Back

Rajan Paswan

Building for idea gu... • 1y

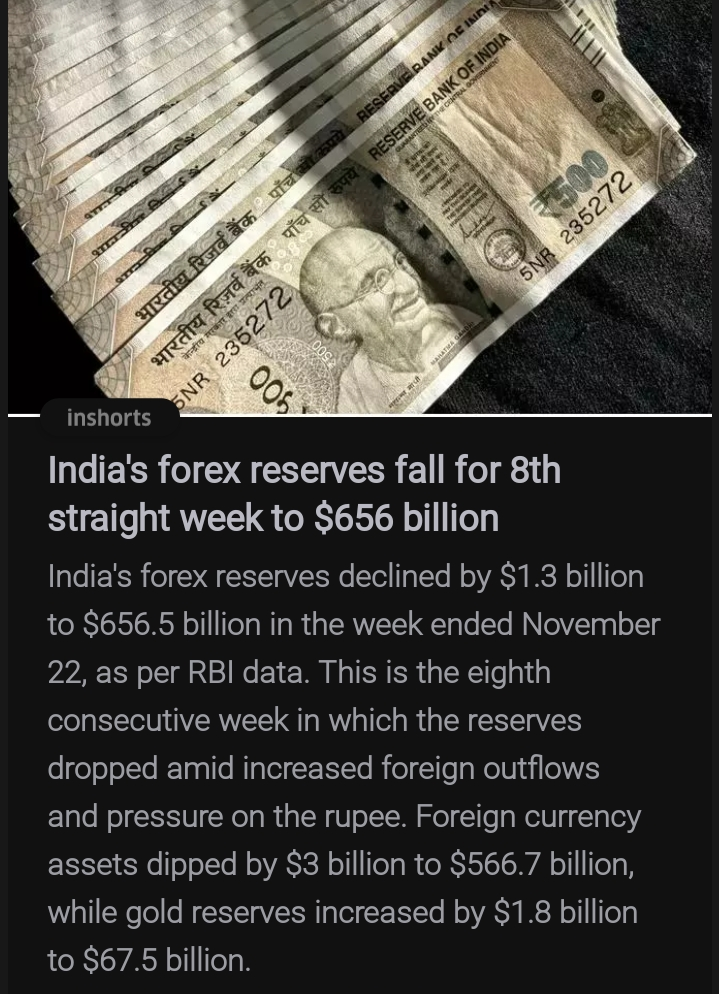

Bad News: Rupee falls to record low 83.60/$ Here are negative impacts of falling Rupee: 1) Increased Costs for Imports: Many Indian businesses rely on imported goods and raw materials. A weaker rupee means they will have to pay more for these imports, which can increase operational costs and reduce profit margins. 2) Higher Inflation: The increased cost of imports can contribute to higher inflation within the country. This can lead to higher prices for goods and services, affecting consumer purchasing power and overall economic stability. 3) Impact on Funding: Startups, in particular, often depend on foreign investments. A depreciating rupee can make Indian assets less attractive to foreign investors, potentially leading to a reduction in available funding for new and existing ventures. 4) Debt Servicing Costs: Many Indian companies have debt denominated in foreign currencies. A weaker rupee increases the cost of servicing these debts, putting additional financial strain.

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

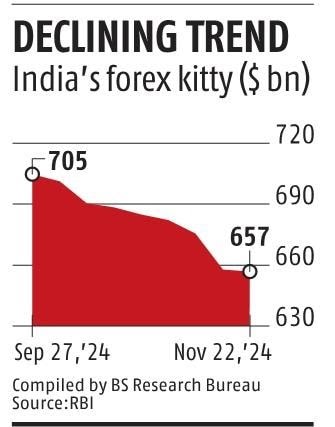

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gol

See More

Rohan Saha

Founder - Burn Inves... • 5m

Rupee Losing to Dollar – What’s Happening Lately the rupee has been slipping against the dollar and you can feel it in daily life Fuel gets pricier, overseas trips or studies cost more and even gadgets that rely on imports see a rise in price on the

See MoreOnly Buziness

Everything about Mar... • 9m

Every coin has two sides same as every war has two sides -First it’s going to win over the other country (In this case it is India ) -Second which is just paying the price for the win Certainly, the potential impacts of a conflict between India

See MoreMayank Rajput

Digital Marketing le... • 1m

🇮🇳 Why Made in India Matters — A Small Choice, A Big Impact When you buy Made in India products, you’re not just shopping — you’re investing in India. ✅ More jobs for Indians Indian companies hire Indian workers. Your money supports families, not

See MoreAyush gandewar

Just go with the flo... • 9m

Hey, so the job market's kinda shaky, right? And the gold market's not doing great either. If things keep going like this, we're looking at trouble: no jobs, fewer opportunities, foreign investors bailing, the rupee tanking, and inflation soaring.

See MoreRohan Saha

Founder - Burn Inves... • 1y

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See MoreRohan Saha

Founder - Burn Inves... • 1y

If anyone thinks that this market fall is solely because of Trump, that's not the case. The Q3 results of Indian companies aren't looking great either, and the financial sector is still struggling to manage the stress of unsecured loans. The budget i

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)