Back

mg

mysterious guy • 12m

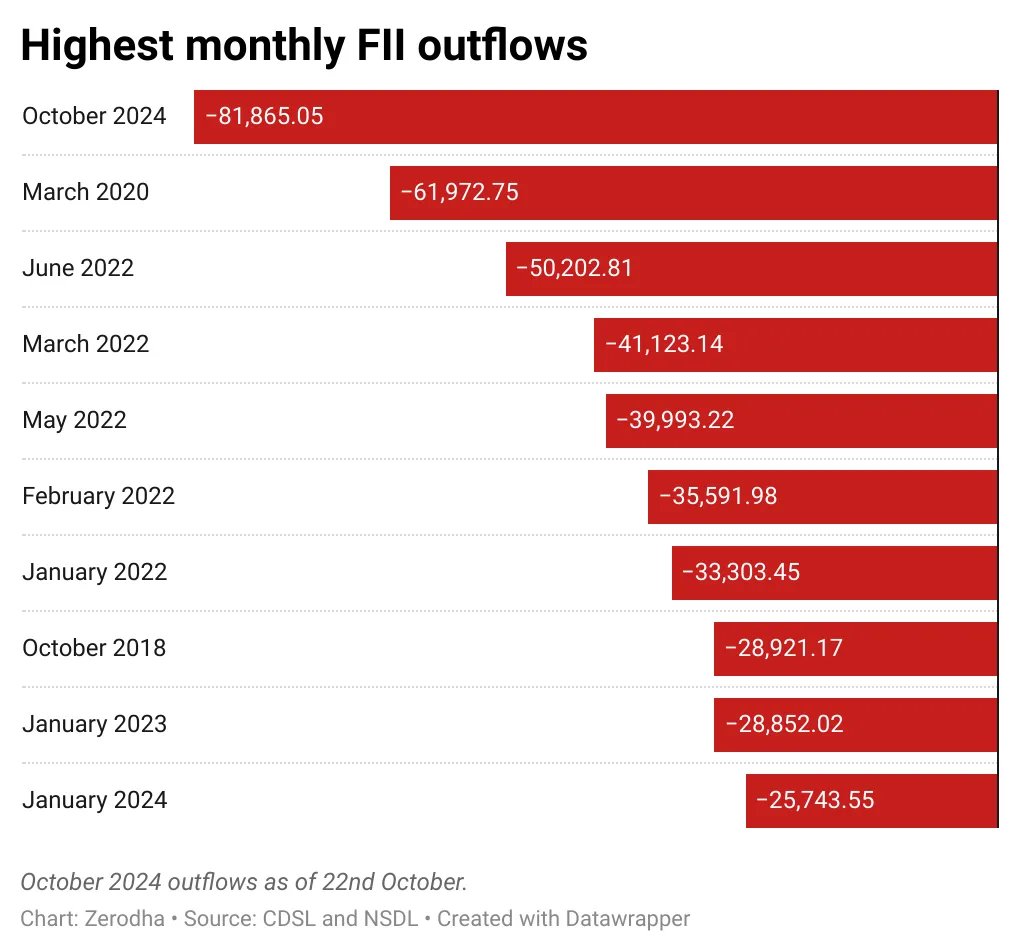

Foreign Institutional Investors (FIIs) have sold Indian equities worth ₹1.12 lakh crore in 2025, signaling a significant shift in global investment trends. The "Buy China, Sell India" strategy has gained momentum, with investors diverting funds to Chinese markets. This trend is reflected in the Hang Seng Index, which has surged 19.6% year-to-date, outperforming many global indices.

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"FIIs Return, Invest ₹11,100 Crore in Indian Equities Over Two Sessions" ### FIIs Reverse Selling Streak, Invest ₹11,100 Crore in Indian Equities Foreign Institutional Investors (FIIs) have made a dramatic turnaround in the Indian stock market, pur

See MoreTushar Aher Patil

Trying to do better • 10m

Stock Market Today - Global Selloff Triggers Big Fall in Indian Markets 7 April 2025, 09:25 AM Today, Indian stock markets opened with sharp losses, reflecting global market jitters. Both the Sensex and Nifty 50 are trading deep in the red, as risin

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

Indian Stock Market Closure for Holi 2025? The Bombay Stock Exchange (BSE) building stands tall as investors await confirmation on whether the stock market will remain closed for Holi 2025. Meanwhile, benchmark indices, Sensex and Nifty 50, ended low

