Back

Tushar Aher Patil

Trying to do better • 9m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is it? Instead of the central bank paying commercial banks for holding reserves, banks are charged a fee to deposit excess reserves at the central bank. The idea? To make holding onto cash costly and encourage banks to lend it out. ➡️ Why use it? NIRP is primarily used to stimulate economic growth, especially in times of low inflation or deflation. By making it more attractive for banks to lend, it can lead to lower borrowing costs for businesses and individuals, hopefully increasing investment and spending. It can also help fight deflation by encouraging economic activity. 📉 How it works: 1. The central bank sets its key interest rate below zero. 2. Banks face a cost for reserves held at the central bank. 3. This cost incentivises banks to lend money out instead of holding reserves. 4. Increased lending can lead to increased investment and spending, boosting the economy. 🌍 Where has it been used? NIRP isn't entirely new. Switzerland used it during a currency crisis in the 1970s. More recently, the European Central Bank introduced negative rates in 2014, followed by the Bank of Japan in 2016. Both continue to use negative rates today. 🤔 Potential Considerations: While aiming to stimulate growth and fight deflation, negative rates can also influence a nation's currency, sometimes leading to depreciation. Some also argue that NIRP could create financial instability by distorting investment and savings behaviour. NIRP remains a fascinating and debated tool in the central bank toolkit! #MonetaryPolicy #CentralBanking #Economics #Finance #NIRP #EconomicGrowth #Inflation #Deflation

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

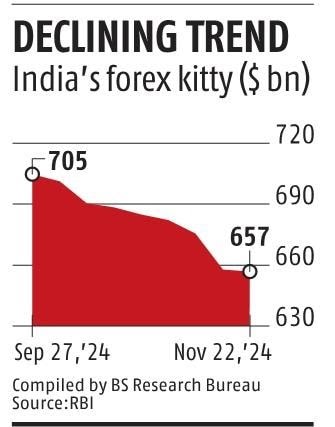

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gol

See More

Rohan Saha

Founder - Burn Inves... • 8m

While central banks across the globe are still holding back on cutting rates the RBI is in a position where it could go ahead and make another rate cut if it really wanted to. I won’t dive into all the technical details but honestly India is in a fan

See More

Atharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreMohit Singh

Hey I am on Medial • 1y

We will borrow money from our relatives, around 50,000. Since they are our relatives, they will lend us the money without any interest. Then, we will lend this money further to someone else at interest. The interest we earn will be our profit, and we

See MoreSARASHI ASSOCIATION

Hey I am on Medial • 1y

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)