Back

financialnews

Founder And CEO Of F... • 1y

"FIIs Return, Invest ₹11,100 Crore in Indian Equities Over Two Sessions" ### FIIs Reverse Selling Streak, Invest ₹11,100 Crore in Indian Equities Foreign Institutional Investors (FIIs) have made a dramatic turnaround in the Indian stock market, purchasing equities worth ₹11,100 crore in just two trading sessions. This comes after an extended 38-session streak of net selling, signaling a positive shift in investor sentiment. ### Key Drivers Behind the FII Buying Spree The BJP-led Mahayuti alliance's decisive victory in the Maharashtra Assembly elections has boosted market confidence. Additionally, expectations of a potential pause in US Federal Reserve rate hikes have further encouraged foreign investors to re-enter Indian equities. These factors collectively signal a favorable outlook for the Indian market. ### Breakdown of Recent FII Activity On Monday, FIIs bought stocks worth ₹9,947.55 crore, followed by an additional ₹1,157...if you want to know more click below 👇 the link

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

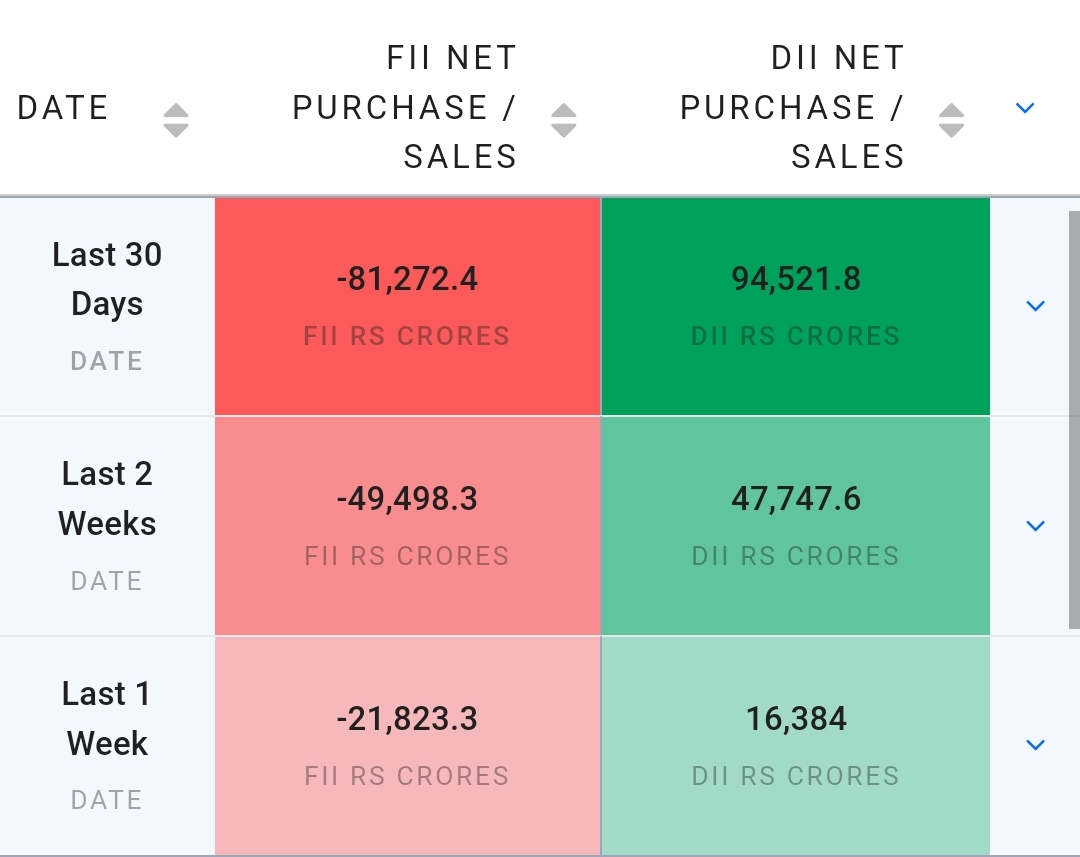

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See MoreRohan Saha

Founder - Burn Inves... • 1y

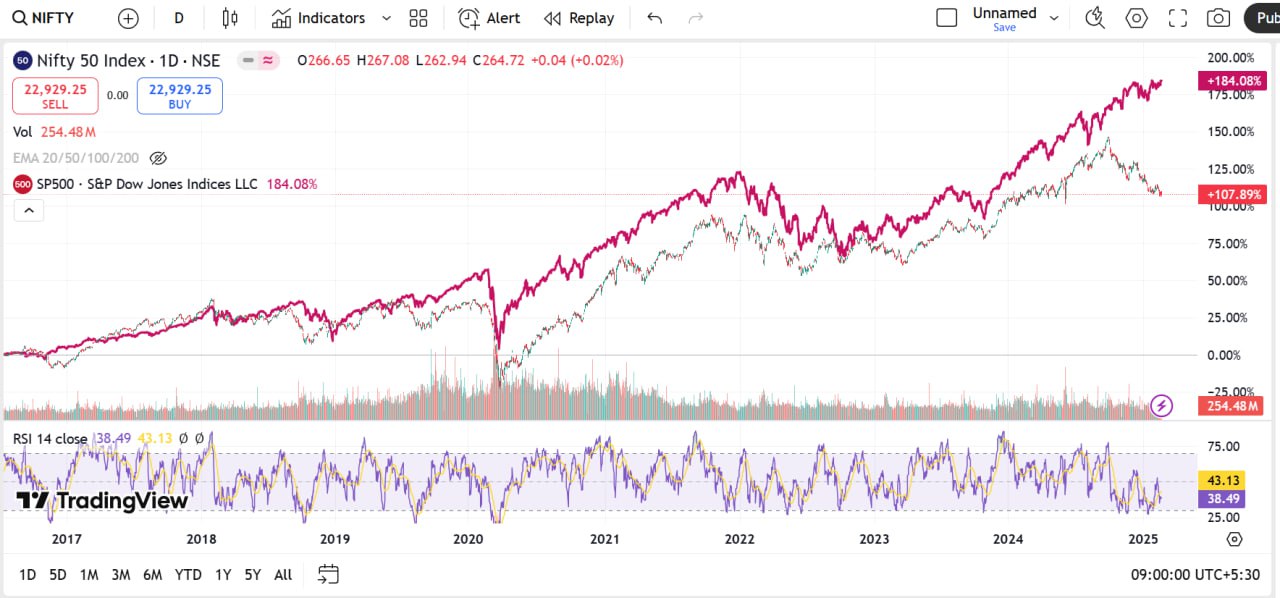

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 1y

As I mentioned earlier, Foreign Institutional Investors (FIIs) are significantly withdrawing their money from the Indian market. Many factors are working together, such as China’s economy, the US election, poor results from Indian companies, and the

See More

Rohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)