Back

Sairaj Kadam

Student & Financial ... • 1y

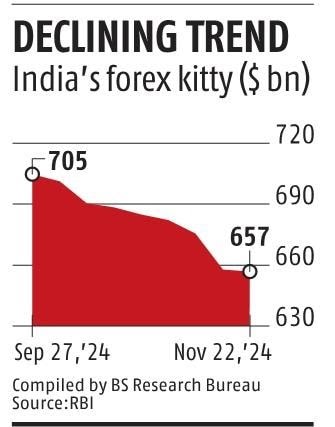

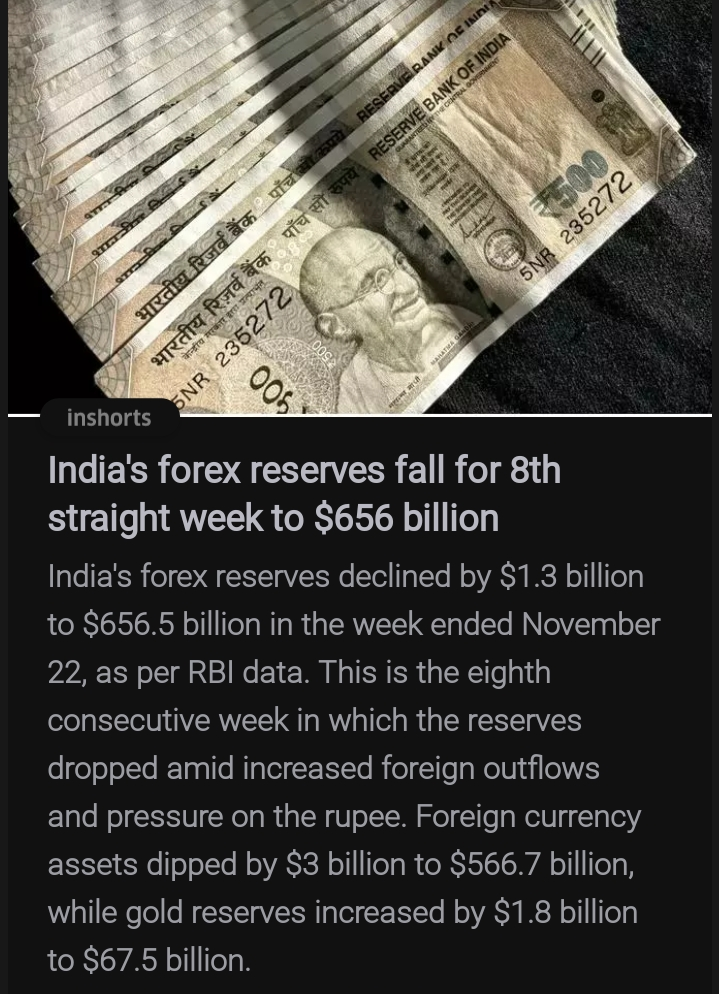

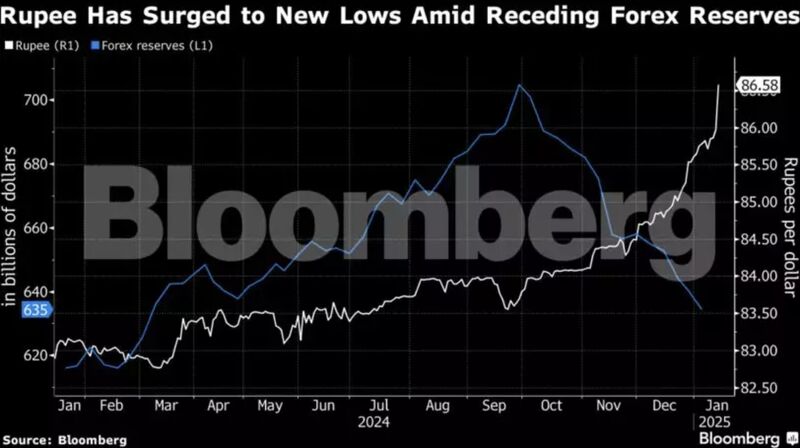

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gold, and IMF assets, held by the central bank. These reserves act as a buffer, ensuring a country can pay for imports, stabilize its currency, and handle emergencies like economic crises or sudden outflows of foreign investment. But What Do Forex Reserves Actually Do? Forex reserves: 1. Stabilize the Currency: They are used to prevent sharp fluctuations in the value of the local currency. 2. Pay for Imports: Especially crucial for importing essential goods like oil, food, or machinery. 3. Build Investor Confidence: A higher reserve indicates a stable economy, attracting foreign investors. 4. Support Economic Policies: Governments can use them to manage trade imbalances and repay international debts. What Is the Impact of Declining Forex Reserves on Us? Weaker Rupee: The central bank has less power to stabilize the rupee, leading to higher exchange rates. Higher Inflation: Imported goods become more expensive, pushing up prices of everyday items. Costlier Loans: Central banks may raise interest rates to manage inflation, increasing loan EMIs and borrowing costs. Economic Stress: A fall in reserves signals reduced economic strength, potentially reducing foreign investments. This decline impacts not just the macroeconomy but also our daily lives by increasing costs and influencing financial decisions. Feel free to add your perspective!

Replies (7)

More like this

Recommendations from Medial

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

RBI Increases Gold Purchases The Reserve Bank of India has significantly increased its gold purchases, buying 50 tonnes so far in FY25. This move aims to diversify its foreign exchange reserves and mitigate revaluation risks, as part of efforts to m

See Morefinancialnews

Founder And CEO Of F... • 11m

RBI’s Record $77.5 Billion Short Positions: Impact on Rupee Liquidity and Forex Reserves The Reserve Bank of India (RBI) currently holds a record $77.5 billion in net short dollar positions, which could influence rupee liquidity and foreign exchange

See MoreRajan Paswan

Building for idea gu... • 1y

Bad News: Rupee falls to record low 83.60/$ Here are negative impacts of falling Rupee: 1) Increased Costs for Imports: Many Indian businesses rely on imported goods and raw materials. A weaker rupee means they will have to pay more for these impor

See MoreTushar Aher Patil

Trying to do better • 9m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

’m a bit surprised by how everyone’s in a tizzy over Indian Rupee's slide against the Dollar, and how Govt and RBI are being bashed over it. It makes it amply clear that much of people don’t understand how & why currency markets move 🙏🙏 And, the

See More

Sukhveer Singh

Contact number 62831... • 5m

The Forex Market: The World’s Largest Financial Market The foreign exchange (forex) market is the global marketplace for buying and selling currencies. With a daily turnover exceeding $7 trillion, it is the largest and most liquid market in the worl

See More

Atharva Deshmukh

Daily Learnings... • 1y

Brief History of RBI The Reserve Bank of India (RBI) was established on April 1, 1935, based on the Hilton Young Commission's recommendations and the Reserve Bank of India Act, 1934. Initially, the RBI took over the functions of the Controller of

See Morefinancialnews

Founder And CEO Of F... • 1y

"Manmohan Singh’s Landmark 1991 Budget Speech: The Dawn of a New India" Manmohan Singh’s Historic 1991 Budget Speech: A Turning Point in India’s Economic Journey On July 24, 1991, then Finance Minister Dr. Manmohan Singh delivered a landmark budget

See MoreDr Sarun George Sunny

The Way I See It • 3m

📌Rupee is Asia's worst performing currency' Asia’s worst‑performing currency” is not a headline any country wants but that is where the rupee finds itself in 2025. With a 4.3% depreciation versus the dollar, record trade deficits fuelled by US tar

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)