See More

Business Creator

Don't Miss Opchunity... • 1y

As of January 20, 2025, the Indian stock markets exhibited positive momentum, with key indices showing notable gains. Market Performance: BSE Sensex: Opened at 76,989.23, up 369.90 points. Nifty50: Opened at 23,264, up 60.80 points. Top Gainer

See More

Nandishwar

Founder @StudyFlames... • 1y

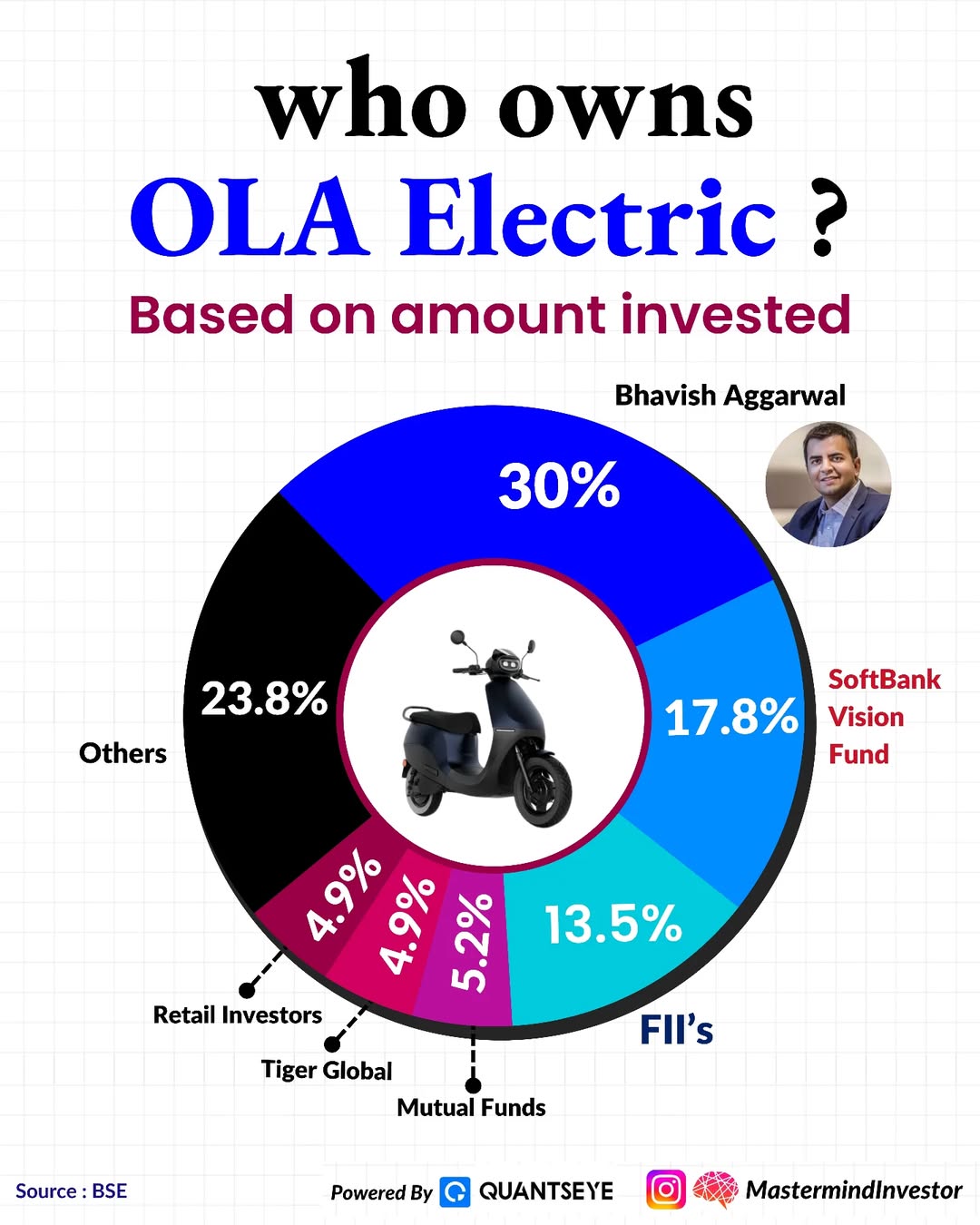

🚀 Who Owns Ola Electric? 🛵 Here’s a quick breakdown based on investment stakes: 1️⃣ Bhavish Aggarwal: 30% 🏆 2️⃣ SoftBank Vision Fund: 17.8% 🌏 3️⃣ Foreign Institutional Investors (FIIs): 13.5% 📈 4️⃣ Others: 23.8% 🧩 5️⃣ Mutual Funds: 5.2% 💰 6️

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)