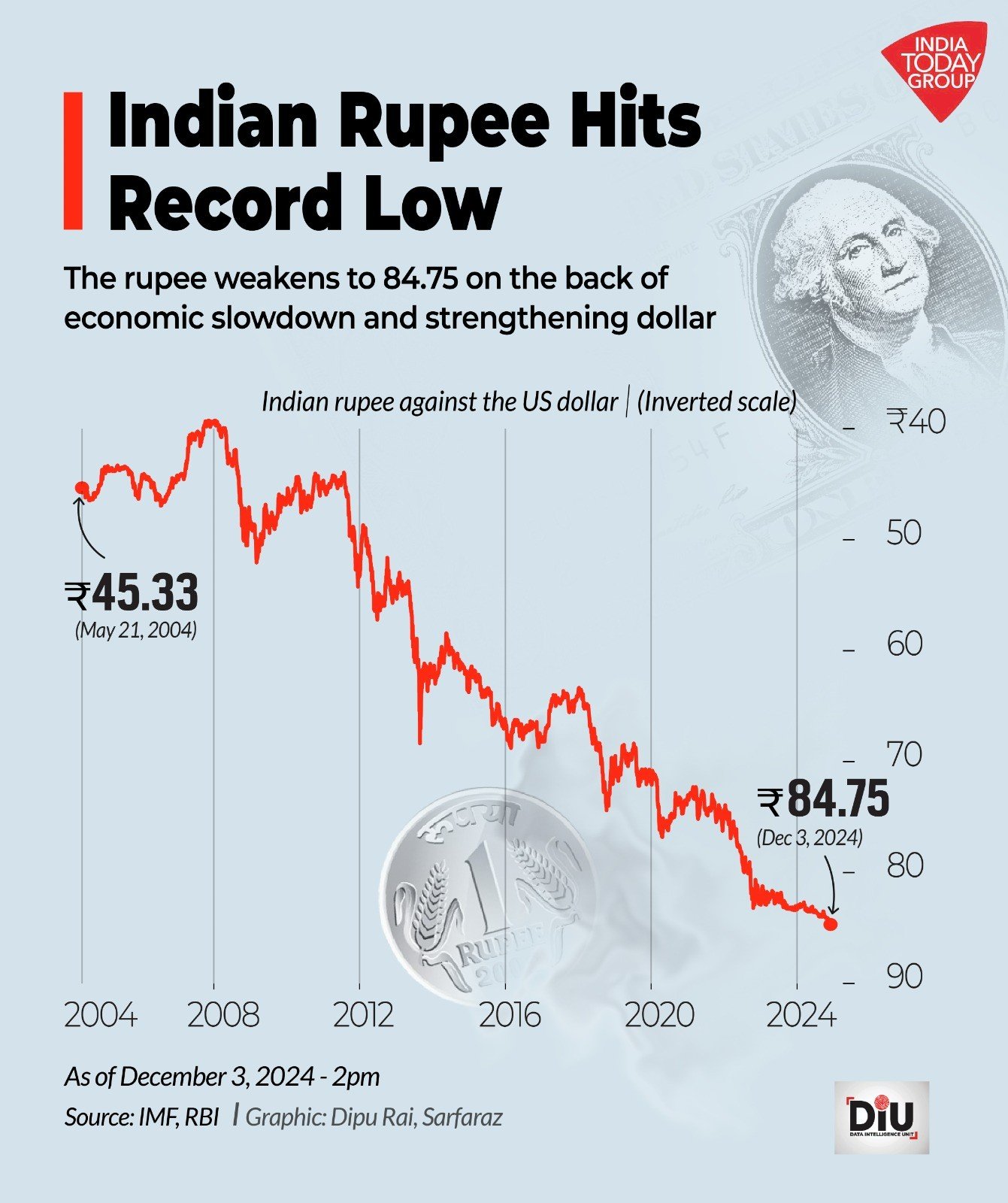

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banking: Upside • EMIs on home, auto, and business loans can soften • Banks get more room to push credit into the economy Downside • FD and savings rates may slip • Bank margins can get squeezed Consumers and Businesses: Upside • Spending picks up, helping real estate, autos, and retail • MSMEs get cheaper capital to expand Downside • Conservative investors earn less and often move toward riskier assets • A softer rupee can make imports pricier, nudging inflation back up Markets and Currency: Upside • Equities usually like lower rates, especially banks and consumption plays • Liquidity lifts growth sentiment Downside • Rupee volatility can rise • Too much easy money risks bubbles A rate cut sounds technical, but it shapes everything from how much we pay on loans to how businesses invest. That’s why every MPC signal matters.

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreRohan Saha

Founder - Burn Inves... • 8m

While central banks across the globe are still holding back on cutting rates the RBI is in a position where it could go ahead and make another rate cut if it really wanted to. I won’t dive into all the technical details but honestly India is in a fan

See More

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)