Back

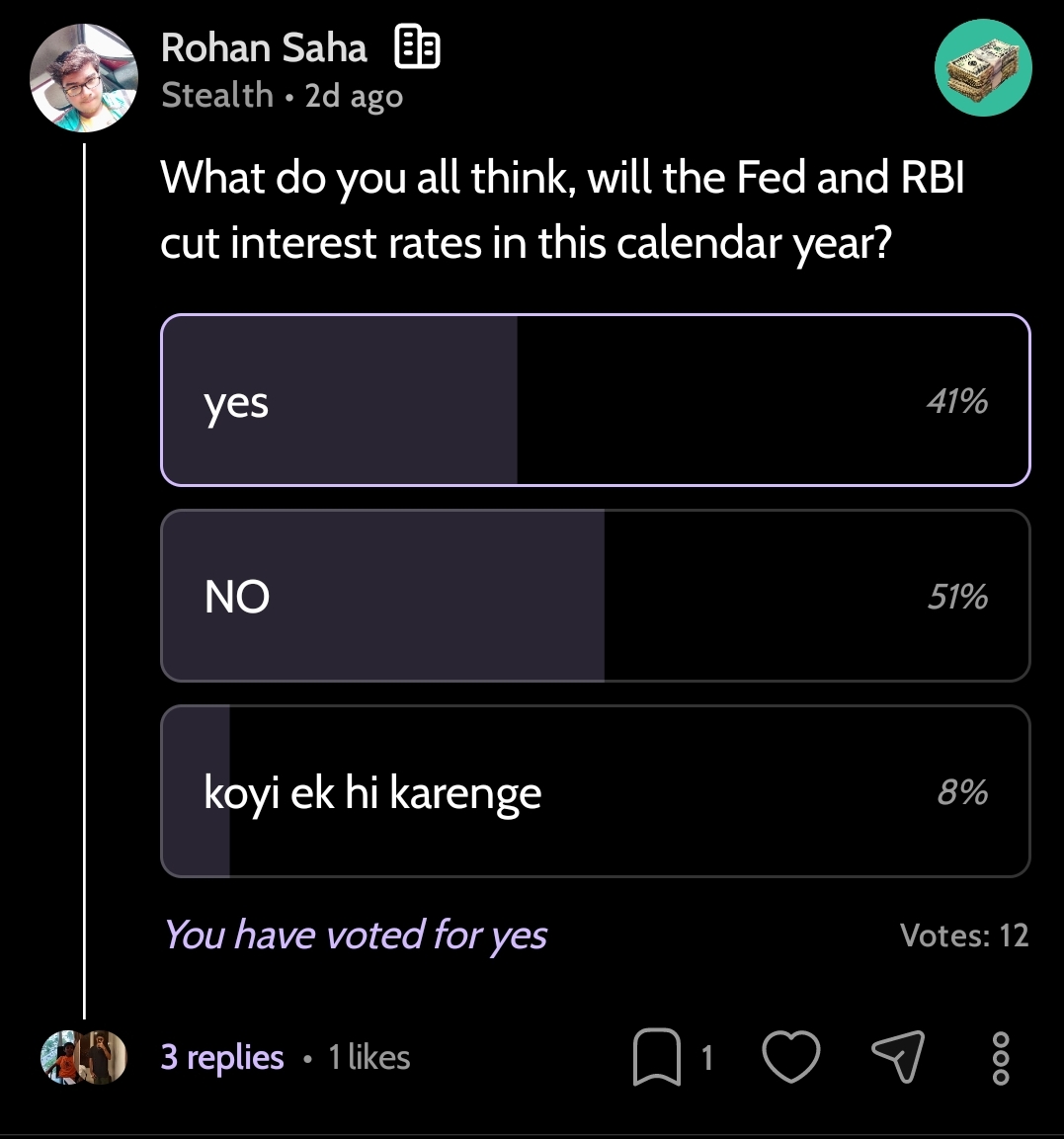

Rohan Saha

Founder - Burn Inves... • 8m

While central banks across the globe are still holding back on cutting rates the RBI is in a position where it could go ahead and make another rate cut if it really wanted to. I won’t dive into all the technical details but honestly India is in a fantastic sweet spot right now.

Replies (3)

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreTushar Aher Patil

Trying to do better • 9m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Poosarla Sai Karthik

Tech guy with a busi... • 3m

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreRohan Saha

Founder - Burn Inves... • 1y

The RBI has made a 25 basis points rate cut. However, there is still some tension in the market regarding what the RBI will do about banking liquidity and how it will manage future inflation. Due to these concerns, the market is somewhat sideways and

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreAtharva Deshmukh

Daily Learnings... • 1y

About Rates in the market... To strike a balance in market, the RBI has to consider all economic factors and carefully set the key rates. Any imbalance in these rates can lead to economic chaos: 1)Repo Rate:-The rate at which RBI lends money to oth

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)