Back

Rohan Saha

Founder - Burn Inves... • 1y

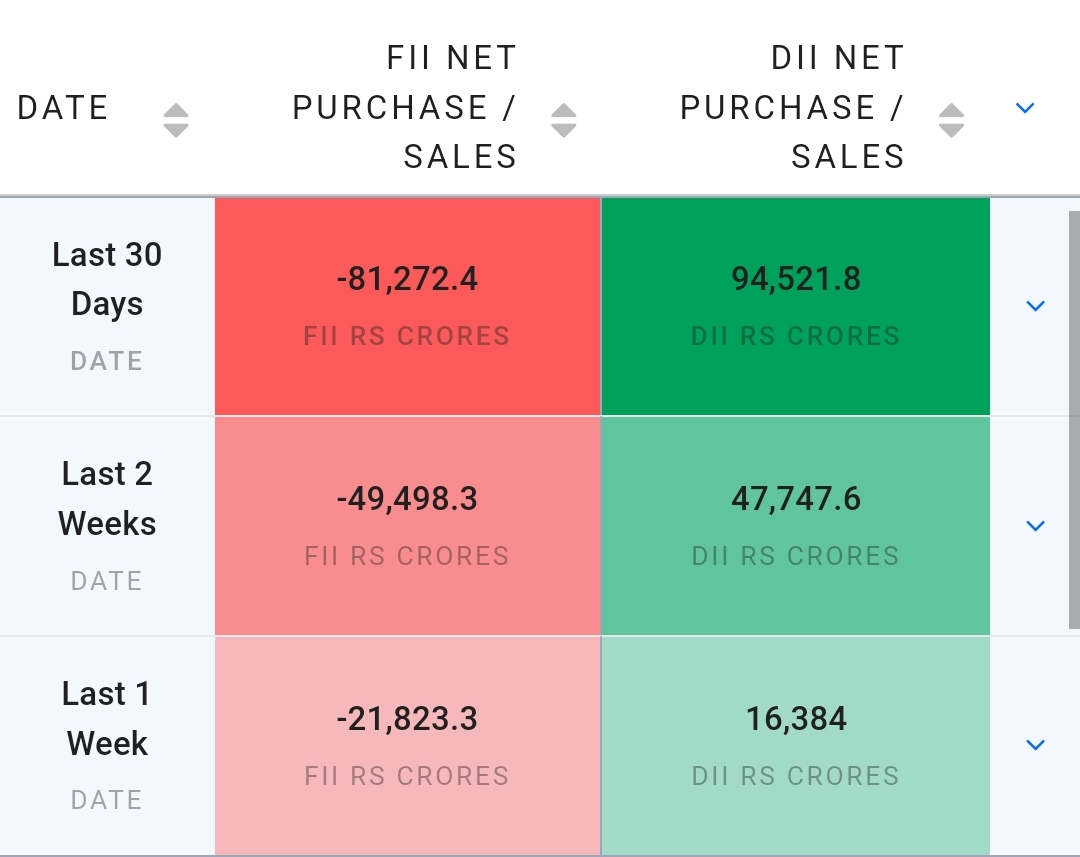

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into debt.

Replies (3)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

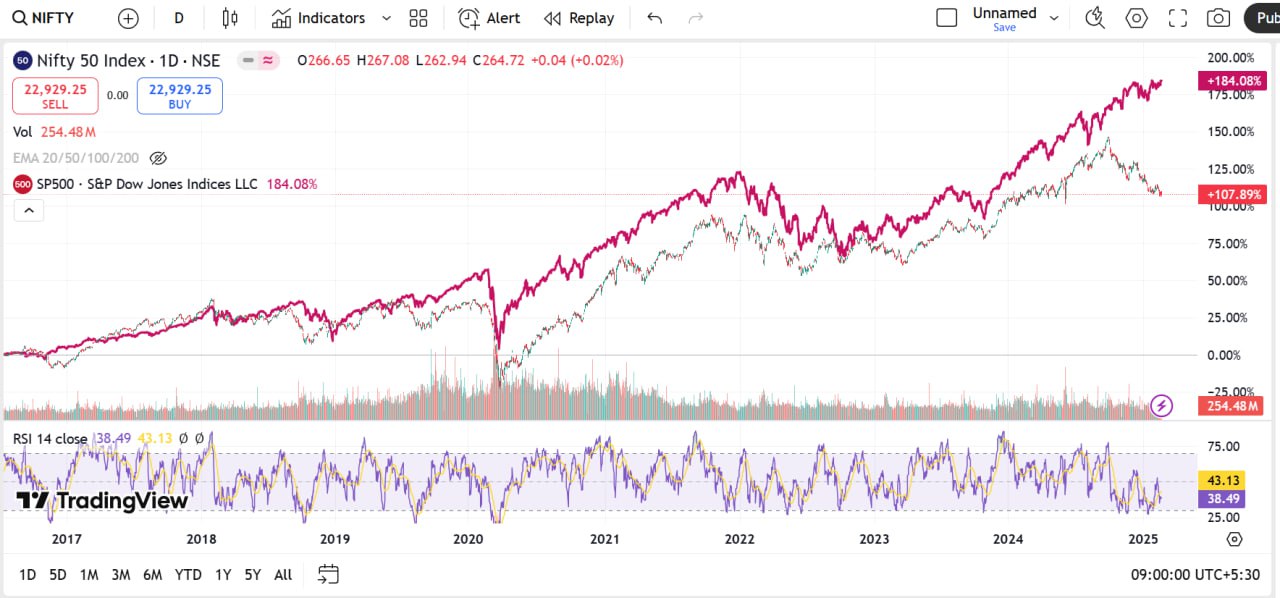

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 1y

As I mentioned earlier, Foreign Institutional Investors (FIIs) are significantly withdrawing their money from the Indian market. Many factors are working together, such as China’s economy, the US election, poor results from Indian companies, and the

See More

financialnews

Founder And CEO Of F... • 1y

"FIIs Return, Invest ₹11,100 Crore in Indian Equities Over Two Sessions" ### FIIs Reverse Selling Streak, Invest ₹11,100 Crore in Indian Equities Foreign Institutional Investors (FIIs) have made a dramatic turnaround in the Indian stock market, pur

See MoreRohan Saha

Founder - Burn Inves... • 10m

There’s nothing to worry about, really. 'Wait and watch' always works in the market. Sometimes, doing nothing can be better than doing something. So, take advantage of a cheap market, have patience, and eventually the foreign institutional investors

See MoreRohan Saha

Founder - Burn Inves... • 1y

Where are those people who used to say that FIIs (Foreign Institutional Investors) don’t affect the market? Even if they leave, what will happen? Look, they have sold shares worth ₹94,000 crore so far, and this is the situation. Just imagine if they

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)